The Lombard team keeps SHIPPING UPDATES

Everyone who is using Lombard and yapping should pay attention 🗣️

Below are all the latest updates🧵👇

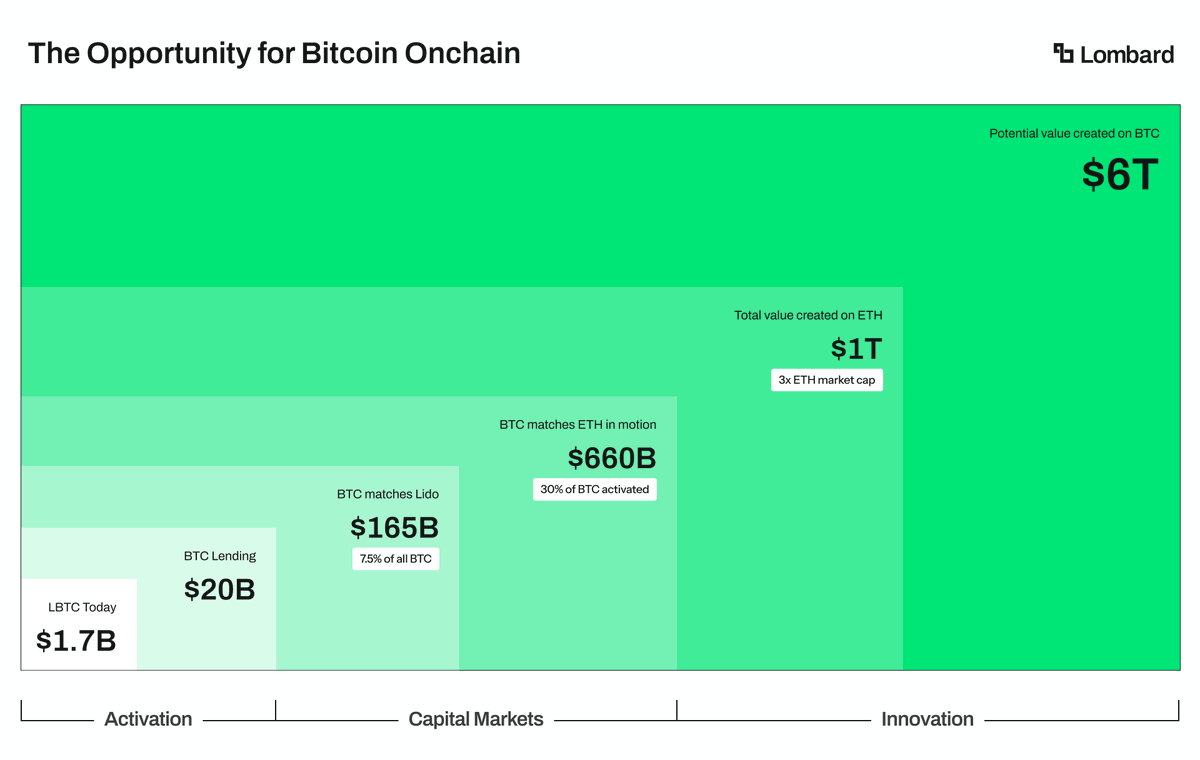

2) uBTC is underutilized in DeFi; Lombard is changing that

• Despite being the largest crypto asset, BTC sees little on-chain use. Most BTC sits idle, disconnected from DeFi.

• $LBTC solves this by being liquid, yield-generating, fully BTC-backed, and secured by institutional validators.

• It reached $1B TVL in 92 days and onboarded over $2B of BTC liquidity across 12 blockchains. Over 80% of $LBTC is actively deployed in DeFi.

