Pendle has been live for just under 2 weeks and has already surpassed $300M in TVL.

At HyperLend, we’re big supporters of Pendle’s approach to capital efficiency and unlocking higher-yield opportunities.

We’ve recently onboarded PT-kHYPE as collateral on HyperLend and enabled E-Mode, allowing users to loop PT-kHYPE<>HYPE and target yields of up to 20% APY.

Below is a breakdown of the recent report from @BlockAnalitica.

// Summary

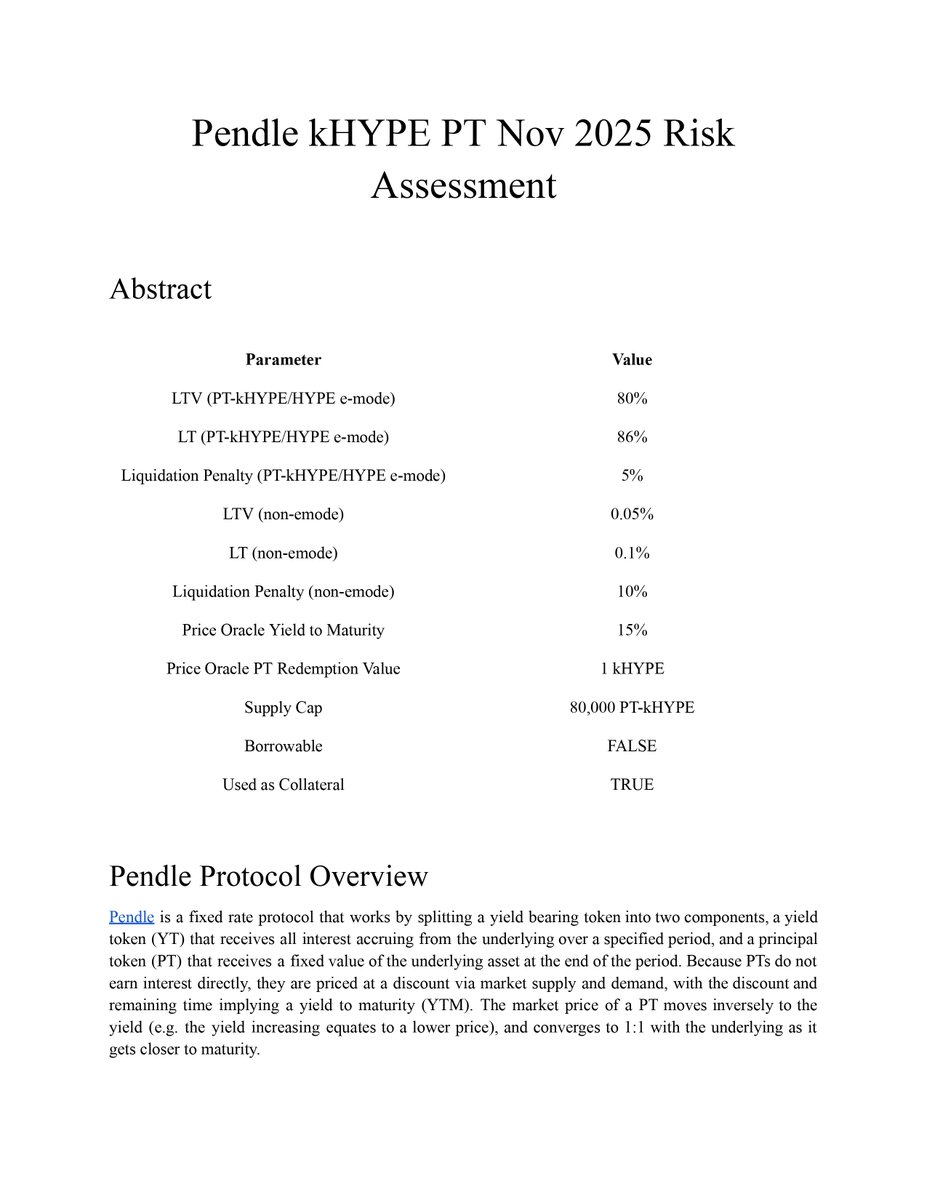

Pendle’s kHYPE Principal Token (PT), maturing November 13, 2025, on HyperLend, splits yield-bearing assets into Yield Tokens (YT) and PTs, with PTs priced at a market-driven discount for a fixed maturity payout.

Risks include low technical issues, backed by audits and Pendle’s $1B+ TVL, and duration risk, where PT prices shift inversely to yields, impacting volatility and liquidity.

A bgdlabs-developed linear discount oracle prices PT-kHYPE at 15% YTM, supported by Spectra kHYPE data showing stable 15% APY, reducing liquidation and manipulation risks compared to AMM TWAP.

Proposed e-mode settings: 80% LTV, 86% LT, 5% liquidation penalty; non-e-mode at 0.05% LTV and 0.1% LT to limit unrelated asset debt. A 80,000 PT-kHYPE supply cap addresses Pendle AMM pool liquidity constraints, with PT borrowing discouraged to ensure redemption stability.

As of July 30, 2025, with 106 days to maturity, the 15% YTM guards against 50% yield spikes, keeping LTVs below 100% (~93% at maturity). These settings prioritize market stability, collateral safety, and liquidity. HyperLend, with Block Analitica’s risk expertise.

Bank wiser, HyperLend.

15.38K

101

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.