This morning I saw the project @etherexfi on @LineaBuild, which has a mechanism similar to the previous $shadow of sonic. Compared to traditional ve33, the tokens that go into ve can exit at half the price in advance.

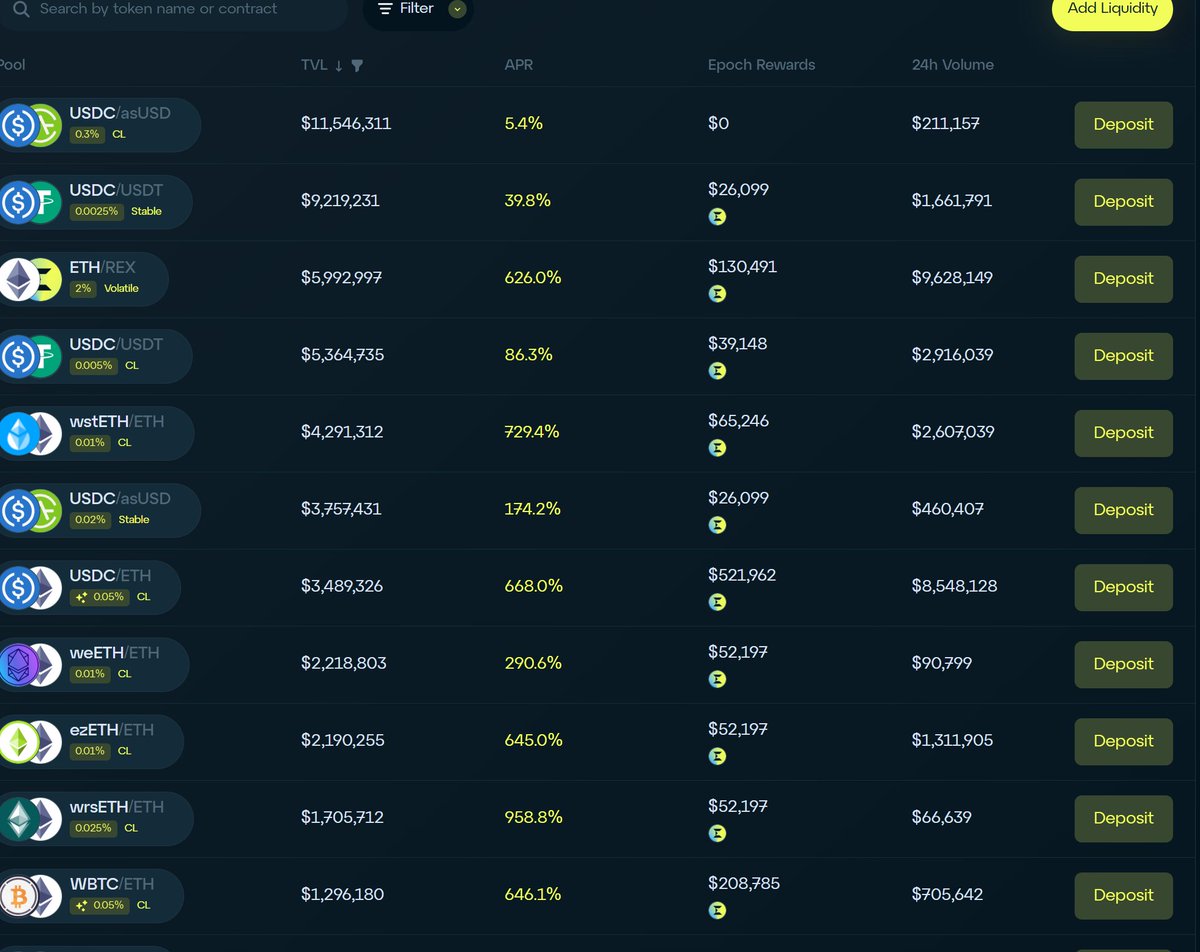

Currently, the platform's APRs are quite good, so it's worth checking out and mining according to your own risk preference. In extreme cases, the project team might run away with the pool, but that shouldn't be a big issue.

