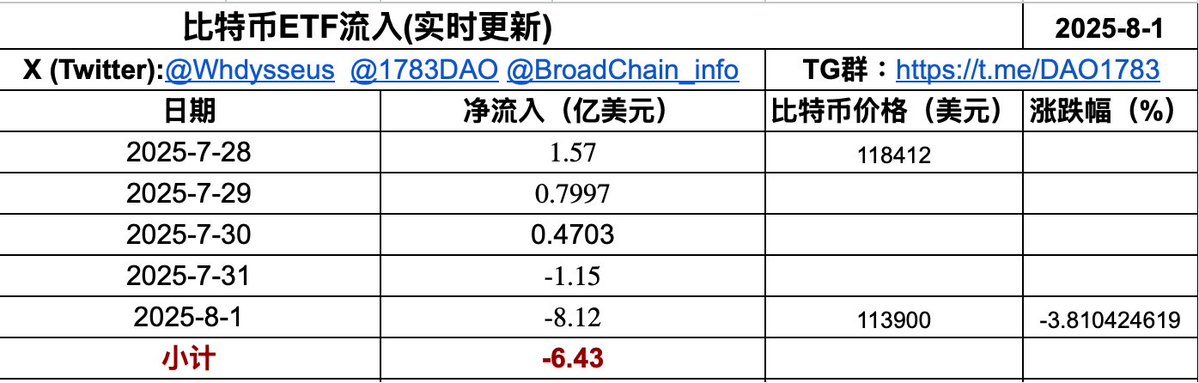

In the past week (Eastern Time July 28 - August 1; Beijing Time July 28 21:00 - August 2 04:00 when the US stock market closed), the price of Bitcoin $BTC dropped from $118,412 to $113,900, a decrease of 3.8%.

The cumulative net inflow of Bitcoin spot ETFs reached -$643 million, with net outflows on 2 out of 5 days, including:

On July 28, net inflow of $157 million

On July 29, net inflow of $79.97 million

On July 31, net inflow of $47.03 million

On July 31, net outflow of -$115 million

On August 1, net outflow of -$812 million

Top 11 Bitcoin ETFs:

BlackRock $IBIT holds 741,055 BTC

Fidelity $FBTC holds 200,088 BTC

Grayscale $GBTC holds 181,364 BTC

ARK 21Shares $ARKB holds 49,607 BTC

Grayscale $BTC holds 42,100 BTC

Bitwise $BITB holds 40,740 BTC

VanEck $HODL holds 16,801 BTC

Coinshares Valkyrie $BRRR holds 5,996 BTC

Invesco Galaxy $BTCO holds 5,418 BTC

Franklin $EZBC holds 5,355 BTC

WisdomTree $BTCW holds 1,564 BTC.

Show original

4.92K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.