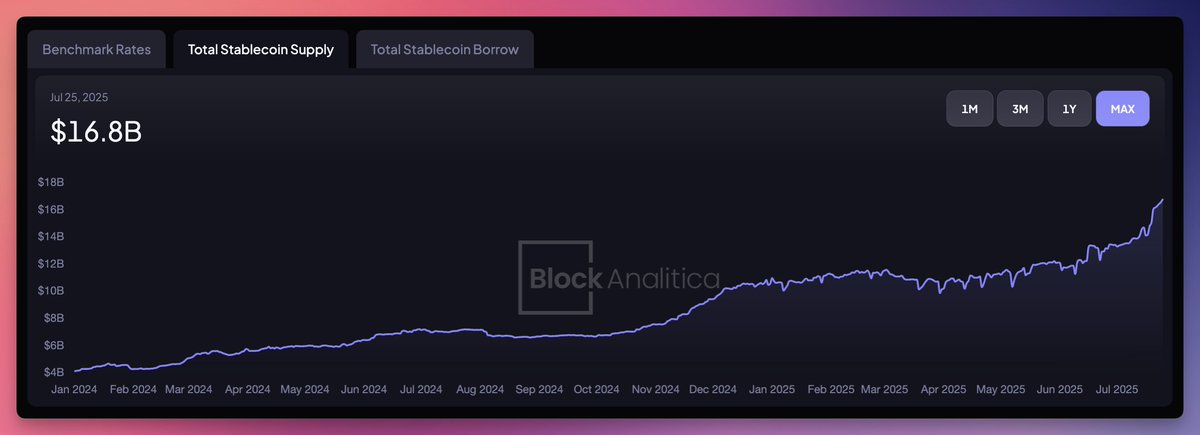

Total stablecoin supply in DeFi just hit a record high of $16.8B. Where is this capital allocated, and which pools currently offer the best risk-adjusted rates?

TLDR:

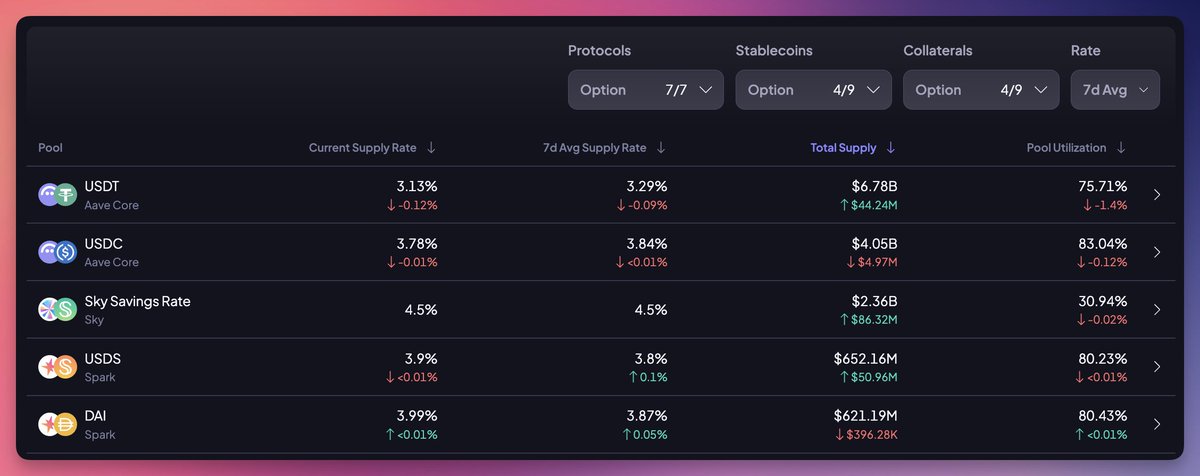

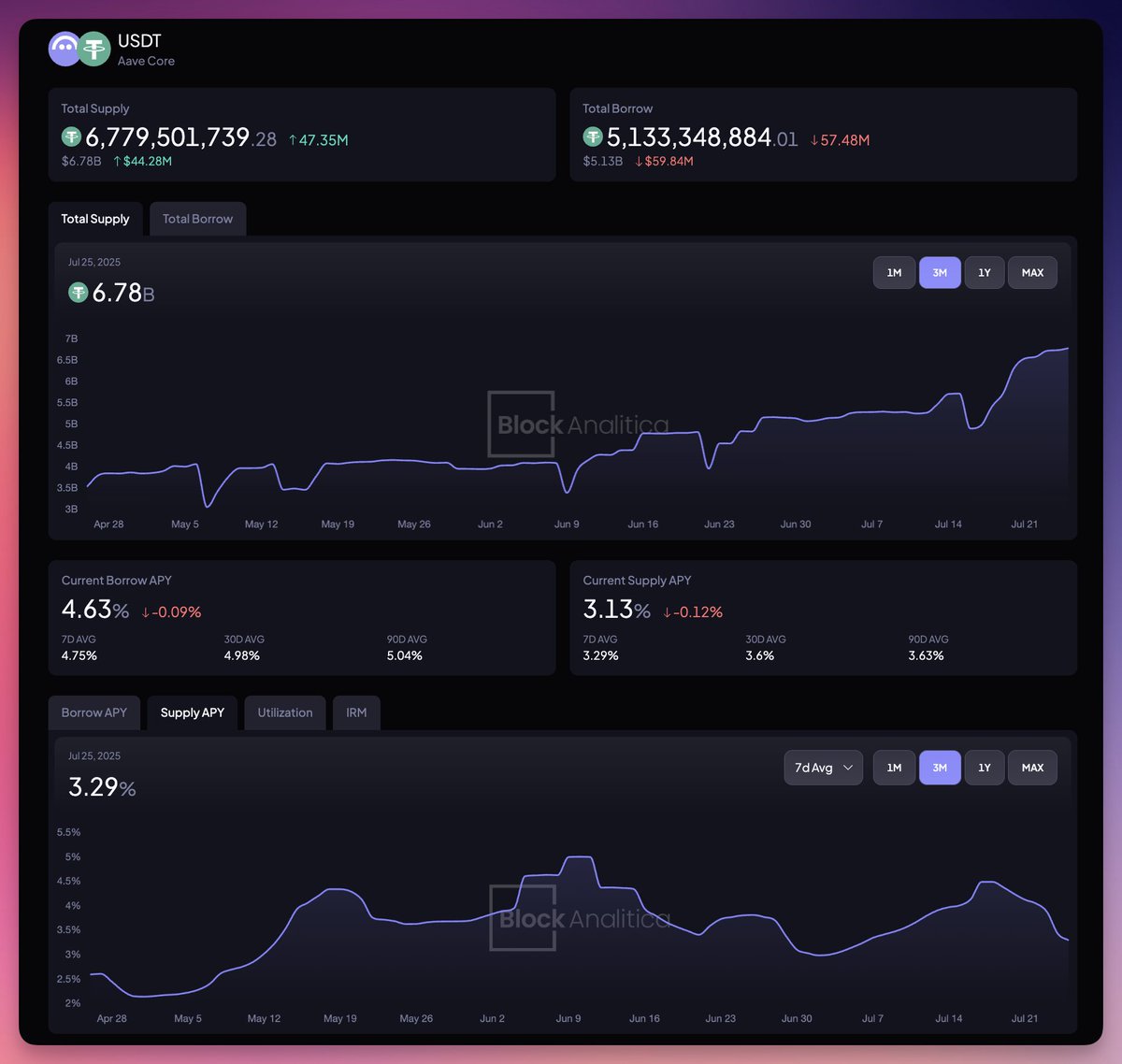

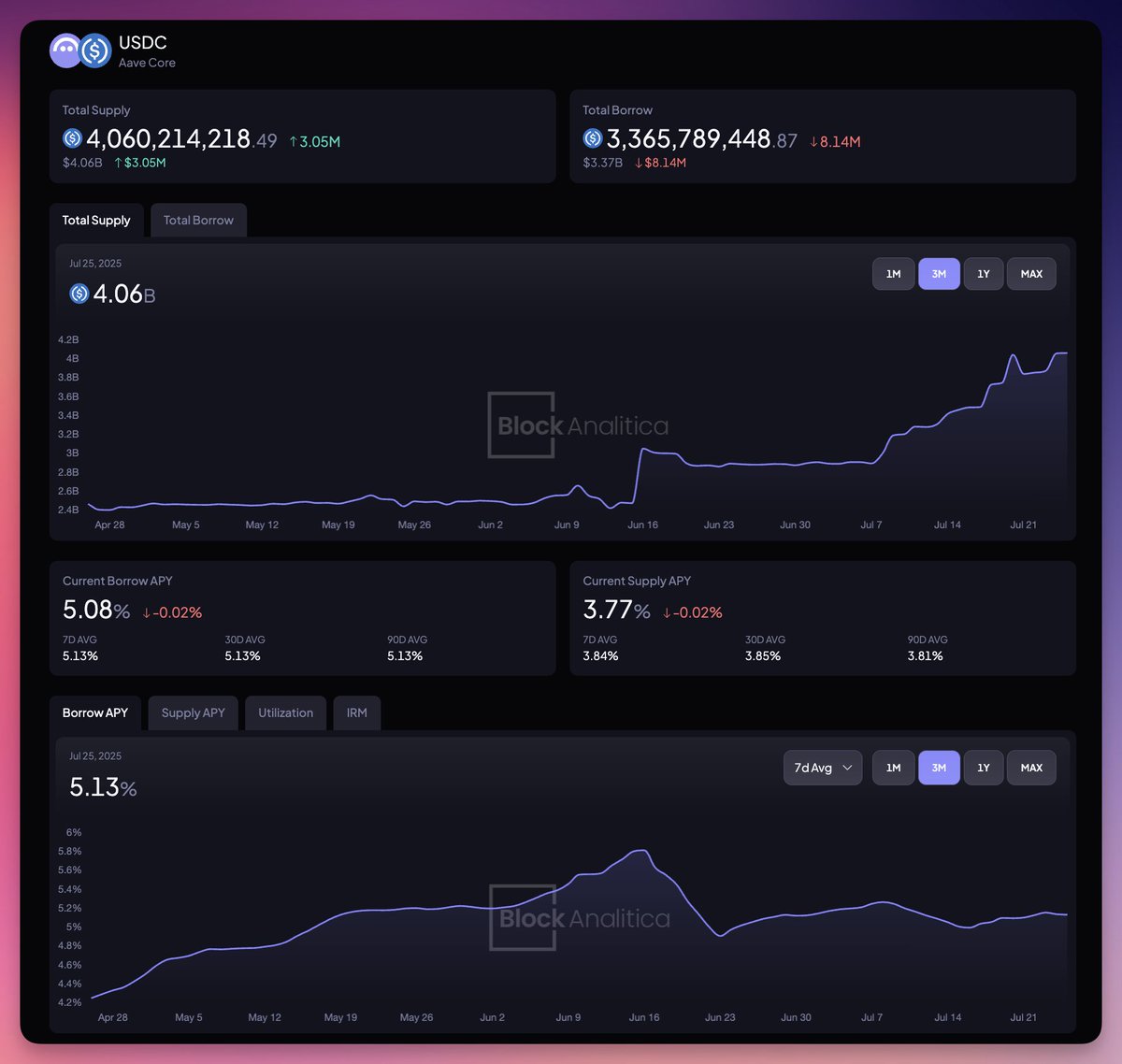

• For USDT and USDC, @aave is the most popular alternative, accounting for 64.5% of total stablecoin deposits ($10.83B).

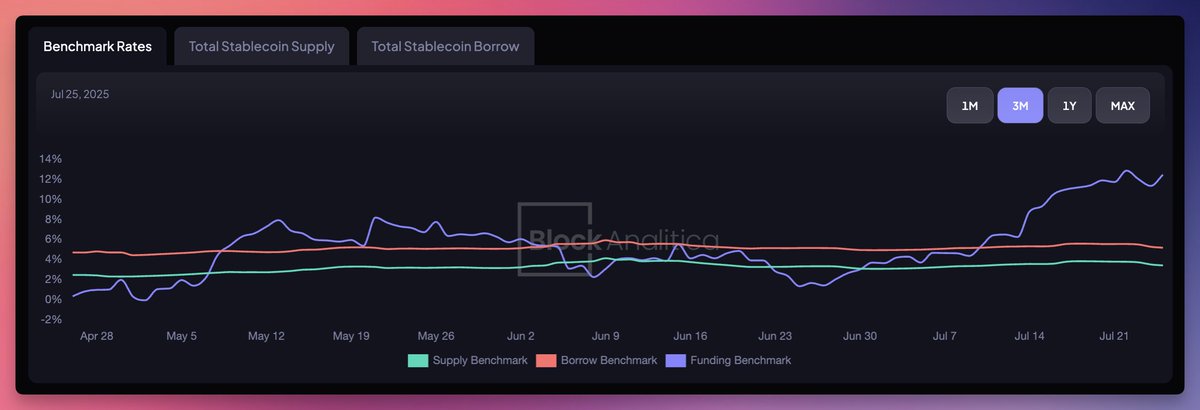

• @MorphoLabs' WBTC/USDC 86% market currently provides the highest 7d avg APY (4.83%) with the lowest market risk score. USDS on @aave (4.82%) and USDC on @0xfluid (4.74%) offer the most attractive yields with the lowest liquidity risk scores.

• @SkyEcosystem Savings remains competitive at 4.5% APY, with over $2.36B supplied.

Where are users supplying stablecoins?

• Aave Core dominates USDT and USDC deposits. Their supply rates sit close to the Sphere Supply Benchmark (supply-weighted average rate across all stablecoin lending markets on Sphere), while its deep liquidity makes it the preferred venue for larger users.

• Sky Savings Rate (SSR+DSR) is third in line, with $2.36B in deposits. Because SSR is set by Sky Governance rather than pool utilization, the yield is stable regardless of size, another benefit for large suppliers.

• A significant share of liquidity also sits in @sparkdotfi's SparkLend USDS and DAI markets, made possible by the Sky Allocation System, whereby assets are allocated to SparkLend via the Spark Liquidity Layer.

5.13K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.