This is a very good popular science post. Can 7943 and 3643 coexist?

"ETH to 10k? Dream on! - Until I saw this proposal"

"After studying ERC-7943, I feel like I see the shadows of the 'forefathers' ERC-20 and ERC-721. ETH might really reach 10k because of this; I have to make a video to discuss it, I'm so excited!"

This was a sentence I shared with a friend after researching ERC-7943. Now it seems that due to the obscure content, along with various numbers, proposals, and technical terms, it is more appropriate to write an article in text form. Without further ado, let's get straight to the point.

The following content roughly includes the following sections:

1⃣ Basic concepts of Ethereum proposals

2⃣ Content of the ERC-7943 proposal

3⃣ Token standards suitable for compliant on-chain RWA assets

4⃣ Current token standards used for on-chain RWA assets

5⃣ Detailed comparison and discussion between ERC-3643 and ERC-7943

6⃣ My creative ideas

————————————————————

❓ What is ERC/EIP? (Skip if you're familiar)

EIP stands for Ethereum Improvement Proposals, which allows anyone to propose improvements to Ethereum. It can be at the core code level or the application level; in short, if you think Ethereum needs improvement, you can propose it, and your proposal will be followed by a unique number identifier. For example, I could propose EIP-888.

However, whether it gets executed requires multiple rounds of discussion and review by the Ethereum community. For instance, the Ethereum upgrades we often hear about are based on different EIPs to improve Ethereum.

This is the Ethereum EIP proposal community:

ERC stands for Ethereum Request For Comment, which is a form of EIP. You can also see the ERC section on the website. Simply put, ERC focuses on application improvements for Ethereum, making its applications more widespread or convenient.

——————————————————

❓ What are ERC-20/721/1155? (Skip if you're familiar)

ERC-20/721/1155 are among the proposals mentioned above. So why are these proposals so important?

ERC-20 defines the standard for "fungible tokens," meaning anyone can issue a large quantity of a certain token on Ethereum. A significant portion of the tokens we commonly see are in ERC-20 form, such as LINK, UNI, AAVE, Pepe, and various other meme coins, all existing on Ethereum as ERC-20.

ERC-721 is the standard for "non-fungible tokens". Don't understand? Let me put it another way - NFT. This token can only have one, meaning only one person can own this item.

ERC-1155 is a bit harder to understand; simply put, when you create a token using this protocol, you can specify whether your token is ERC-20 or ERC-721, and it also supports "batch" functionality, as the above two token types can only perform single transactions (which is not the focus of this discussion).

——————————————————

Having understood the basic information above, let's get to the main topic:

❓‼️ What is ERC-7943?

The original proposal is here:

ERC-7943: uRWA - Universal Real World Asset Interface, An interface for common base tokens defining compliance checks, transfer controls, and enforcement actions for Real World Assets (RWAs).

Translated, ERC-7943 is a type of universal RWA asset. It is a token that complies with compliance checks, has controllable transfers, and even enforcement capabilities.

In simpler terms, it allows any asset to be represented on-chain in this token form, but this token has regulatory/control functions.

The proposal was put forward by @xaler2 in May. This guy is coding for OpenZeppelin, and those familiar with this organization or who have written smart contract code know that it provides the standard code libraries for ERC-20/721/1155, making it quite famous in the Ethereum tech circle. Therefore, this guy's technical abilities should be beyond doubt.

At the same time, he is also a co-founder of Brickken, a company specializing in RWA. This company is also supporting the ERC-7943 proposal.

——————————————————

❓ What stage is ERC-7943 at?

First, we need to understand the steps a normal ERC proposal goes through to go live:

1) Drafting the proposal: Community members draft detailed proposals and code.

2) Review stage: Community members and core developers discuss whether it can go live and how to improve it, ultimately forming a proposal that has no major objections from the community or sending it back.

3) Last Call: The final 14 days, where everyone reviews if there are any remaining issues.

4) Final launch: Launch on Ethereum testnet and mainnet, providing the standard code.

ERC-7943 entered stage 2 on July 31, which is the decision-making stage for whether ERC will go live. If it passes, it’s basically done; if not, it’s over. This stage often depends on the strength of consensus within the Ethereum community regarding this ERC, the number of objections, and other issues of safety and standardization, usually lasting from 2 months to 2 years, depending on community support.

The main discussions in the Ethereum community about ERC-7943 are on ethereum-magicians:

And the GitHub code repository:

Currently, there is a controversy on ethereum-magicians, as this proposal conflicts significantly with the previous ERC-3643, because both token standards are aimed at RWA, leading to intense debates among developers. Therefore, I summarized the differences between the current ERC token standards suitable for RWA assets below.