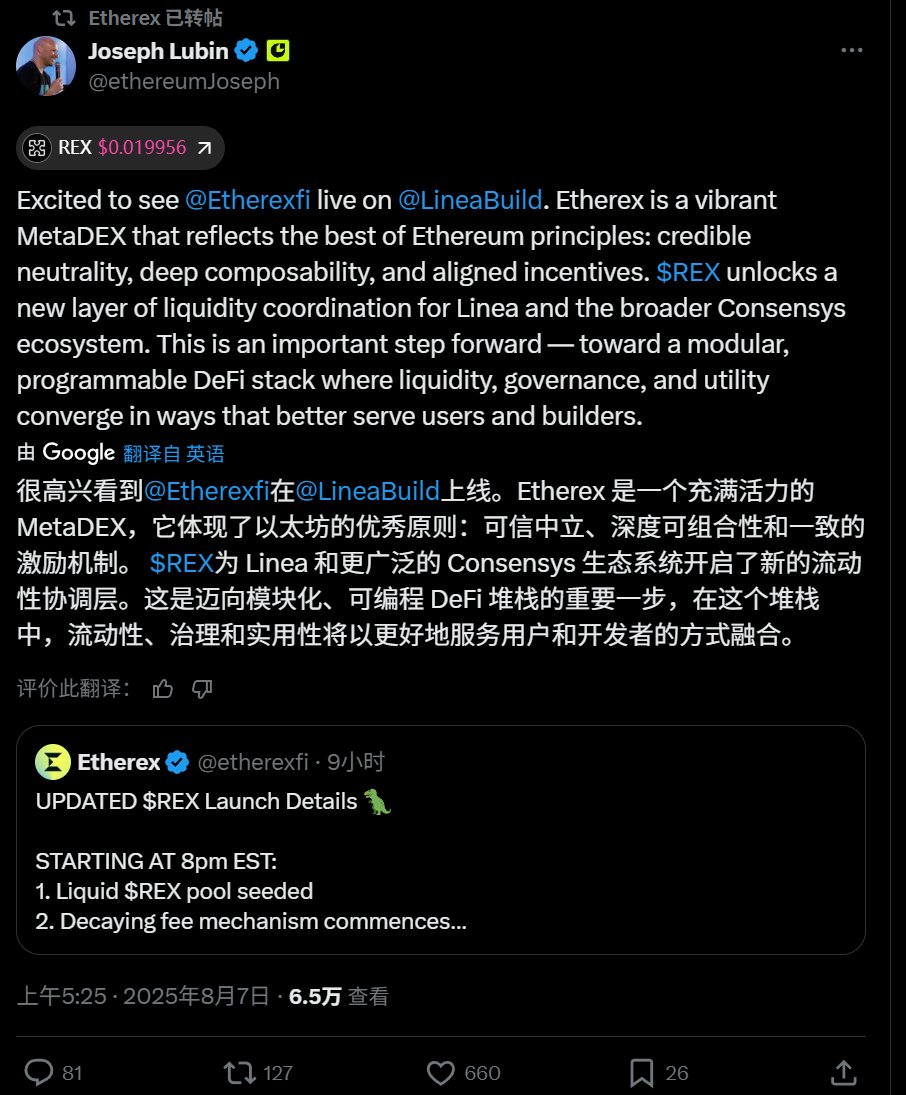

According to the official Twitter, it has the endorsement of Consensys' big boss @ethereumJoseph, and this project was previously a ve33 project on linea called @NileExchange. It feels a bit familiar, like velodrome and aerodrome; it's hard to say if it will follow this script, so we need to observe.

Currently, the market cap of @etherexfi's token $REX is a bit high. Based on the history of $aero, I wouldn't recommend buying it; you can put some money into mining on @LineaBuild instead.

There's also a strange token $asUSD, with the official Twitter being @Asterafinance. It doesn't have a blue check and not many mutual followers, but it added around 10 million in liquidity to @etherexfi without being locked. It seems like the project team's own stablecoin, but there's no evidence for that. If anyone knows more, feel free to share. Currently, I'm not brave enough to buy it for mining; brave brothers should be cautious.

Show original

3.08K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.