Update on @NEARProtocol on-chain data still requires attention to the overall market trend.

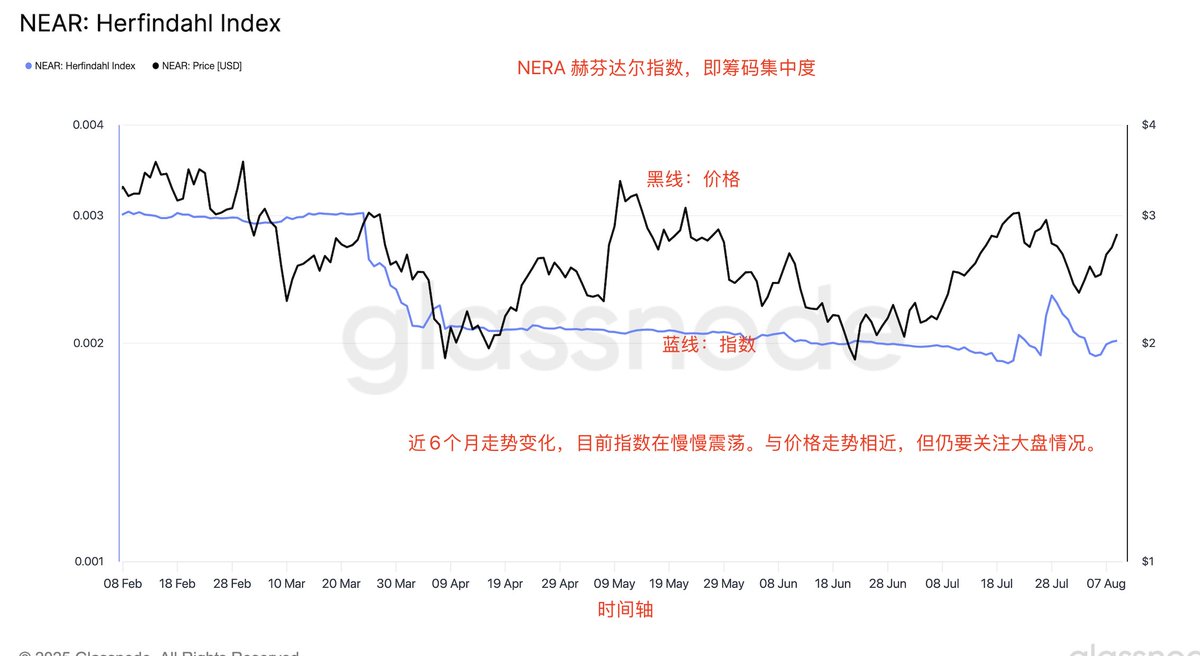

The Herfindahl Index, which measures the concentration of chips, is used to assess the share of network addresses in the current supply, indicating the level of concentration. A high index indicates that a few large holders are dominating the market, while a low index suggests a more even distribution of chips.