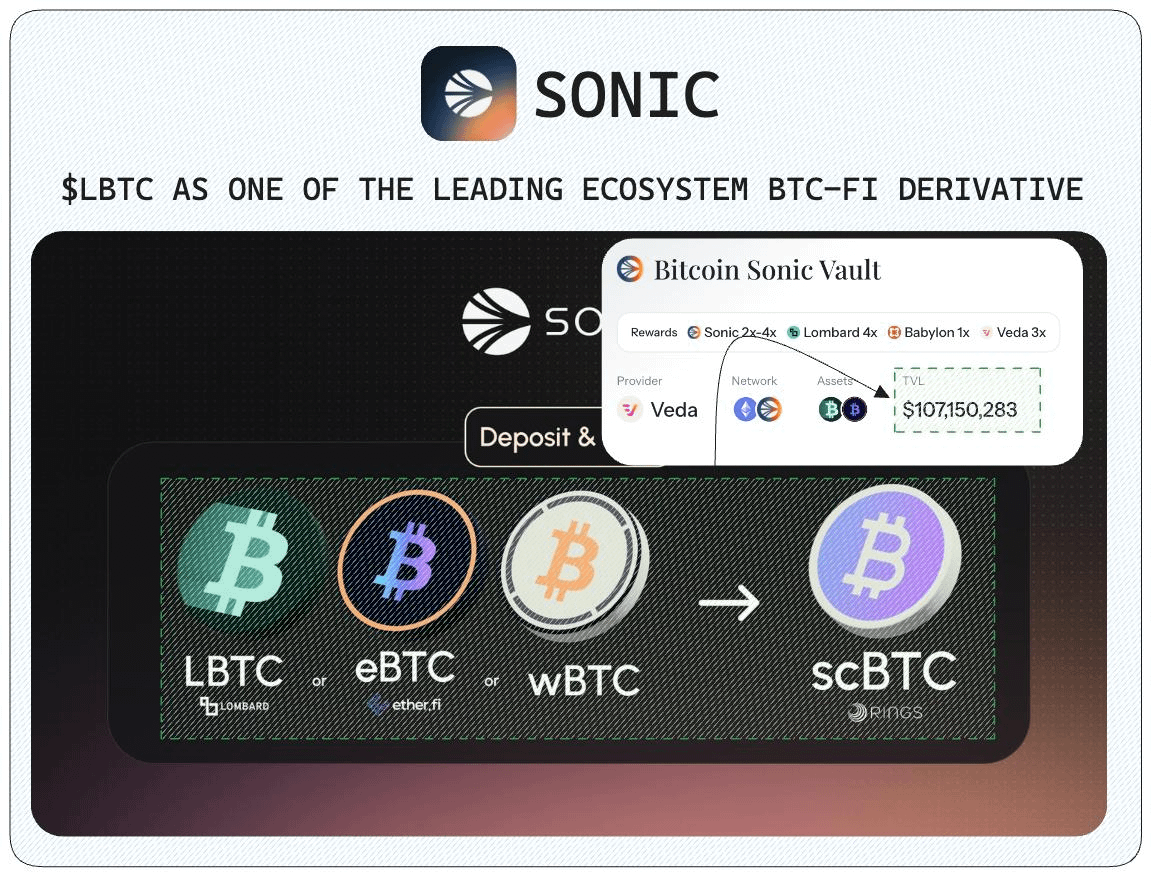

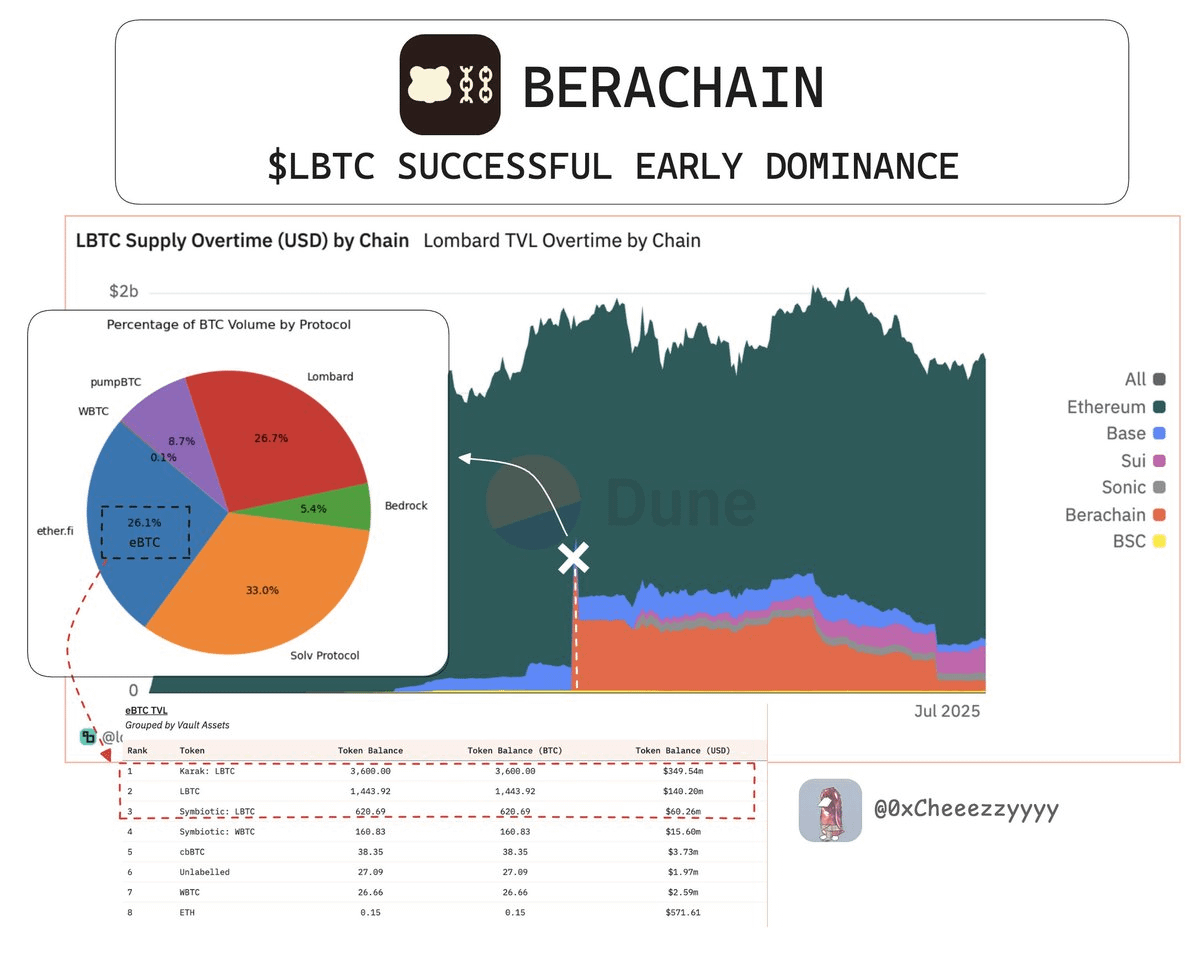

4) Lombard scaled $LBTC by targeting early ecosystem wins

• On SEI, Lombard became the first LSP on MoveVM, capturing $600M+ TVL.

• On Berachain, pre-deposit vaults peaked at $550M. In Sonic Labs, $scBTC launched via Trevee with $LBTC deposits.

