🚨🚨 $U token supply confirmation; @union_build mainnet is upon us

I stumble upon what might be the mainnet migration script for Union build on their Github, written in Go by @PoisonPhang. This is a commit from the 15th of July.

@union_build appears to be migrating from a testnet/PoA system to a PoS mainnet with the $U token as the primary economic asset, with the foundation initially controlling all staking to ensure network stability during the transition.

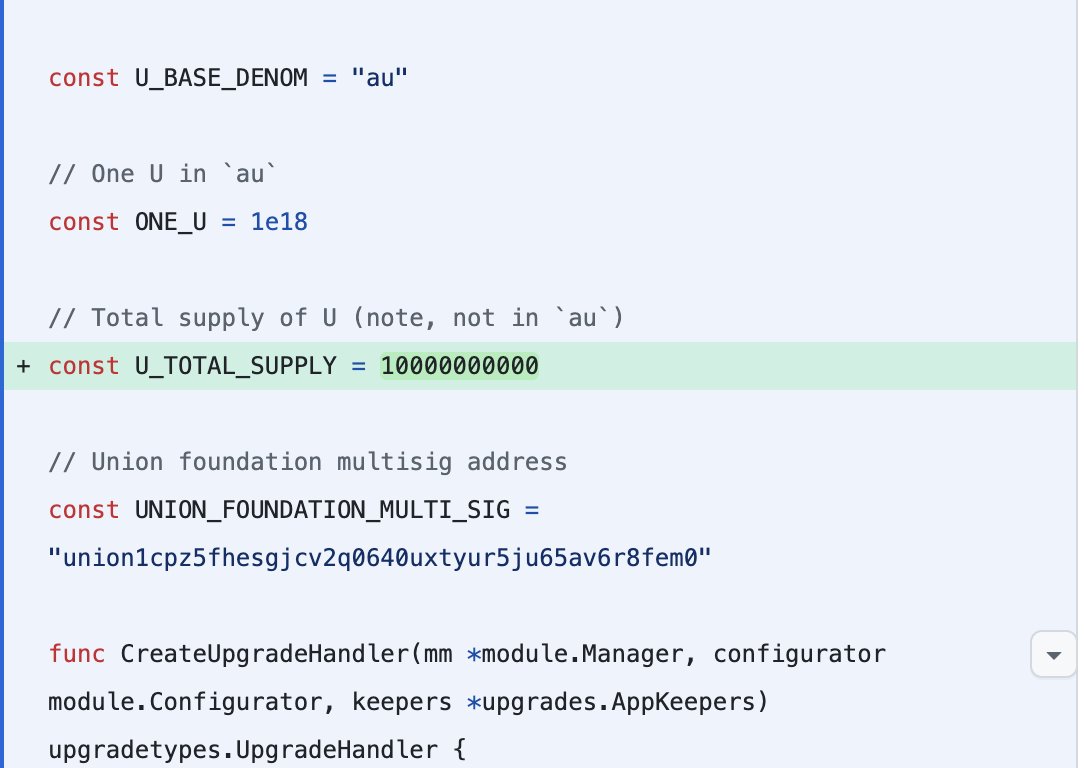

$U Token Details

> Token Name: "U"

> Base Denomination: "au" (atto-U)

> Total Supply: 10,000,000,000 * 1e18 = 1e28 au (10 billion U)

> U token is the gas token on mainnet.

This confirms the $U token supply and base domination.

au (atto-U) is not auBTC. "au" means "atto-U," or 1e-18 U similar to wei for ETH.

The code also confirms the union foundation address and the undelegation and redelegation parameters for validators, strongly hinting at mainnet delegation criteria.

Union Foundation Multisig Address

> All minted $U tokens are sent to this multisig foundation wallet

> This address likely controls treasury and genesis allocations and early staking

const UNION_FOUNDATION_MULTI_SIG = "union1cpz5fhesgjcv2q0640u...fem0>"

this is the real multisig address controlling $U at genesis .

Staking & Validator Reset

This portion of the code screams mainnet to me.

what it aims to do is

> remove all existing delegations

> validator self-delegation minimum is reset

> validator rewards are claimed and wiped

> validator entries are also rewritten

it basically cleans slate for staking in preparation of a mainnet launch

Re-delegation from Foundation

validators get new delegation from the foundation (foundation holds all $U tokens at this point) after the successful validator reset

> the foundation account re-delegates to validators what was taken initially.

