➥ The Triumvirate of AgenticFi

In recent months, AI has increasingly merged with crypto, especially in DeFi.

While DeFi 1.0 laid the groundwork, DeFi 2.0, or AgenticFi, focuses on execution and user interface, aiming to onboard billions with AI superintelligence.

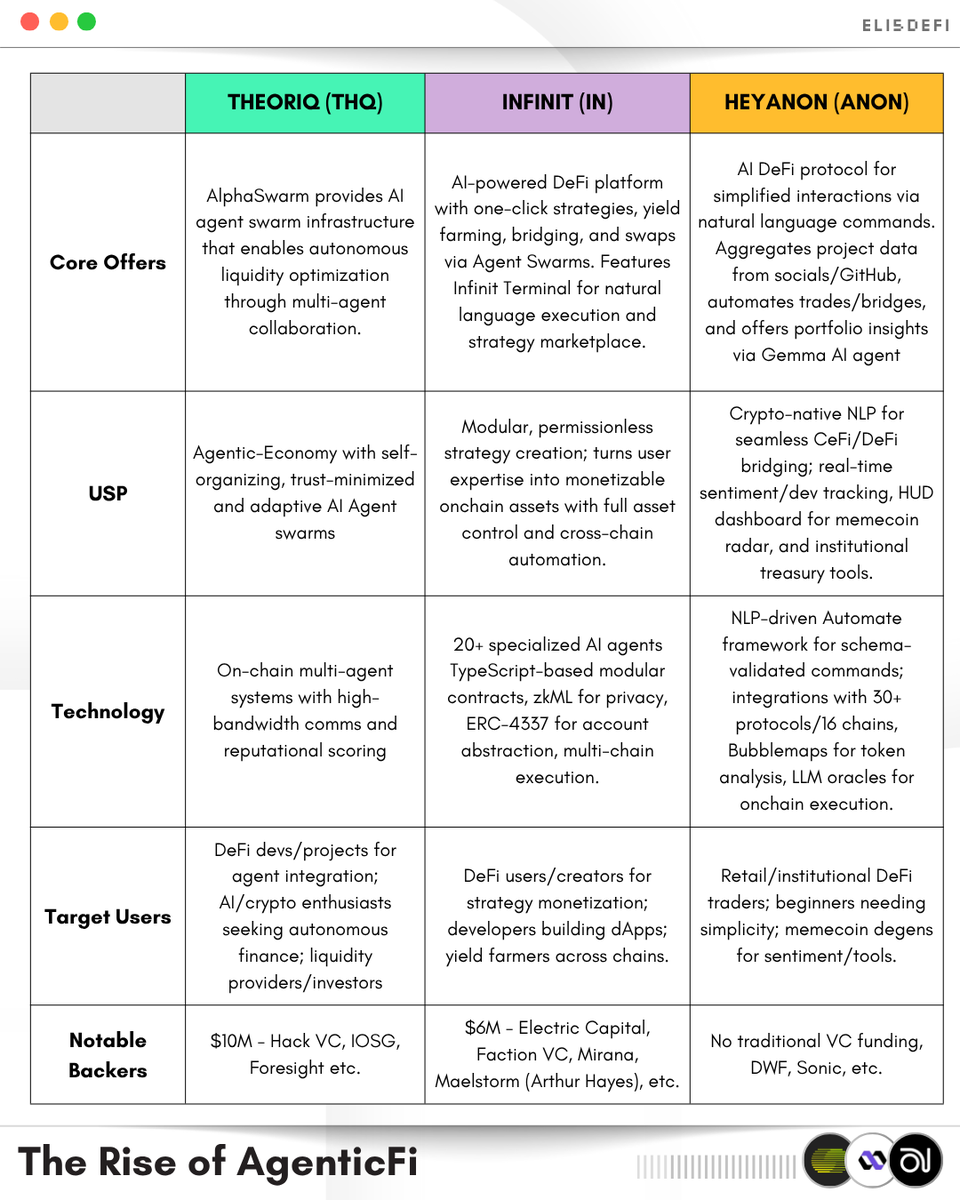

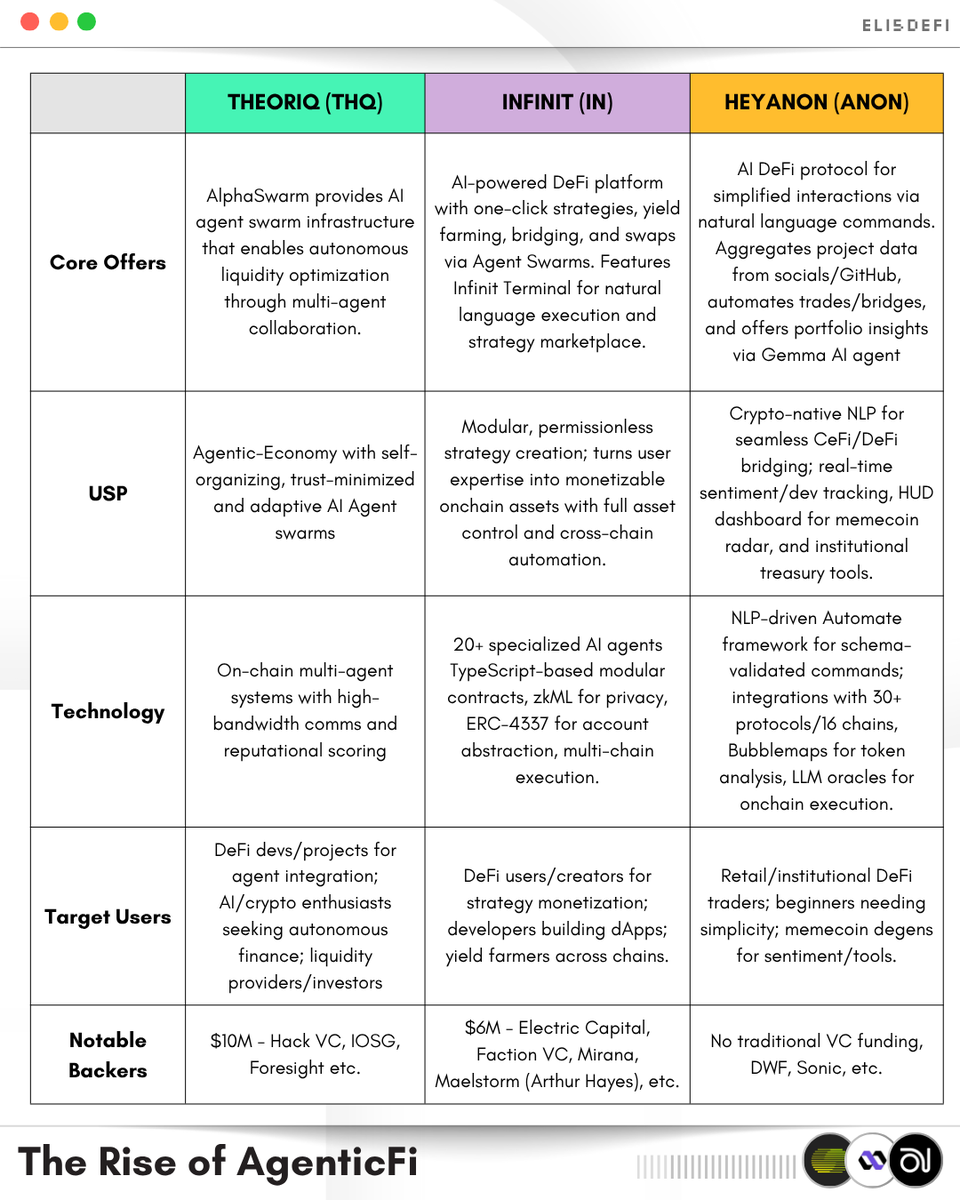

Today, we will compare three AgenticFi protocols:

➤ @TheoriqAI

➤ @Infinit_Labs

➤ @HeyAnonai

These protocols share similarities but differ in execution and maturity. Let's explore them 🧵

...

— Theoriq - $THQ (Not Live)

Theoriq is a decentralized protocol designed for AI agent swarms, enabling autonomous DeFi strategies, liquidity optimization, and multi-agent collaboration through AlphaSwarm.

It features self-organizing, trust-minimized agents equipped with reputation scoring and on-chain autonomy, leveraging blockchain-integrated technologies like reinforcement learning. Theoriq primarily targets DeFi developers and liquidity providers.

Theoriq secured $10 million in total funding from notable backers such as @hack_vc, @IOSGVC, and @ForesightVen, among others. They also recently launched the THQ public sale on @KaitoAI, which was ~39 times oversubscribed.

...

— Infinit - $IN (Not Live)

Infinit offers an AI-driven DeFi platform featuring one-click strategies, yield farming, and cross-chain automation through agent swarms and a strategy marketplace.

