Most investors wonder why the $BTC price doesn't go up as they think.

If you're holding $BTC, here are 4 fundamental charts to explain why the $BTC supply will never be 21M:

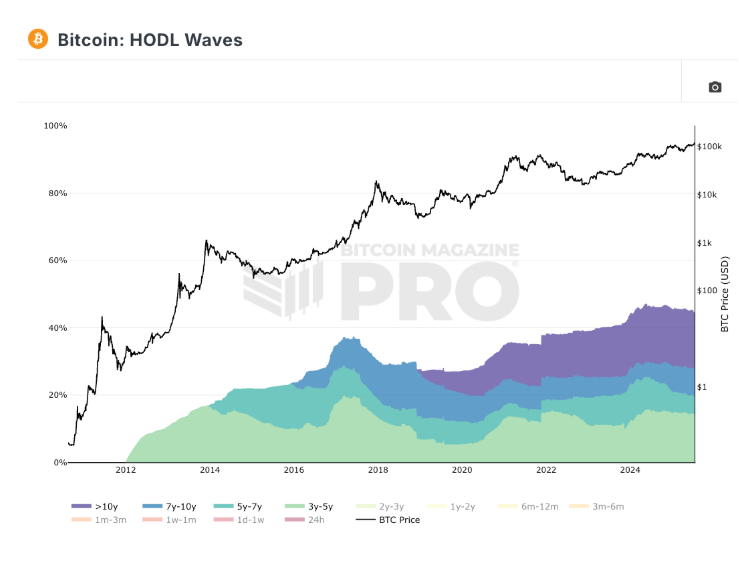

#1: 40% of all $BTC is held by 5+ years hodlers - this is the supply that doesn't move hands

#2: 3-5 years hodlers have been hodling strong since 2017 - supply doesn't move much here either.

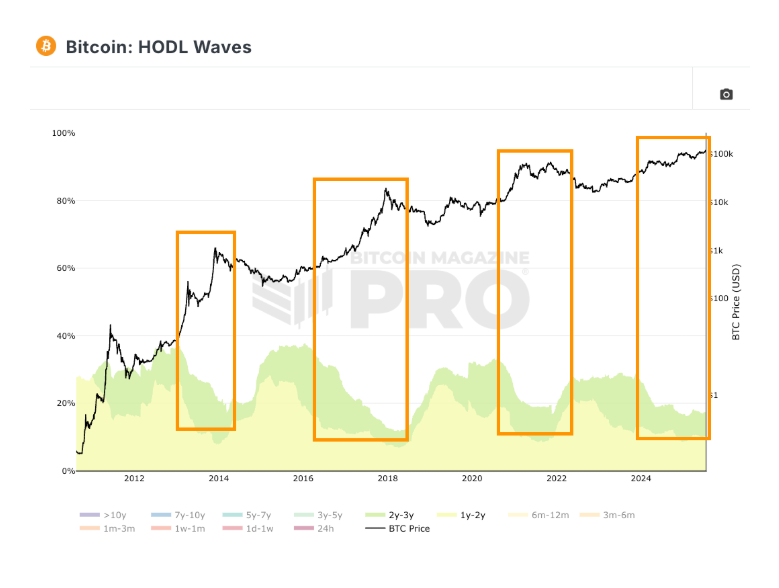

#3: 1-3 year hodlers - supply drops by 15-20% every time $BTC price rises. This is more supply entering the market.

#4: < 12 month hodlers buy the bags of the long-term hodlers every time $BTC price rises

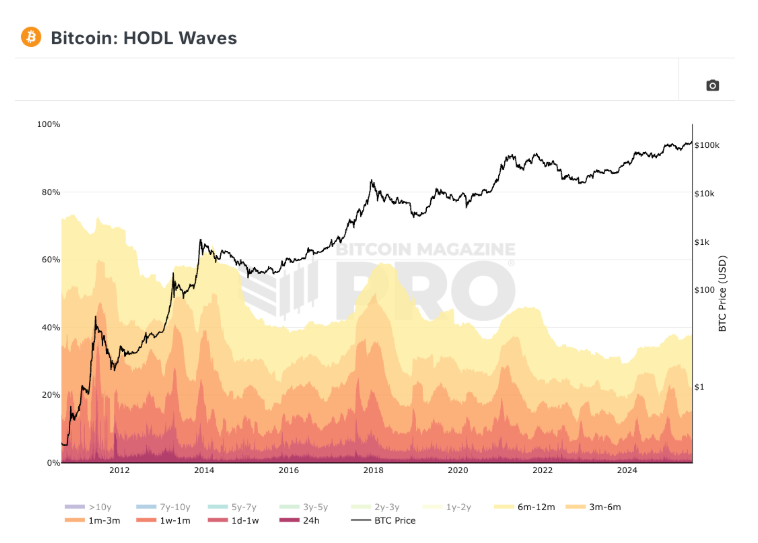

Every time the price goes up, $BTC moves from holder to holder.

That's how markets find price, and how price creates more supply.

But options, ETFs, treasury companies, miners, and more all provide substitutes to the supply of Bitcoin.

This makes even more supply available than believed.

So even if supply is limited to 21 million, you have more and more supply that becomes available to the market.

Thanks for coming to my TED Talk.

2.02K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.