Trump to sign executive order allowing crypto in 401(k) retirement plans today.

This move could unlock the BIGGEST CAPITAL INFLOW in #crypto history.

Check out this thread to know everything in detail 🧵👇

First, what’s a 401(k)?

It’s the most popular retirement savings plan in the U.S.

Employers and employees contribute to it. It’s tax-advantaged.

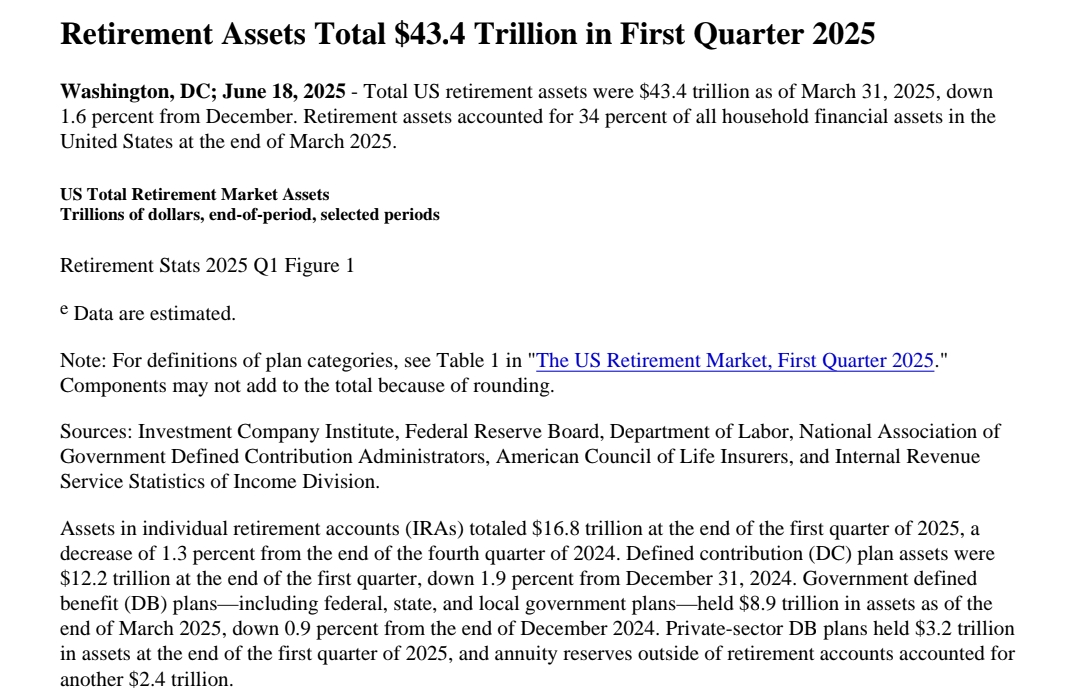

And it holds $8.7 trillion in assets. i.e., 2.24 times more than the entire crypto market cap.

Trump’s executive order:

➡️ Opens the door for #Bitcoin, $ETH & altcoins to be included in retirement portfolios

➡️ Directs the Labor Department to revise guidance for crypto in 401(k) plans

➡️ Instructs the SEC to support access to digital asset products

This is real capital from millions of working Americans.

For comparison:

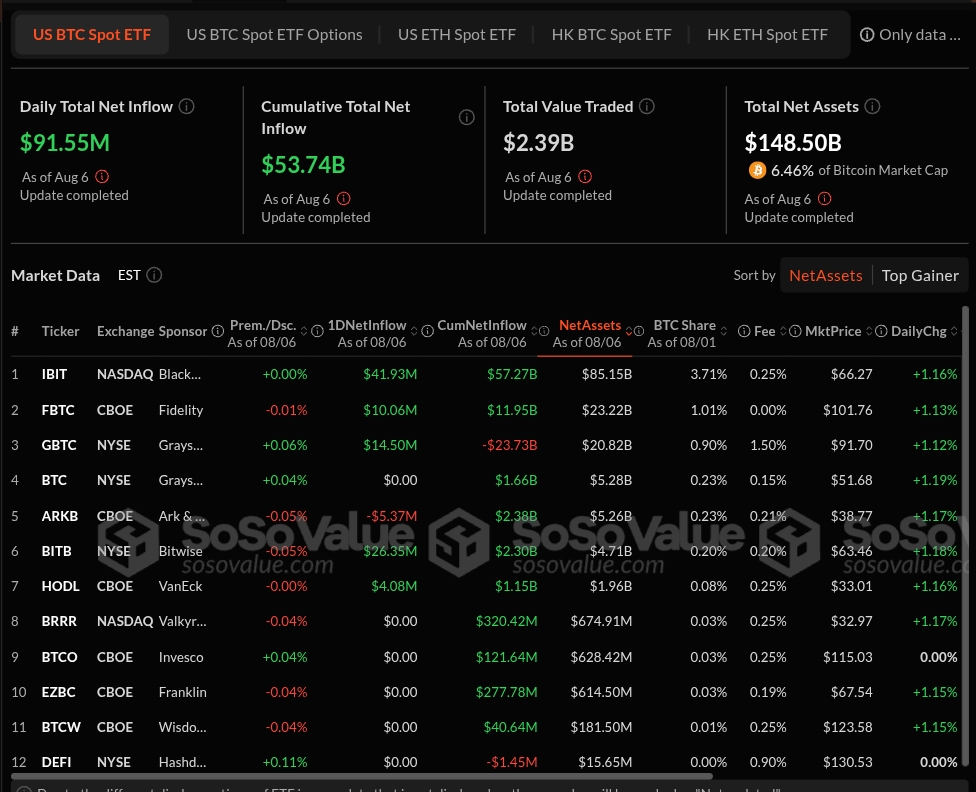

• #Bitcoin ETFs brought in $53.726 billion.

• 401(k) plans = $8.7 TRILLION

Even a 1% allocation = $87B potential inflow into crypto.

Even a 5% allocation = $435 billion potential inflow into crypto.

What does this mean for Bitcoin?

The first reaction is already here.

BTC started to pump instantly after this announcement.

📈 Open interest and derivatives volume surged.

📈 Sentiment has flipped from cautious to euphoric.

And this is just the beginning.

This also builds on a major policy shift:

Biden’s administration blocked crypto access in retirement accounts.

Trump just reversed that and made it a federal policy to include digital assets.

From resistance to red carpet. The pivot is complete.

This move also aligns with Trump’s broader crypto push:

• Hosted Crypto Week at the White House

• Passed the Genesis Act (stablecoin regulation)

• Now unlocking 401(k) access to Bitcoin, $ETH & beyond

Say what you want, but Trump is going all-in on crypto.

What will be its impact?

• Fidelity already offers $BTC in some retirement plans.

• Now the rest of the market has a green light

• ETFs + 401(k)s = A dual engine for institutional + Retail capital

The rails are being built in real time.

Why is this so important?

Because 401(k) investors are long-term holders.

They’re not buying to flip. They’re stacking for 10-30 years.

This could reduce crypto volatility and create a more stable, trillion-dollar demand base.

Not only $BTC, but also altcoins will benefit too.

401(k) plans won’t stop at Bitcoin.

With ETFs coming for ETH and others, expect diversification into:

✅ $ETH

✅ Layer 1s

✅ Infrastructure plays

✅ AI x Crypto plays

✅ Real-world assets

The entire market gets uplifted.

Think of it this way:

We just went from “Should crypto be in retirement accounts?”

To “How do we integrate it safely and at scale?”

This is a regulatory unlock.

It’s no longer if crypto gets mainstream adoption; it’s how fast.

Wall Street wanted ETFs.

But Middle America wants long-term exposure.

#Crypto in 401(k)s means your average teacher, trucker, or tech worker is about to become a long-term Bitcoin holder.

That’s generational adoption.

TL;DR:

• 401(k) = $8.7 trillion in capital

• Even 1% = $87B inflow potential

• $BTC + #altcoins now eligible

• Long-term, sticky demand incoming

• Trump just kicked off the biggest on-ramp in crypto history

This is not just bullish.

This is macro-structural, once-in-a-decade bullish.

If you’re still on the sidelines, ask yourself:

Do you really want to front-run 401(k) money?

Because it’s coming.

Biggest Moment for #Crypto

Years from now, we’ll look back at August 7, 2025 as the day crypto got invited into America’s retirement future.

The next bull run just found its fuel.

That’s a wrap.

If you found value in this thread:

⇛ Like the first tweet

⇛ Bookmark

⇛ RT for someone who needs it

⇛ Follow me @AltCryptoGems for more.

145.98K

1.36K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.