➥ The Next Asymmetric Opportunities - PTC

Time to get serious.

Forget the echo chamber of half-baked protocols on some leaderboards lacking strategy and revenue post-TGE.

What you need are early-bird opportunities before anyone else even whispers about them, and this post is your guide.

Let me introduce you the triumvirate, PTC, or Pendle-Terminal-Converge, your next winning move. Why?

Dive into our 30-second report 📖

...

— Before We Move On

We have previously provided detailed explanations of @pendle_fi and @convergeonchain in our earlier posts:

✧ Pendle →

✧ Converge →

If you're not familiar with these protocols, we recommend reviewing the posts above to better understand the aspects discussed in our content.

...

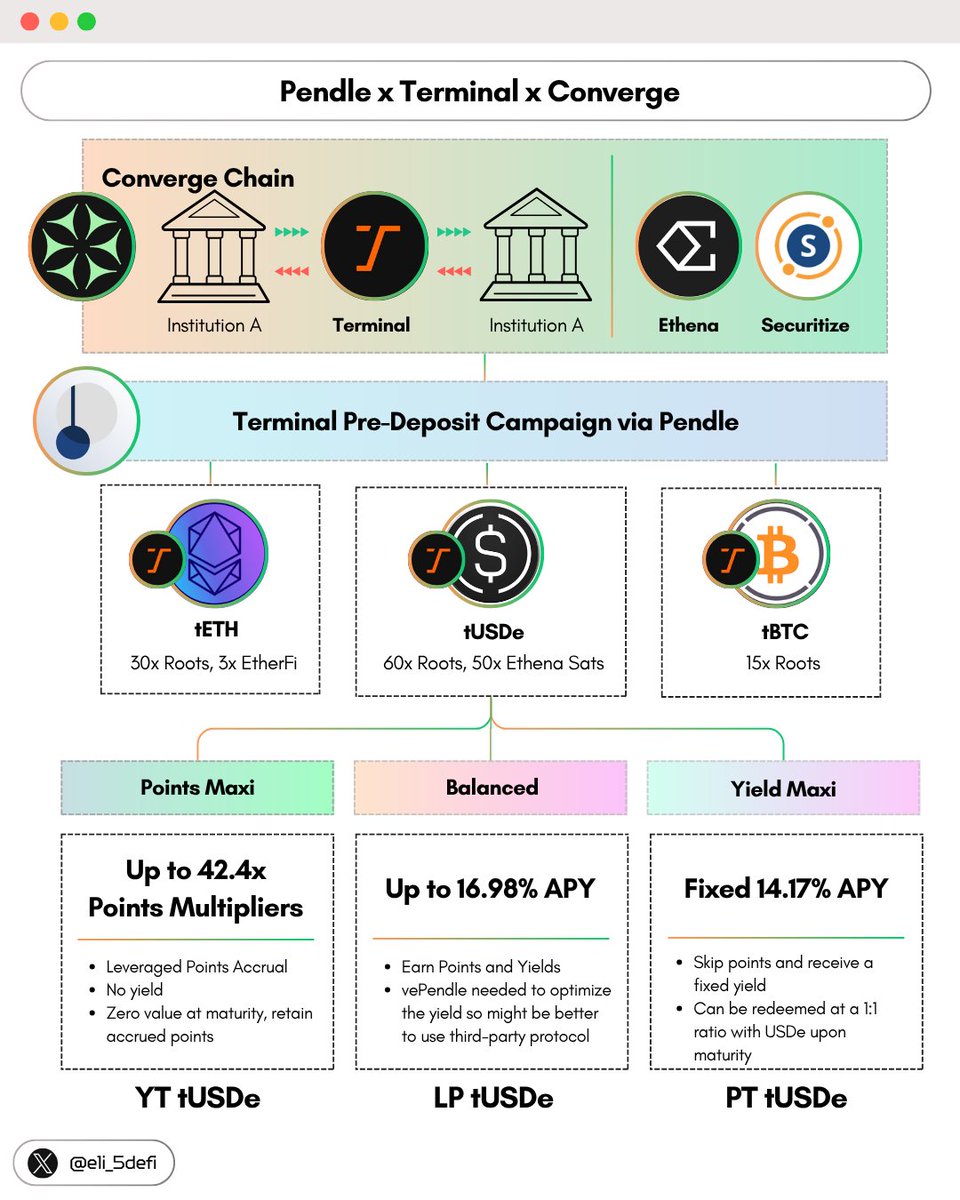

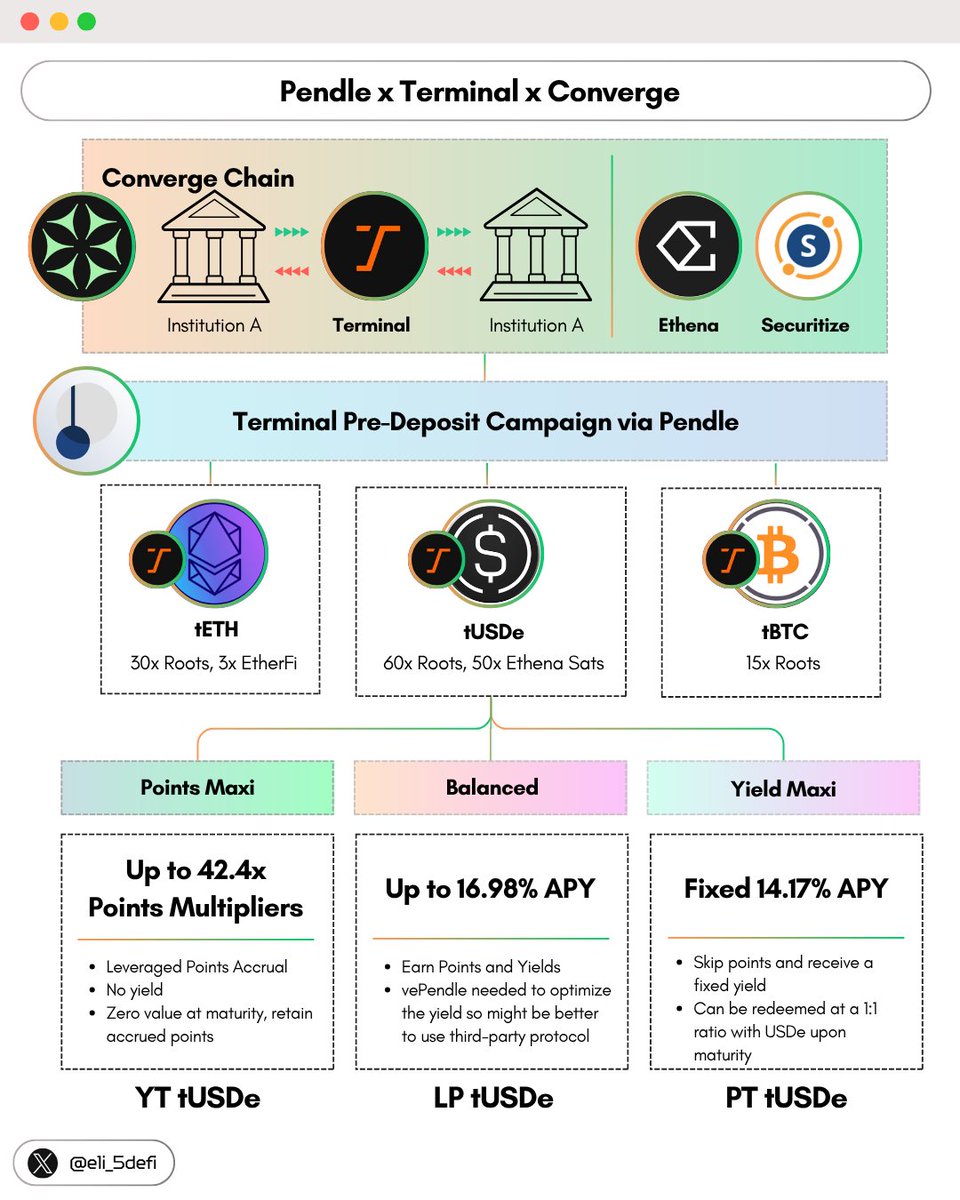

— What is Terminal?

@Terminal_fi is an institutional-grade protocol designed as a liquidity hub and interface for regulated institutions accessing DeFi yield. Key features include:

➠ Built on the Converge Chain and backed by Ethena and @Securitize

➠ Focused on institutional asset trading

➠ Utilizes sUSDe as the base currency for exchange

➠ Mitigates slippage and impermanent loss regardless of position size, common issues in AMM DEX for large orders

Terminal aims to facilitate trillions in trading volume brought by institutions, acting as a native liquidity hub and becomes the growth catalyst for the Converge ecosystem.

...

— The PTC Alpha Opportunities

Here's the alpha: you can participate early in Terminal by pre-depositing in the Pendle Pools below (maturity date: September 25, 2025):

✧ tUSDe → 60x Roots, 50x Ethena Sats

✧ tETH → 30x Roots, 3x @ether_fi Points

✧ tBTC → 15x Roots

Roots are Terminal's native points and can be converted to $TML upon TGE. To date, $100 million has been reached in TVL, with Pendle contributing 71% of that total.

