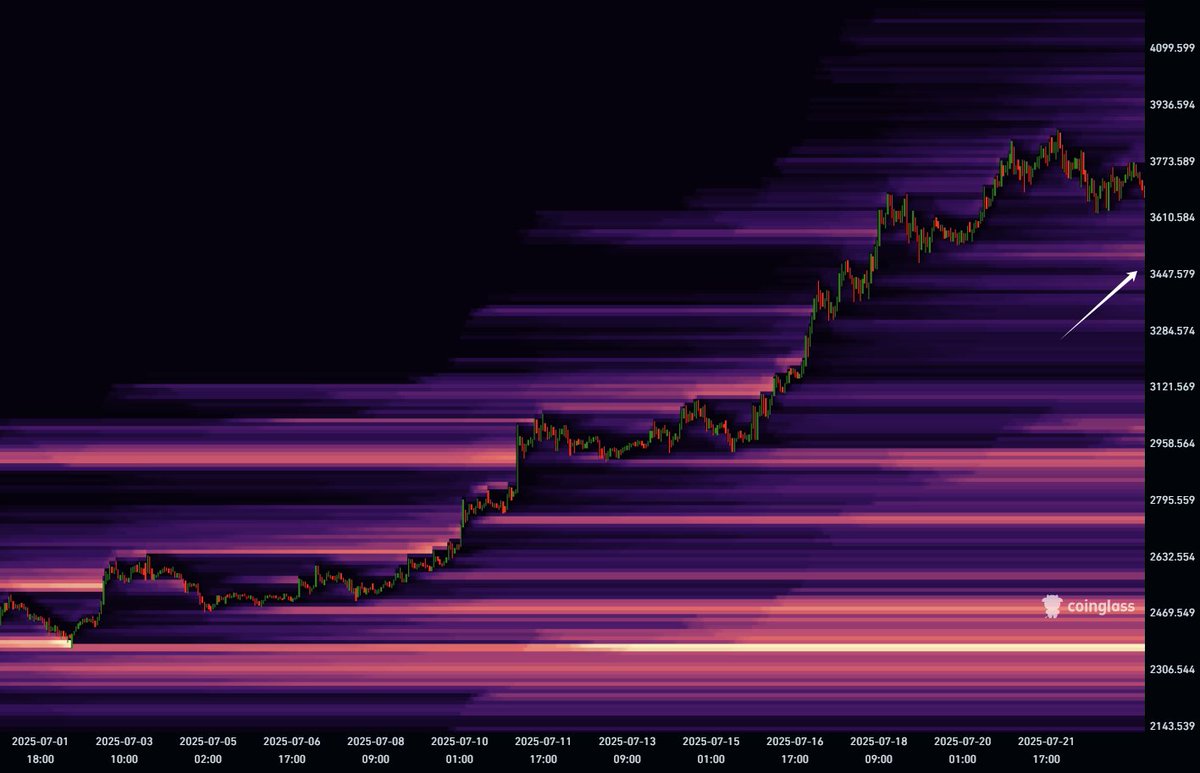

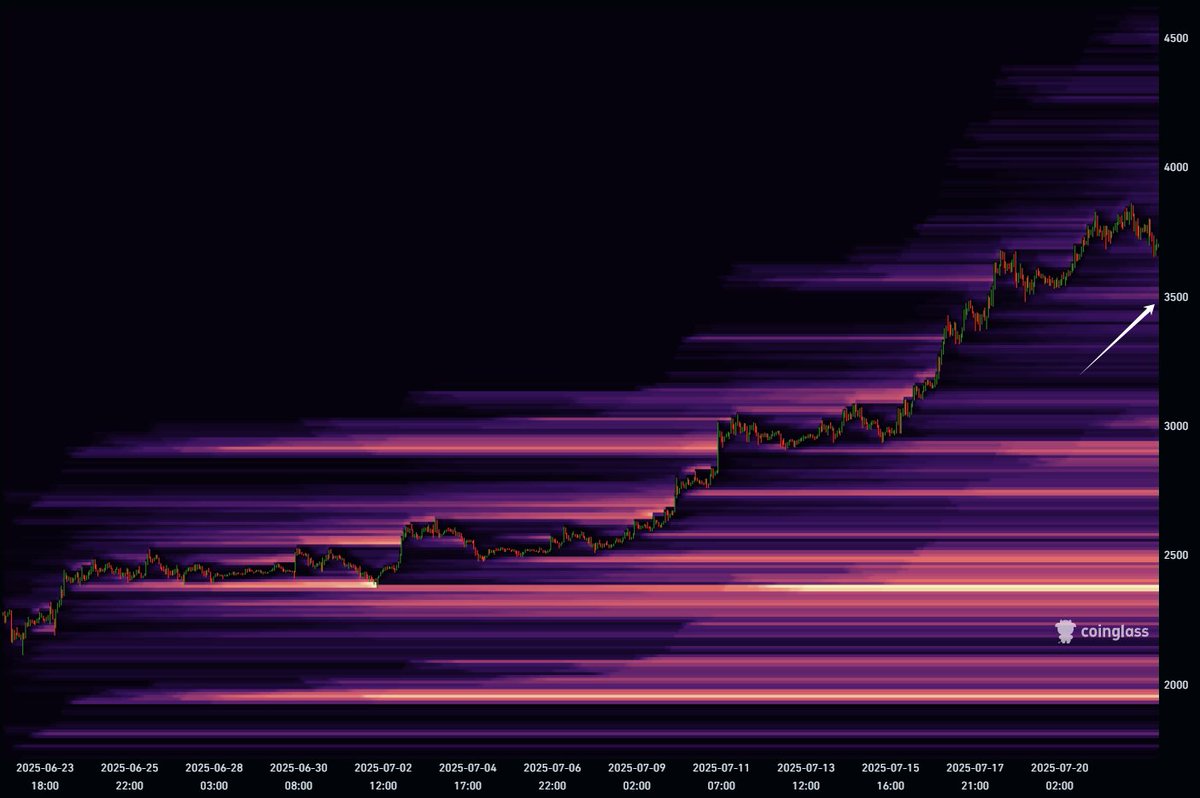

$ETH's pullback seems to be continuing, and since the long liquidity of 3500 is still increasing, we can expect a two-stage ABC pullback, which can just reach around 3500 and liquidate short-term long positions;

This pullback is very healthy, and the futures positions that drag down the continuous rise in prices often come from high-multiplier short-term bulls, even if this wave of market is pulled up by spot, but too much profit of futures bulls will become supply;

Last night during the live broadcast of @Sidekick_Labs, I talked about the long-term expectations of ETH, and my opinion is that it will definitely take a period of time to fluctuate here, but the ultimate goal is most likely to be a new high price, after all, for ETH, the three-year exchange rate downturn has just ended;

