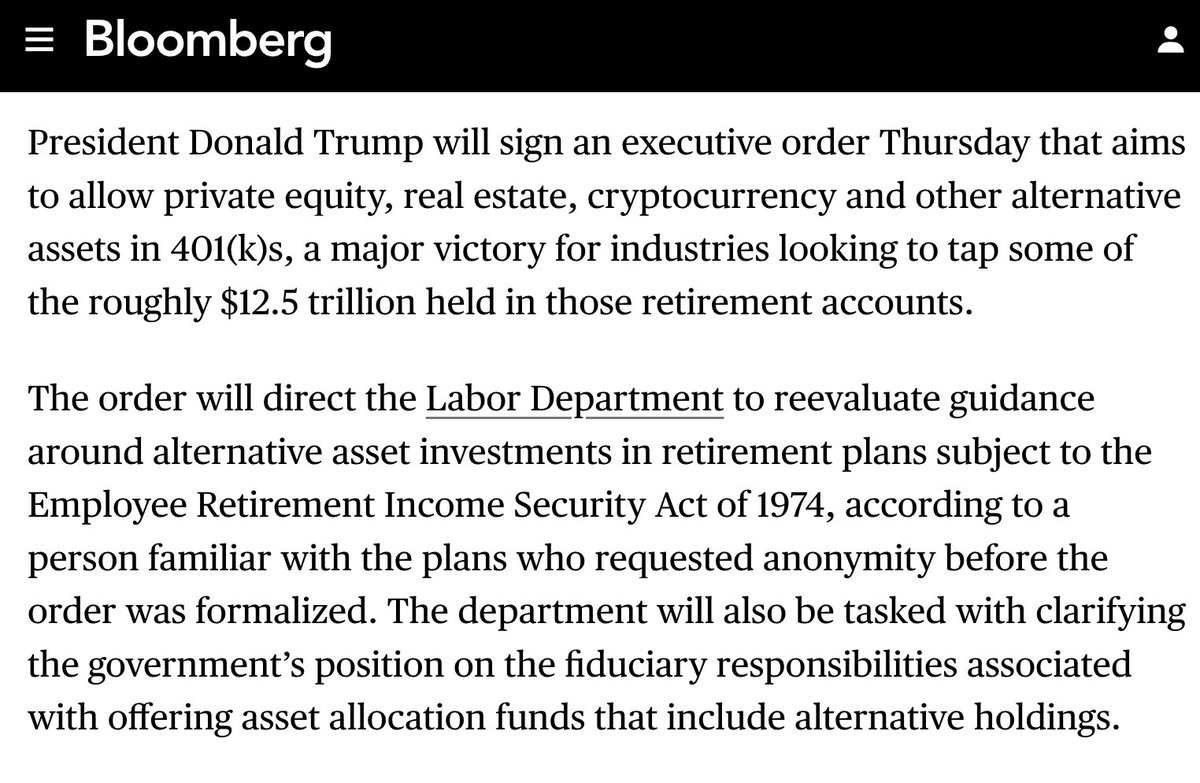

🚨🚨 BREAKING: TRUMP TO SIGN EXECUTIVE ORDER ENABLING CRYPTO, REAL ESTATE & PRIVATE EQUITY IN 401(K) PLANS.

→ $12.5 trillion in retirement assets could soon access Bitcoin & alt assets

→ The Department of Labor will reassess ERISA guidance

→ Fiduciary rules will be clarified for crypto exposure in retirement plans

→ Huge win for asset managers, #ETFs, and the entire digital asset industry

Why this matters:

Most 401(k) capital is locked into traditional stocks & bonds.

This move could unlock billions (if not trillions) into crypto over time.

Even a 1% Bitcoin allocation = $125B in demand.

🔁 Bitcoin + real estate + alternatives = the new retirement portfolio.

📈 This is the biggest on-ramp yet and it’s happening silently, legally, and structurally.

Bitcoin is becoming retirement infrastructure.

Not hype. Not narrative. Just cold policy.

💥 Mass adoption is now just one allocation policy away.

🚨🚨BREAKING: PRESIDENT TRUMP TO SIGN EXECUTIVE ORDER ALLOWING #CRYPTOCURRENCIES IN 401(K) RETIREMENT PLANS TODAY.

SUPER BULLISH FOR CRYPTO.. 🚀

42.39K

94

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.