Its modular, permissionless design allows users to monetize their expertise through royalties, using TypeScript contracts, zkML, and ERC-4337. The platform targets DeFi developers and strategy creators.

Infinit has secured a total of $6M in funding from @ElectricCapital, @MaelstromFund, @mirana, and others.

...

— HeyAnon - $ANON (Live)

HeyAnon streamlines DeFi by using natural language commands, gathering data from social platforms to facilitate automated trades, portfolio insights, and memecoin monitoring via its HUD dashboard.

Its crypto-native NLP connects CeFi and DeFi, offering real-time sentiment tracking and institutional tools, seamlessly integrated across over 30 protocols. HeyAnon targets retail traders and meme trader degens.

Led by the legendary DeFi figure @danielesesta, HeyAnon deviates from traditional VC funding, instead receiving strategic investment from @DWFLabs and @SonicLabs.

...

— Wrap-Up (NFA+DYOR)

While the three protocols may initially seem similar, they differ significantly in terms of target users and functionalities.

Theoriq is crafted for agent swarms executing autonomous on-chain actions. Infinit emphasizes modular strategy automation, while HeyAnon focuses on simplifying natural language for trading.

This convergence propels DeFi forward by democratizing access; making it more intelligent, autonomous, and efficient.

Through AI-driven liquidity management, predictive strategies, and seamless interfaces, these protocols minimize human error, enhance capital efficiency, and scale operations to institutional levels.

Ultimately, they transform DeFi from a manual system into a self-optimizing, intent-based financial network.

...

— Disclaimer

Found this post helpful?

Show your support with:

🔵 Share

🔴 Like

🟠 Retweet

🟢 Bookmark

And follow @eli5_defi

➥ The Triumvirate of AgenticFi

In recent months, AI has increasingly merged with crypto, especially in DeFi.

While DeFi 1.0 laid the groundwork, DeFi 2.0, or AgenticFi, focuses on execution and user interface, aiming to onboard billions with AI superintelligence.

Today, we will compare three AgenticFi protocols:

➤ @TheoriqAI

➤ @Infinit_Labs

➤ @HeyAnonai

These protocols share similarities but differ in execution and maturity. Let's explore them 🧵

...

— Theoriq - $THQ (Not Live)

Theoriq is a decentralized protocol designed for AI agent swarms, enabling autonomous DeFi strategies, liquidity optimization, and multi-agent collaboration through AlphaSwarm.

It features self-organizing, trust-minimized agents equipped with reputation scoring and on-chain autonomy, leveraging blockchain-integrated technologies like reinforcement learning. Theoriq primarily targets DeFi developers and liquidity providers.

Theoriq secured $10 million in total funding from notable backers such as @hack_vc, @IOSGVC, and @ForesightVen, among others. They also recently launched the THQ public sale on @KaitoAI, which was ~39 times oversubscribed.

...

— Infinit - $IN (Not Live)

Infinit offers an AI-driven DeFi platform featuring one-click strategies, yield farming, and cross-chain automation through agent swarms and a strategy marketplace.

Its modular, permissionless design allows users to monetize their expertise through royalties, using TypeScript contracts, zkML, and ERC-4337. The platform targets DeFi developers and strategy creators.

Infinit has secured a total of $6M in funding from @ElectricCapital, @MaelstromFund, @mirana, and others.

...

— HeyAnon - $ANON (Live)

HeyAnon streamlines DeFi by using natural language commands, gathering data from social platforms to facilitate automated trades, portfolio insights, and memecoin monitoring via its HUD dashboard.

Its crypto-native NLP connects CeFi and DeFi, offering real-time sentiment tracking and institutional tools, seamlessly integrated across over 30 protocols. HeyAnon targets retail traders and meme trader degens.

Led by the legendary DeFi figure @danielesesta, HeyAnon deviates from traditional VC funding, instead receiving strategic investment from @DWFLabs and @SonicLabs.

...

— Wrap-Up (NFA+DYOR)

While the three protocols may initially seem similar, they differ significantly in terms of target users and functionalities.

Theoriq is crafted for agent swarms executing autonomous on-chain actions. Infinit emphasizes modular strategy automation, while HeyAnon focuses on simplifying natural language for trading.

This convergence propels DeFi forward by democratizing access; making it more intelligent, autonomous, and efficient.

Through AI-driven liquidity management, predictive strategies, and seamless interfaces, these protocols minimize human error, enhance capital efficiency, and scale operations to institutional levels.

Ultimately, they transform DeFi from a manual system into a self-optimizing, intent-based financial network.

...

4.31K

86

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.