There is a logic in the market that "overcorrection must be corrected" and long-suppressed exchange rate pairs often do so in the same extreme way when they usher in a rebound opportunity.

The market after the explosion must also be repaired through extreme pullbacks.

On the one hand, the long-term bearish trend of the ETH/BTC exchange rate pair requires a more extreme rebound that lasts about a month;

ETH also needs a slightly more extreme pullback on the U-standard to correct the trend structure.

$ETH 的期货多头流动性终于有聚集的迹象了!

目前在3500这里出现了一小块清算区,如果价格在本周有持续回调的动力,那么3500就是那个接你上车的位置。

之前已经明确表达过了,这波ETH的强多头趋势的主要推动力来自现货买盘,大概率与币股认购有关,这种模式的出现,会带来大量现货需求。

但随之而来的问题也一样,那就是这些币股是否有能力像微策略那样可以获得持续的融资?

如果单纯是拉高币价和股价,然后择机增发股票来套现,那么ETH就会失去持续的现货买盘,开始在这个位置不断震荡。

而一旦开始震荡,那么期货市场的流动性就会主导价格行为...

因此,除了关注3500的支撑择机做多以外,还要关注那些基于ETH进行币股融资的公司股价,他们的行为是否具有持续性,以及是否能够拿住现货,将会决定这轮ETH最终的高度!

总体上来说,ETH的趋势结构依旧是强多头趋势,因此即使看回调,也不建议做空,而是等待机会接多。

什么时候出现日线级别更低的低点了,趋势结构被破坏了,做空键才能解锁!

89.97K

57

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.