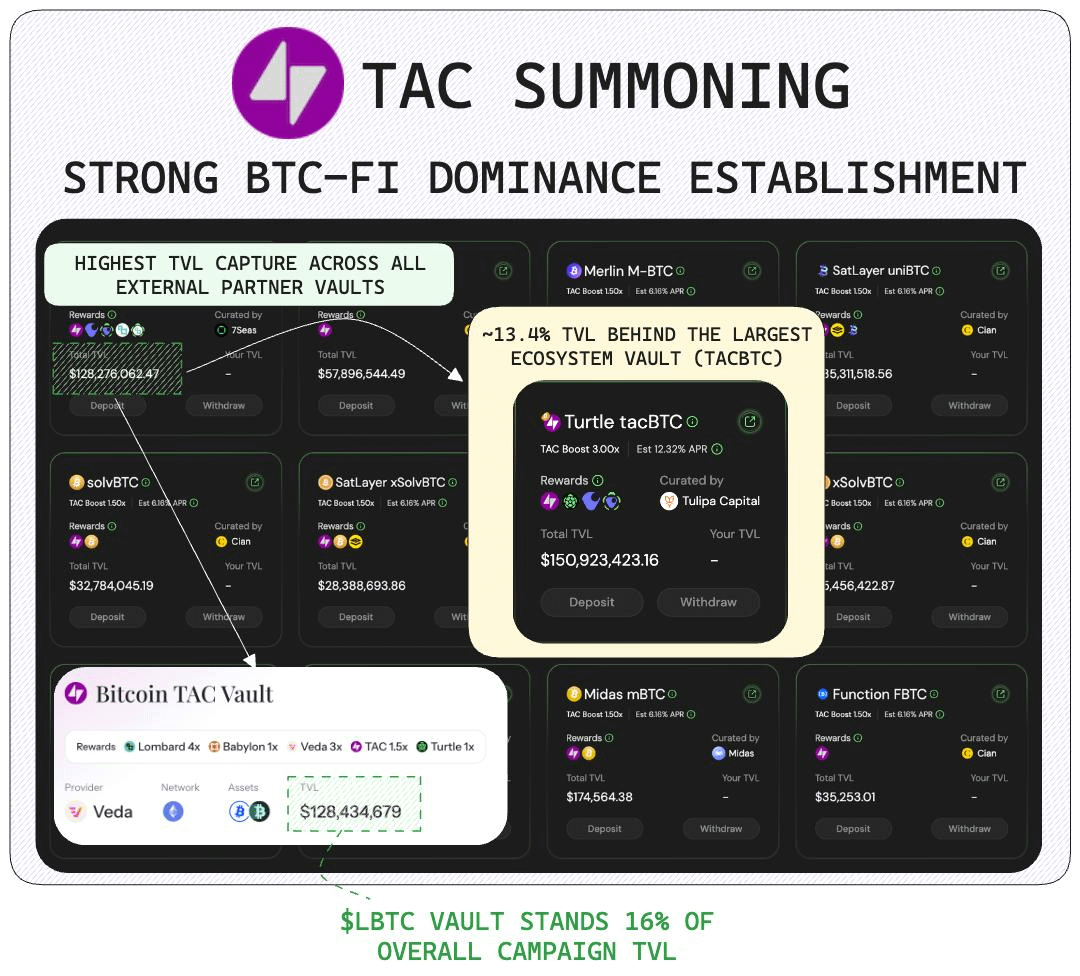

• On TAC, $LBTC became the largest external BTC vault. On Katana, Lombard vaults surpassed $WBTC in depth.

• These integrations weren’t random they followed a go-to-market strategy focused on timing, execution, and ecosystem alignment.

5) $LBTC is becoming BTC-Fi’s default primitive like $stETH for ETH

• Every new integration brings more liquidity, more users, and more trust.

• This compounds credibility, making $LBTC the default BTC asset in more ecosystems. This trust flywheel is hard to replicate.

• As BTC-Fi gains momentum, $LBTC is positioned to dominate just as $stETH did in ETH staking and $eETH is doing in restaking.

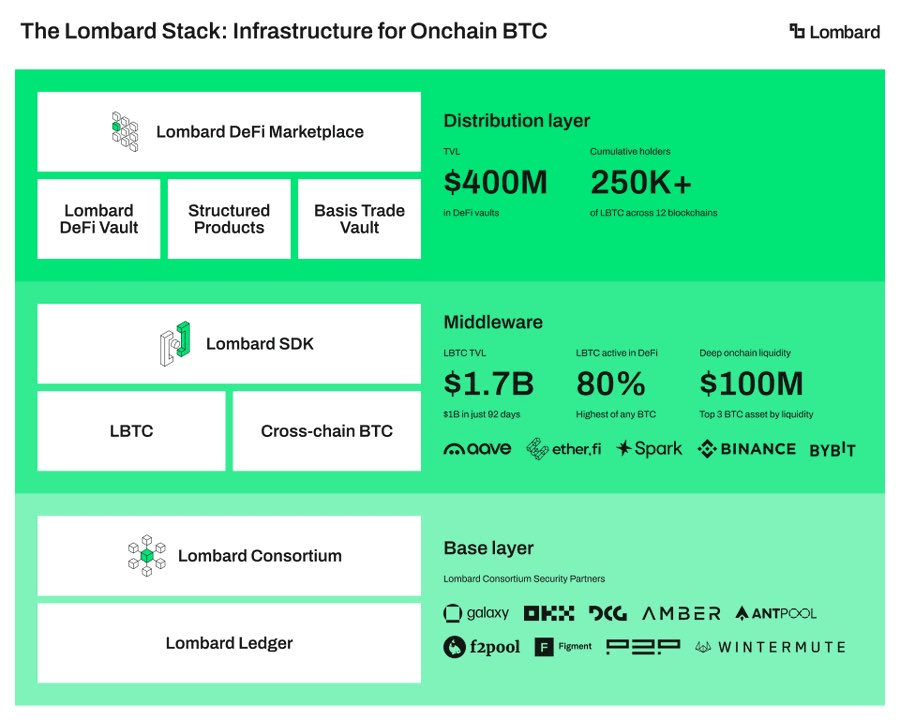

6) Lombard is building the infrastructure layer for Bitcoin onchain

• $LBTC is not just a token it’s the distribution engine for BTC across DeFi, CeFi, and TradFi.

• Lombard is building SDKs, marketplaces, institutional vaults, and compliant wrappers all designed to mobilize idle BTC and make it programmable.

• Tether and Circle didn’t just issue stablecoins they built the stablecoin economy. Lombard is doing the same for Bitcoin.

Lombard is leading the Bitcoin DeFi ecosystem...

hop on board the @Lombard_Finance 👑

18.06K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.