Understanding the $PROVE Token’s Economic Flywheel: An ELI5 Explanation

Imagine the Succinct Prover Network as a bustling online marketplace where “proofs” mathematical certificates verifying computations without revealing details are traded using the $PROVE token. Powered by the SP1 zkVM, which is 10 times faster than competitors, it simplifies zero-knowledge (ZK) proof creation for blockchain applications like Ethereum L1/L2s and Bitcoin/Solana rollups.

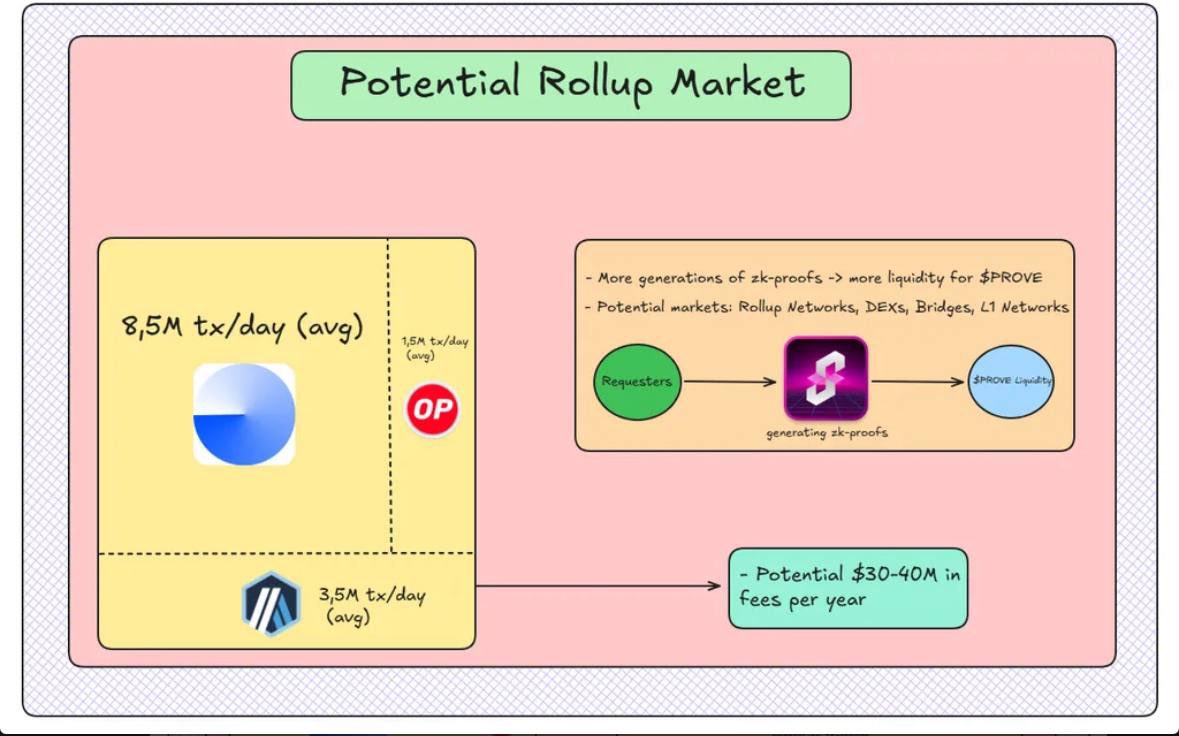

This establishes a proving economy where developers pay in $PROVE, GPU operators compete to generate proofs, and stakers earn fees that grow with transaction volume from thousands to billions.

The flywheel, a self-reinforcing cycle, operates as follows:

• More transactions boost demand and generate higher fees in $PROVE.

• Provers must stake $PROVE to participate, locking up supply.

• Increased revenue raises staking yields, attracting more stakers.

• Growing adoption brings more apps, looping back to higher demand.

For instance, Layer 2 networks like Arbitrum and Optimism handle 12 million daily transactions, potentially yielding $43.8 million annually for Succinct, with additional volume from DEXs and bridges.

Adoption accelerates this cycle through institutional and enterprise support driving volume through:

• Enterprise integrations with millions of users and billions of proofs.

• Regulatory compliance needs making ZK essential.

• Predictable B2B revenue from high-volume contracts.

• Network effects from tech giant adoptions like Google.

The time for $PROVE’s flywheel is now

Show original

20.77K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.