🧭 Pendle Update #75 – High Yield Opportunities in DeFi Are Coming!

@pendle_fi has just released update #75 with a series of highlights for both newcomers and long-term holders: many new pools are about to launch, attractive fixed interest rates are returning with stablecoins, and especially – a rollover opportunity for those holding old-term PT-sUSDe.

🟢 Rollover PT-sUSDe: Double-Digit Fixed Interest Rate

💥 Pendle sends a notice to investors holding PT-sUSDe maturing on 31/07: you can rollover to a new term on 25/09 with a double-digit fixed yield – one of the most attractive rates in the market right now.

The rollover is simple, no asset exchange needed – this is the way to optimize profits while maintaining the original position.

🟢 Many New Pools Preparing to Launch

From the end of September to the end of the year, Pendle will open a series of new pools:

+ Hyperwave hwHLP, StakeDAO asdPendle – opening on 25/09

+ Kinetiq kHYPE, Hyperbeat ultra HYPE – launching on 18/12

Potential community pools:

+ Infinifi siUSD (25/09)

+ SparkleX spETH (09/10)

+ Obol stOBOL (13/11)

+ StabilityFarm wmetaUSD (18/12)

Names like spETH, stOBOL already have large communities and real LSD backing – opening up opportunities for long-term PT positions with liquidity.

🟢 Hot Yields on Pendle

+ USDf (25/09): PT-APY ~14.86%, LP-APY up to 20.44%

+ tUSDe, sUSDe (25/09): both over 11–13% fixed yield

+ rswETH, tETH: maintaining 4–9% APY, suitable for holding ETH staking

+ aUSDC (14/08, SONIC): PT-APY nearly 9%

At a time when macro interest rates are trending down, the ability to lock in yields over 10% for stablecoins is a significant advantage – something that only Pendle is doing well.

🟢 The Ecosystem is Expanding Strongly

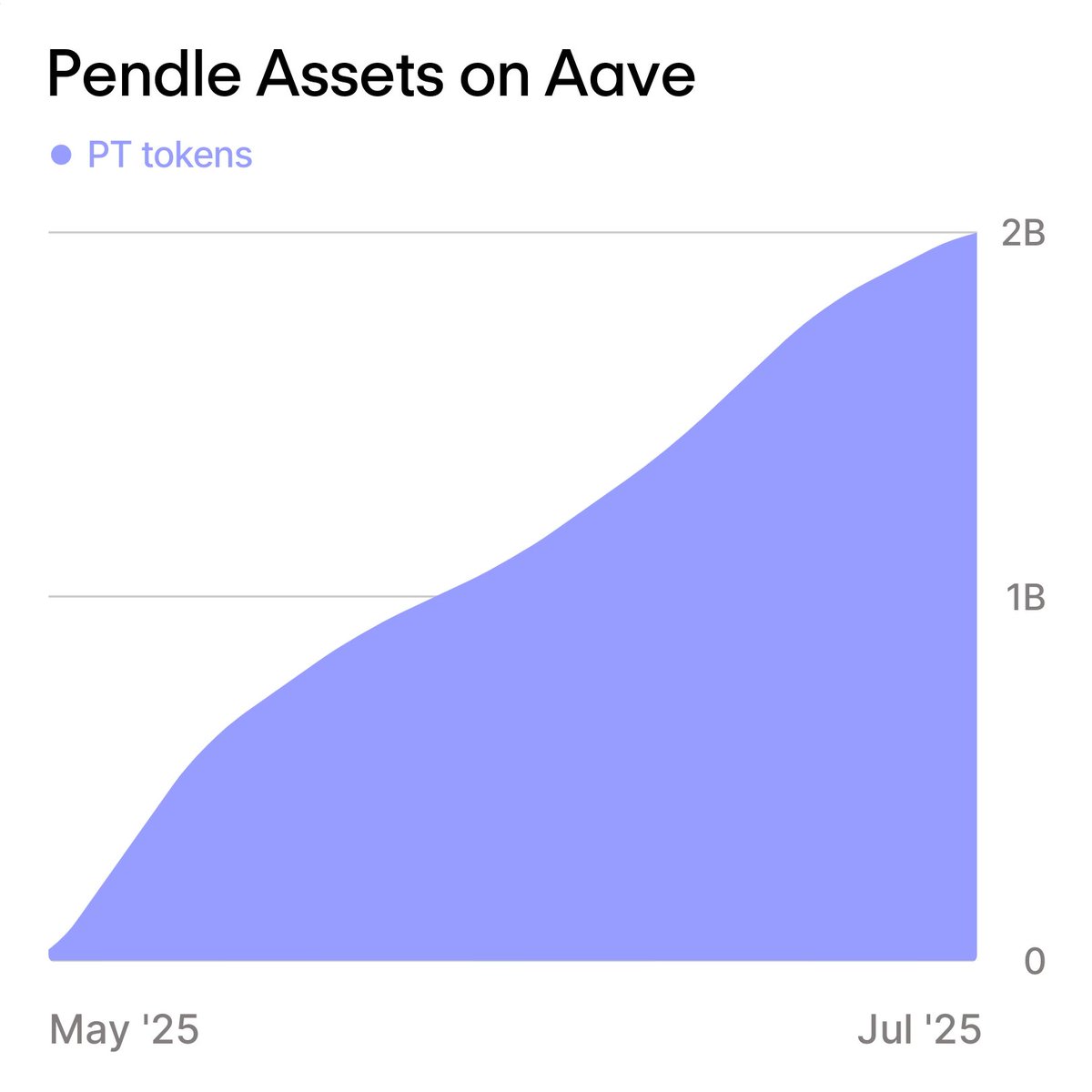

✔️ Total assets on Aave through Pendle have exceeded $2 billion

✔️ 71% of Terminal Finance's TVL is in Pendle pools

✔️ Parties like Spartan Group, DeFi Maestro also name Pendle as "core infra" for the new generation of DeFi yield

This shows: Pendle is no longer a niche platform, but is becoming the default yield infrastructure for many other protocols.

🎯 Strategy Suggestions for Everyone Farming on Pendle:

+ If holding PT maturing on 31/07 → Rollover to 25/09 to maintain high yield

+ If new to the game → Start with PT stablecoins maturing soon, easy to understand and less volatile

+ If already familiar with Pendle → Keep an eye on new community pools (spETH, stOBOL...) to hunt for good price positions before TVL increases significantly

✅ Conclusion

Pendle is entering a new phase: stablecoin flows are returning, pools are expanding, and more community participation.

In the context of traditional interest rates starting to cool down, locking in a fixed yield of 10–20% is extremely valuable.

If you are looking for a way to increase profits from stablecoins or ETH without leverage, Pendle remains the top choice.

Show original

8.34K

41

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.