> typically done to bootstrap staking at genesis block

Union Governance Parameters Set

this part of the code sets governance proposal requirements

> govParams.MinDeposit = 10 $U. this is the minimum deposit required to submit a governance proposal and helps reduce spam

> govParams.ExpeditedMinDeposit = 50 $U. has a higher threshold that allows proposal leap over queues and enters voting consideration quickly used for urgent cases

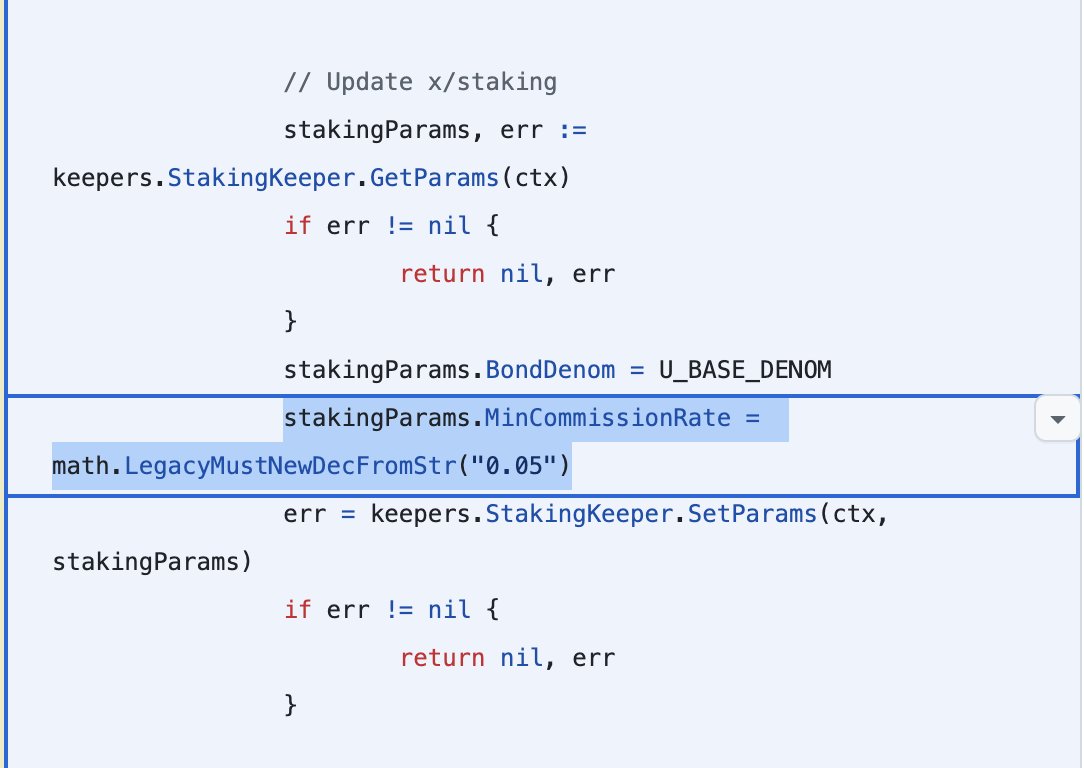

Staking Parameters Updated

these will be the staking parameters applicable at mainnet launch:

> bond denomination changed to "au" (the U token base unit)

> minimum commission rate set to 5% (0.05)

> minimum self-delegation reset to 0 for all validators

Old Tokens Burnt

if you are familiar with the old testnet tokens then these wont look new to you

> burnToken(..., "muno") - union-testnet-10 gas token

> burnToken(..., "upoa") - union-1 and union-testnet-10 PoA token

> burnToken(..., "ugas") - union-1 gas token

My Take

From my research and understanding, this will be the transition from testnet to mainnet. it is a mainnet migration script based on Cosmos SDK.

> It resets all delegations, wipes rewards, and reassigns staking from the foundation

> It mints the entire token supply and sends it to a real multisig

> It burns old testnet tokens.

> It sets real governance, staking, minting, and fee parameters

> It aligns all modules (staking, bank, mint, gov, crisis, fee market) around the new U token.

Tagging @corcoder , @0xkaiserkarel , and @e_beriker to verify if this is indeed mainnet code or just a staging upgrade. @0xNexar too can chime in

github link:

zkgm

Show original

71.42K

701

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.