My favorite among these three is the tUSDe pool. Here are the assets you should choose based on your risk preference:

✧ You can maximize points by buying YT, which gives you optimal exposure if you want to go big on $TML with a multiplier up to 42.4x. However, YT will have zero value at maturity while retaining accrued points, and you can trade it freely beforehand.

✧ You might choose a more conservative approach by selecting PT tUSDe, which gives you approximately 14% fixed APY but you'll forgo all points. Frankly, this is better than the 10% APY on vanilla sUSDe.

✧ Or if you want some balance, choose LP tUSDe, which allows you to get exposure to both points and yield at the same time.

...

— Wrap-Up (NFA + DYOR)

Why I believe this presents an asymmetric opportunity:

First, institutional adoption is inevitable, and these institutions will need a new venue for trading. Among other solutions, Converge provides the programmability and composability similar to DeFi for institutions, with backing from Ethena and Securitize.

Second, Terminal is quietly becoming the unofficial DEX for the Converge ecosystem, and the best way to maximize exposure is through Pendle, which offers diverse strategies depending on your goals. Are you betting on $TML, or do you want to earn better yields on USDe, or both?

The choice is yours. 👀

Tagged my friends that reshape the narrative and elevate the conversation.

> @HouseofChimera

> @stacy_muur

> @belizardd

> @SherifDefi

> @0xCheeezzyyyy

> @moic_digital

> @Mars_DeFi

> @Nick_Researcher

> @YashasEdu

> @thelearningpill

> @cryptorinweb3

> @kenodnb

> @Tanaka_L2

> @TimHaldorsson

> @AlwaysBeenChoze

> @satyaXBT

> @Haylesdefi

> @Hercules_Defi

> @DeRonin_

> @0xAndrewMoh

> @0xDefiLeo

> @Defi_Warhol

> @CryptMoose_

> @TheDeFiPlug

> @arndxt_xo

> @CryptoShiro_

> @the_smart_ape

➥ The Next Asymmetric Opportunities - PTC

Time to get serious.

Forget the echo chamber of half-baked protocols on some leaderboards lacking strategy and revenue post-TGE.

What you need are early-bird opportunities before anyone else even whispers about them, and this post is your guide.

Let me introduce you the triumvirate, PTC, or Pendle-Terminal-Converge, your next winning move. Why?

Dive into our 30-second report 📖

...

— Before We Move On

We have previously provided detailed explanations of @pendle_fi and @convergeonchain in our earlier posts:

✧ Pendle →

✧ Converge →

If you're not familiar with these protocols, we recommend reviewing the posts above to better understand the aspects discussed in our content.

...

— What is Terminal?

@Terminal_fi is an institutional-grade protocol designed as a liquidity hub and interface for regulated institutions accessing DeFi yield. Key features include:

➠ Built on the Converge Chain and backed by Ethena and @Securitize

➠ Focused on institutional asset trading

➠ Utilizes sUSDe as the base currency for exchange

➠ Mitigates slippage and impermanent loss regardless of position size, common issues in AMM DEX for large orders

Terminal aims to facilitate trillions in trading volume brought by institutions, acting as a native liquidity hub and becomes the growth catalyst for the Converge ecosystem.

...

— The PTC Alpha Opportunities

Here's the alpha: you can participate early in Terminal by pre-depositing in the Pendle Pools below (maturity date: September 25, 2025):

✧ tUSDe → 60x Roots, 50x Ethena Sats

✧ tETH → 30x Roots, 3x @ether_fi Points

✧ tBTC → 15x Roots

Roots are Terminal's native points and can be converted to $TML upon TGE. To date, $100 million has been reached in TVL, with Pendle contributing 71% of that total.

My favorite among these three is the tUSDe pool. Here are the assets you should choose based on your risk preference:

✧ You can maximize points by buying YT, which gives you optimal exposure if you want to go big on $TML with a multiplier up to 42.4x. However, YT will have zero value at maturity while retaining accrued points, and you can trade it freely beforehand.

✧ You might choose a more conservative approach by selecting PT tUSDe, which gives you approximately 14% fixed APY but you'll forgo all points. Frankly, this is better than the 10% APY on vanilla sUSDe.

✧ Or if you want some balance, choose LP tUSDe, which allows you to get exposure to both points and yield at the same time.

...

— Wrap-Up (NFA + DYOR)

Why I believe this presents an asymmetric opportunity:

First, institutional adoption is inevitable, and these institutions will need a new venue for trading. Among other solutions, Converge provides the programmability and composability similar to DeFi for institutions, with backing from Ethena and Securitize.

Second, Terminal is quietly becoming the unofficial DEX for the Converge ecosystem, and the best way to maximize exposure is through Pendle, which offers diverse strategies depending on your goals. Are you betting on $TML, or do you want to earn better yields on USDe, or both?

The choice is yours. 👀

11.11K

115

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.