——————————————————

✅ About the expansion of RWA assets on-chain, my personal views and ideas

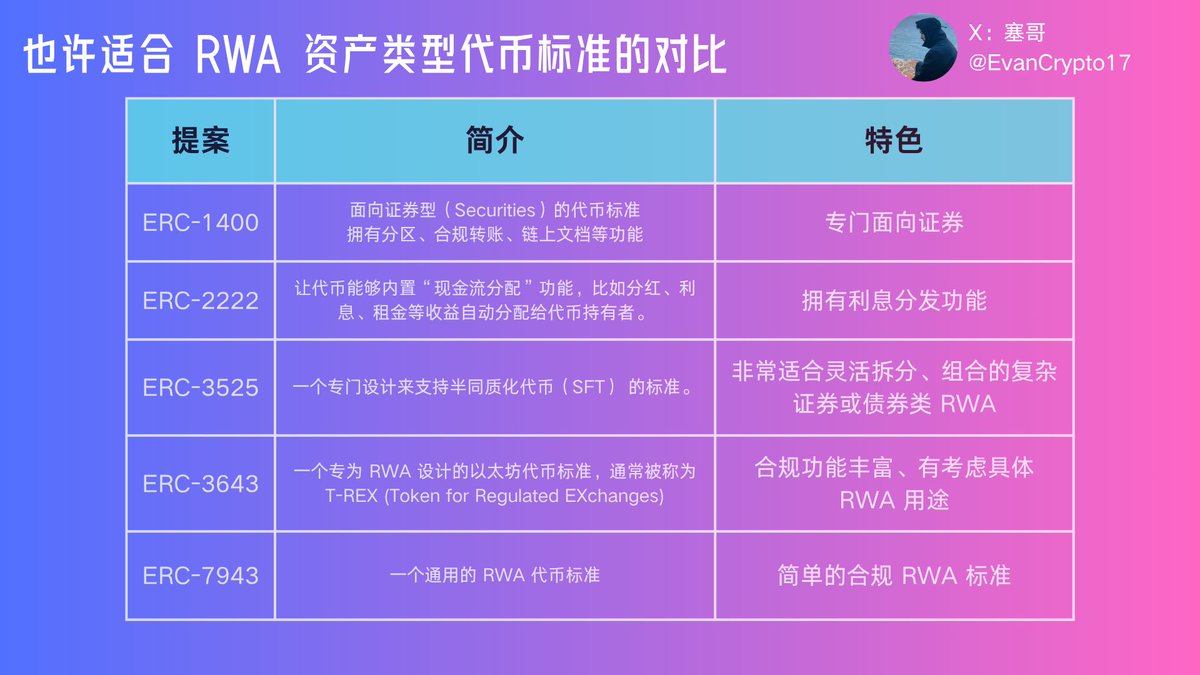

The following content is my opinion on suitable token forms for RWA on-chain. Discussions about ERC-3535, ERC-3643, ERC-7943, ERC-1400, and ERC-2222 are all personal views and not objective. First, let’s understand the content and characteristics of each standard through this table (referenced GPT).

Based on the above table and references from @bocaibocai_ and Professor Meng Yan @myanTokenGeek's code and articles:

I personally believe that while ERC-3525 fits some complex situations for RWA in terms of token form, it lacks emphasis on compliance control;

ERC-1400 is specifically a standard for security-type tokens;

ERC-2222 has a profit distribution function;

All of the above standards lack the "unified" characteristic of RWA. RWA, Real World Assets, should ideally support as many real asset types as possible with a strong compliance function. Regulators want absolute control, which is why I believe Ondo is pursuing a 'machine room chain'.

Thus, ERC-3643 has been highlighted by the SEC chairman.

From both proposals and codes, I believe ERC-7943 is more like a simplified version of 3643, emphasizing "compliance" functions, allowing any RWA asset type to have its "personalized RWA asset function" redesigned by the user.

Therefore, ERC-7943 is also named uRWA - Universal Real World Asset Interface.

In simpler terms, ERC-7963 only designed functions like freezing, forced transfers, whitelisting, etc. For other functions like generating income or splitting, you can write functions to represent them.

You can issue dividends on this basis or add any RWA asset functions you want; ERC-7943 only provides the "compliance" function.

"I gave you the compliance key; which RWA asset drawer do you want to open?"

——————————————————

🆚 Next, I will discuss the differences between ERC-3643 and ERC-7963 in detail to help us better understand the distinctions between these two asset types (completely personal views).

Let’s directly look at the underlying functions.

ERC-3643 can implement all the current functions of ERC-7943 and has an OnchainID that points to an identity verification contract to achieve KYC real-name functionality. This contract stores and manages user identity information, permissions, verification data, etc.

