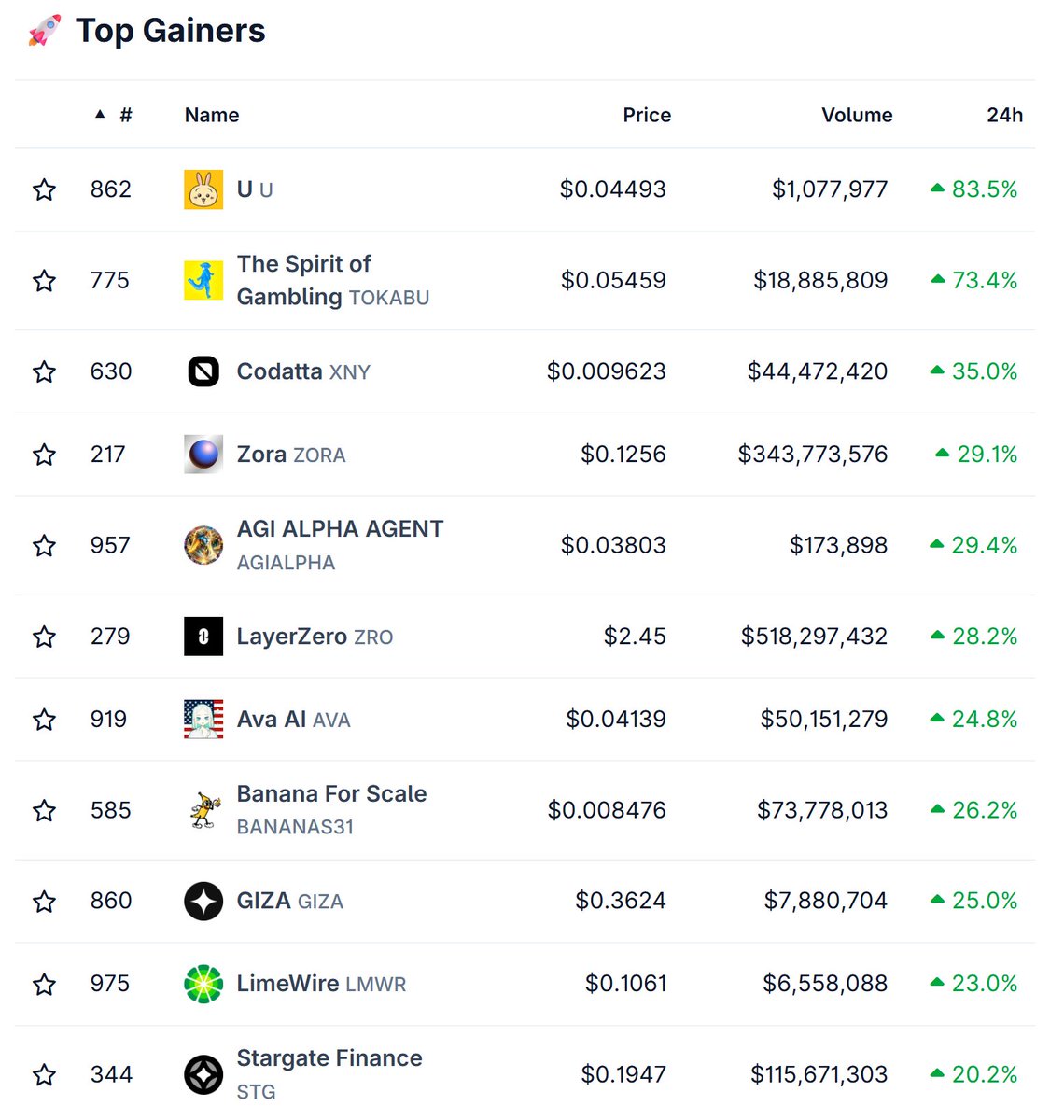

Every day, a new gem pops up as the top gainer across the entire crypto market.

But let’s be real, this isn’t a one-day grind.

These projects grind in silence, build through the red days, stay consistent under pressure, and then they finally break out from the shadow and shine harder.

I’ve already shared why $ZRO and $STG are catching new money.

Read that post and you might learn something to help you spot upcoming alphas in the market.

Stay sharp and you’ll be able to catch moves like these gems in the future. If you’ve already got some alpha, drop it in the comments.

Another thing that matters for money to flow into small caps is how large caps react to news and pull in fresh liquidity.

This is why today's LayerZero and Stargate news matters for the entire mid to low cap market!

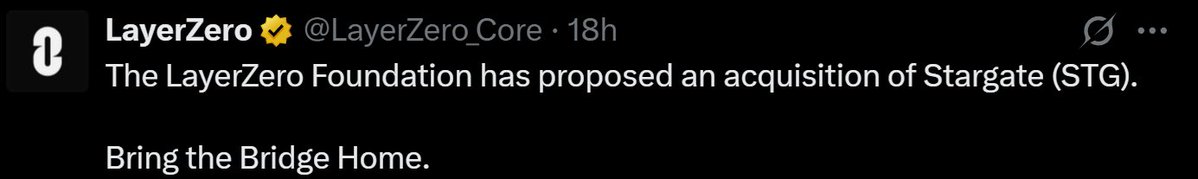

# Quick headline:

LayerZero Foundation proposed buying Stargate in a token-swap deal worth about $110 million. Markets reacted and both ZRO and STG jumped.

# What is LayerZero -

LayerZero is an omnichain protocol that helps blockchains talk to each other. It created the OFT standard so tokens can move across chains without messy wrappers. The goal is cheaper, faster, developer-friendly cross-chain tools.

# How the token (ZRO) came to be -

LayerZero Labs raised large VC rounds as the protocol scaled. That institutional backing plus real integrations gave ZRO on-chain utility and investor interest.

# The alpha — what got people excited before today

LayerZero’s OFT has been used to move real liquidity, for example wrapped bitcoin on new chains and some multichain token launches.

The protocol already powers several projects and has strong VC support. These are proof points that the tech is being adopted.

# What happened today and why the pump

The Foundation proposed a $110 million acquisition / token swap to fold Stargate (STG) into LayerZero (ZRO). That would effectively retire STG and move Stargate revenue into the LayerZero ecosystem. Traders read that as consolidation plus future revenue for ZRO holders.

Price reaction: ZRO and STG rose sharply as markets priced in the deal and the chance of buybacks or shared revenue.

Why consolidation matters?

Stargate is a major cross-chain liquidity layer. Bringing messaging and liquidity under one stack would simplify developer work and could create stable revenue that supports ZRO buybacks or funding. That is the main bullish case.

The market facts

Trading volume, market cap, and volatility spiked after the announcement. Expect big swings while the news digests and governance votes play out.

- What to expect next (realistic scenarios)

Bull case

STG holders approve the swap. Revenue flows into the LayerZero-controlled stack. LayerZero funds buybacks or product expansion. ZRO becomes the unified cross-chain token and demand rises.

Base case

The deal faces governance pushback or negotiation. Integration is slower or partial. Some revenue-share mechanics are built in. Volatility calms and ZRO ends higher than before the news but not massively higher.

Bear case and risks

Stargate holders reject the deal or legal and governance fights drag on. Token-swap math might be seen as unfair by STG holders, causing selling pressure. Technical or security problems could also surface. These risks can destroy value fast.

Why this is important:

If LayerZero folds Stargate into its stack and converts bridge revenue into utility or buybacks for ZRO, the combined tech and cashflow is a strong structural bull case. Execution and governance risks are high, so expect heavy volatility.

11.31K

87

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.