As shown in the figure. @NEARProtocol

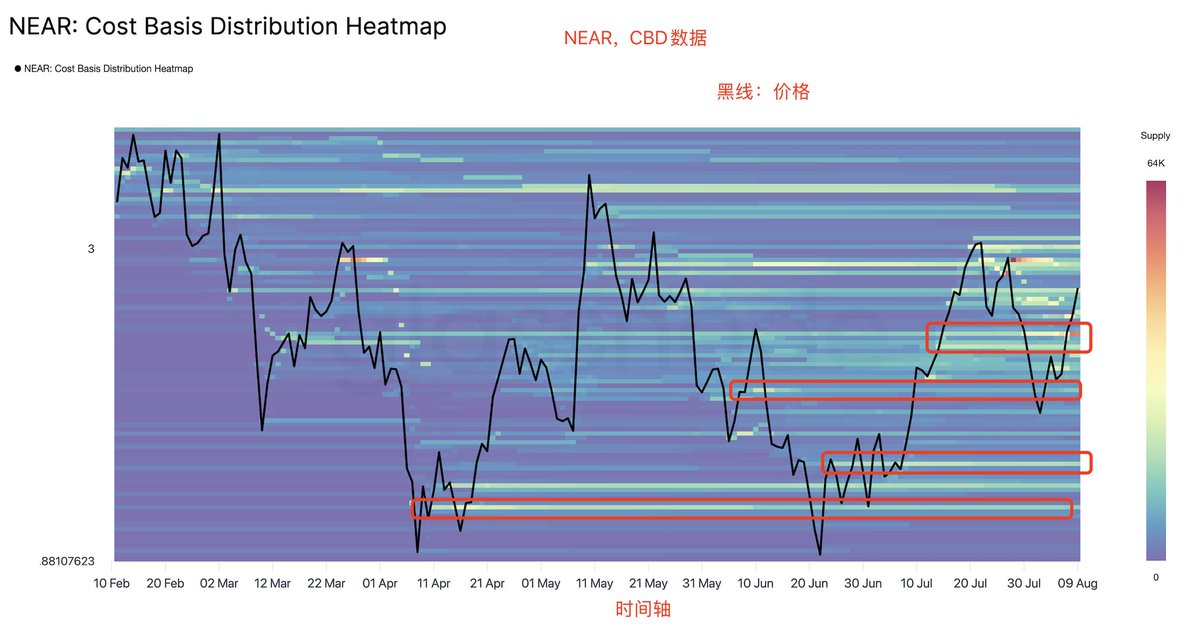

Cost Basis Distribution (CBD) data

The Cost Basis Distribution (CBD) heatmap provides a detailed visualization of supply density at price levels over a specific time period (e.g., 1 month, 1 year). By selecting a time range, this indicator displays a heatmap where the y-axis represents the cost basis on a logarithmic scale, ranging from below 1% of the lowest price in the selected time period to above 1% of the highest price.

The color intensity of each pixel reflects the concentration of supply at that price level, allowing investors to identify key acquisition points corresponding to significant portions of asset supply.

This helps to better understand the relationship between price levels and cumulative supply density, thereby gaining insights into potential support and resistance areas based on historical acquisition levels.

As shown in the figure. For reference and learning, not investment advice.