However, ERC-7943, in its design, discarded the KYC function. The author @xaler2 believes that 3643 is not simple enough, and KYC is not a necessary option for RWA assets; if needed, corresponding functions can be added through inheritance. He specifically mentioned Promissory notes assets and government RWA projects.

See details:

Thus, he changed many MUSTs in ERC-3643 to Maybes, releasing many customizable functions.

It only wrote "forced transfer," "freeze address," "get the number of tokens in the frozen address," "transfer permissions," and "whitelisting."

But the author of ERC-3643 believes that there is no need to consider niche RWA assets. In short, there seems to be a bit of a dispute, with each side having its own reasoning.

——————————————————

✅ Ultimately, my view is:

ERC-7943 is simpler and has a broader scope, while ERC-3643 is more detailed but relatively narrower. At the same time, a lawyer in the discussion area expressed that many countries' laws are not very friendly towards putting identity information on-chain with OnchainID.

Therefore, from a technical perspective, I personally lean towards supporting ERC-7943.

However, it is true that ERC-7943 is still in its early stages and requires much discussion among Ethereum community members.

On the other hand, ERC-3643 has already formed a standard, has been running for a long time, and has an organization @ERC3643Org supporting this standard, which has received support from many institutions and has also been highlighted by the SEC chairman.

——————————————————

⬇️ What are the main tokenization circulation forms of RWA assets on-chain currently?

Through the data from , we can see that the mainstream RWA assets on-chain are currently implemented as basic ERC-20 + custom extension functions.

Therefore, ERC-3643 seems not to be as widely applied in RWA as imagined, as the current mainstream assets have not adopted its solution, with only a small group reaching a consensus to use it, and several companies pushing it behind the scenes. So we cannot say that ERC-7943 has no chance to flip.

———————————————————

✅ If you see this, let’s return to the initial topic: why am I excited?

Recently, everyone has seen the price of ETH, but I discussed in my previous article that while rising is good for everyone, such a rise is unhealthy:

The rise of Ethereum should be driven by the prosperity of the ecosystem, leading to ETH burning/deflation/scarcity. Let’s recount the bull markets I have heard/seen in the past:

The 2017 ICO bull market, the launch of the ERC-20 token standard, everything went on-chain, and the market surged.

In 2020-2021, DeFi + NFT, new narratives and asset types exploded (ERC-721 was launched in 2018 but became popular in 2021).

We find that in every bull market, a certain type of asset token tends to become popular, and even last year's Bitcoin inscriptions were also a new asset type.

Referring to history, new token types are very likely to become the theme of Ethereum's next bull market phase. After all, as @HAZENLEE_ said, "You wouldn't really expect Wall Street to pull you out of the depths with real money, would you?"

And why is it likely to be the RWA token type? We can see various signs indicating that Ethereum will focus on the RWA narrative in this cycle:

Vitalik has already changed Ethereum's description from "world computer" to "world financial ledger."

Ethereum has never gone down since its launch, and Tom Lee said it is very suitable for financial products, hence the crazy CX on Wall Street.

Institutions like Robinhood are establishing RWA assets in the Ethereum ecosystem (I couldn't find what token type Robinhood is using on Arbitrum; if anyone knows, feel free to discuss).

And so on...

So not only do I think so, but many people also believe that RWA will be the main theme of this bull market and will be the first major step towards mass adoption of blockchain.

However, I have always struggled with the fact that ordinary people have no way to participate in RWA to reap the benefits, and just at this time, ERC-7943 has emerged, which now seems to be a breakthrough.

——————————————————

⬇️ Let me share some of my speculations:

Because ERC-7943 is universal enough, simple enough, and easier to implement than ERC-3643, it can be more easily packaged into a compliant "RWA" concept.

What I actually look forward to is not stocks on-chain, not bonds on-chain, and certainly not real estate carbon credits on-chain; I hope that even my uncle's chair can be on-chain. That kind of FOMO is what a raging bull market should have. Currently, ERC-7943 seems capable of achieving this and can tell a good story.

But rationally thinking, if ERC-7943 becomes popular, there will definitely be countless Wall Street and conspiracy groups manipulating it; they need to see the value in this token type.

——————————————————

✅ So, if, just if, this token type really takes off, what opportunities do we ordinary people have?

First and foremost, it will definitely be the first token that applies ERC-7943. At that time, regardless of what RWA it is (stocks and bonds can be set aside, as they are tied to real prices), it must be something vague and abstract, like the income certificate of some obscure company or the land rights of some remote area.

Then, there are the exchanges for this type of asset, which are what primary market players should focus on.

Currently, I can only think of these two ways to participate.

The remaining content will be illustrated with images and continued in the thread below⬇️

16.7K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.