1/ Welcome to another evolution in DeFi lending:

$PEAS is now live on Teller.

Hailing from @PeapodsFinance, "pods" are isolated lending markets built to support leveraged LP strategies with a twist: Peapods allows borrowers to borrow even if there are no lenders present.

Let's dive in:

2/ @PeapodsFinance presents a unique approach to yield farming:

Its "pods" generate real yield through market volatility and arbitrage.

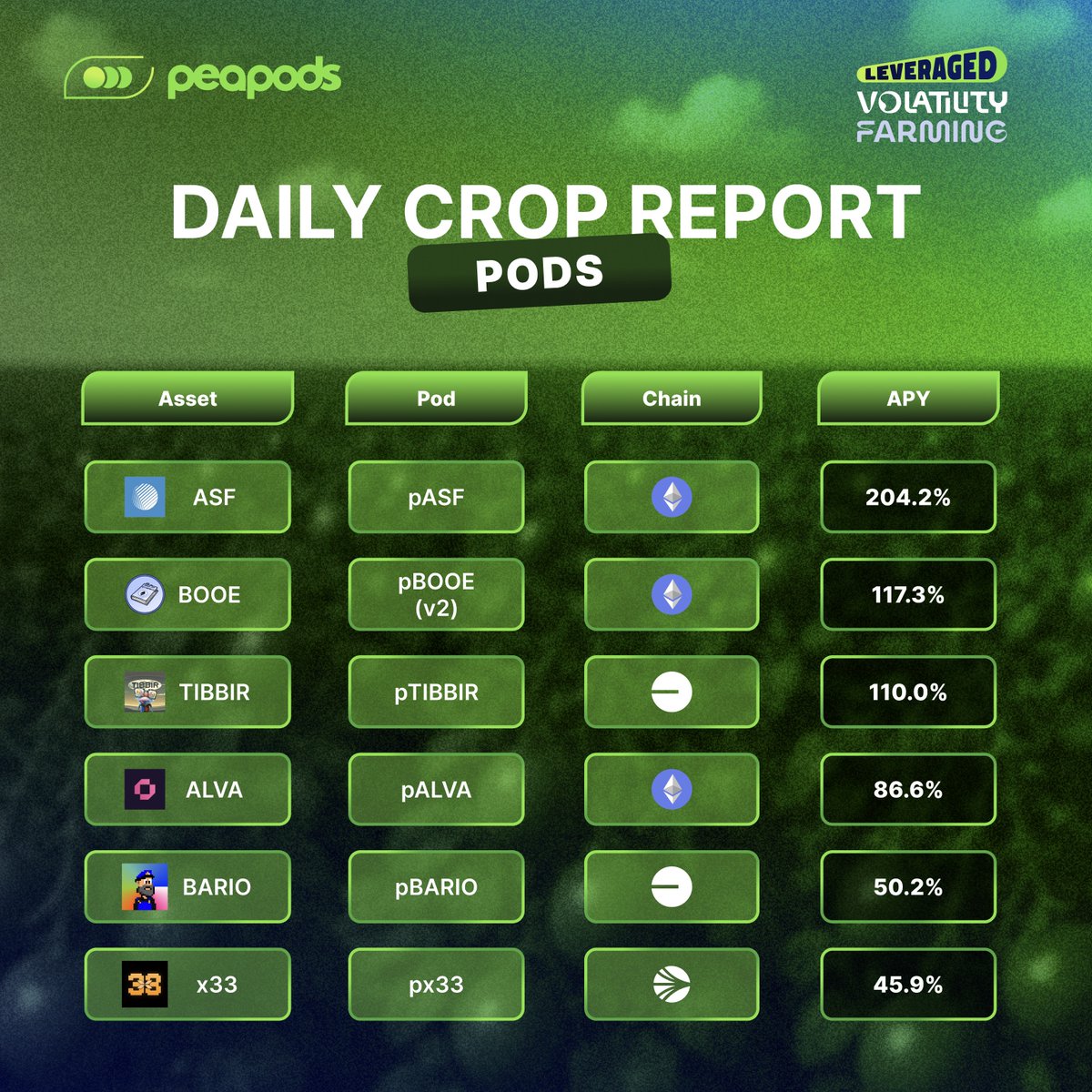

🧵 Daily Crop Report (13/07/25) – Leveraged Volatility Farming (Pods)

Weekends are for resting, but Peapods farmers know how to balance relaxation with productivity.

With their Pods farming the market 24/7, they can enjoy beach days any time 🌴

Here’s what weekends with yield looks like:

🏖️ 204.2% on $ASF – pASF (Ethereum)

🏖️ 117.3% on $BOOE – pBOOE (V2) (Ethereum)

🏖️ 110.0% on $TIBBIR – pTIBBIR (Base)

🏖️ 86.6% on $ALVA – pALVA (Ethereum)

🏖️ 50.2% on $BARIO – pBARIO (Base)

🏖️ 45.9% on #x33 – px33 (Sonic)

🌐 Start farming at

📣 Need help? Hop into the Telegram, we are always around:

🧵 Curious why LP farming is better on Peapods?

Read this:

3/ The $PEAS token is not your average farm token 🌱

• No emissions. Ever.

• Instead: protocol revenue is used to buyback and burn $PEAS — that’s how value accrues.

• Owning $PEAS = owning the ecosystem.

Oh, and a share of a Pod? That’s a pTKN — like $pBTC for a BTC Pod.

4/ Why hold $PEAS?

• Fully diluted. No emissions.

• Deflationary: protocol revenue buys & burns.

• 60% of rev goes to vlPEAS voters 🗳️

• Lend $pPEAS to Pods that borrow $PEAS.

This isn’t just a token — it’s the core engine of the ecosystem. 🌱

5/ The beauty of @PeapodsFinance lies in its simplicity:

Investors can either wrap or buy into a pod, providing liquidity and allowing them to earn yield, denoted as $PEAS, over time.

6/ This design doesn’t rely on emissions or gimmicks.

It’s a capital-efficient system that ties real usage (borrowing for LP leverage) to real demand for $PEAS and gives power back to protocol participants.

No fake yield.

No diluted governance.

No inflation.

Just a protocol where leverage is the product — and $PEAS is how it flows.

🌱

7/ Now, $PEAS takes on a new role - collateral on Teller.

Borrowers can post $PEAS and access (1, 3, 7, or 30 days) loans:

• Overcollateralized

• No liquidation risk

• Full upside retained

• Unlock capital instantly

8/ @PeapodsFinance and $PEAS represent a new frontier of yield farming and index investing.

Now, $PEAS also unlocks stablecoin liquidity—without giving up yield or exposure.

Explore all borrowing options 👇

4.11K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.