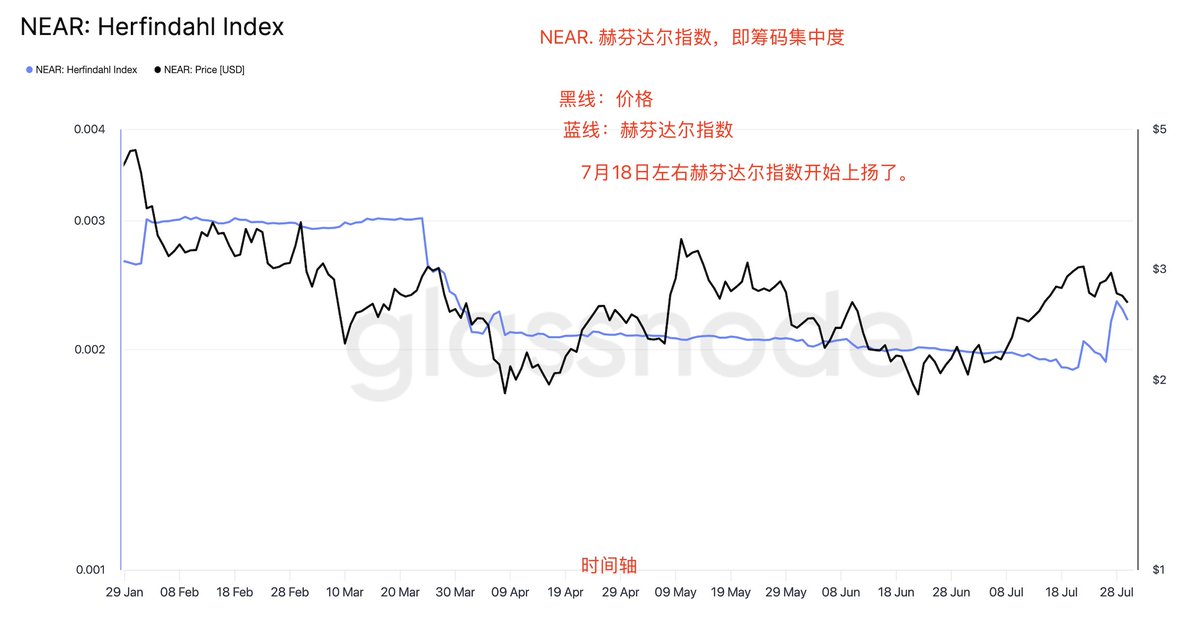

继续更新 @NEARProtocol 链上数据

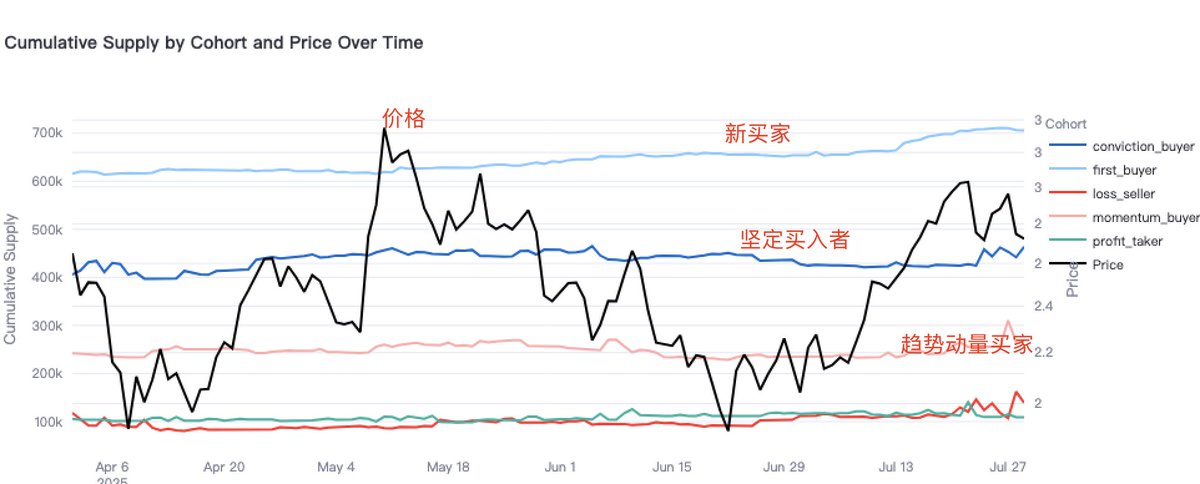

最近 @NEARProtocol 确实展现不错的发展势头,新买家和动量买家最近似有蓄势的苗头,结合最近Near 得动作,但是大的层面仍然还是要看大盘的情况。7月没有降息,8月没有议息会议。9月降息的话也还有一个多月时间。只能继续关注。

NEAR 赫芬达尔指数,用来衡量网络地址在当前供应量中所占的份额,即筹码集中度。指数高表示少数的大持有者正在主导市场,指数低则表示筹码分布更均匀。如图。

在TOKEN刚发行时,早期持有者往往集中大量供应,高度控盘,从而导致较高的赫芬达尔指数。随着这些早期持有者的抛售,指数开始下降,反映了代币分布从集中慢慢变得分散。

筹码更集中虽然不代表一定就拉盘,但一定更有利于控盘,且波动性会被放大。最近筹码集中度确实在上扬了,但并不强势,需要继续观察

然后 @NEARProtocol - 供应映射,如图,前面仔细讲过逻辑的,

供参考学习了,小伙伴们。非投资建议。

8.39K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.