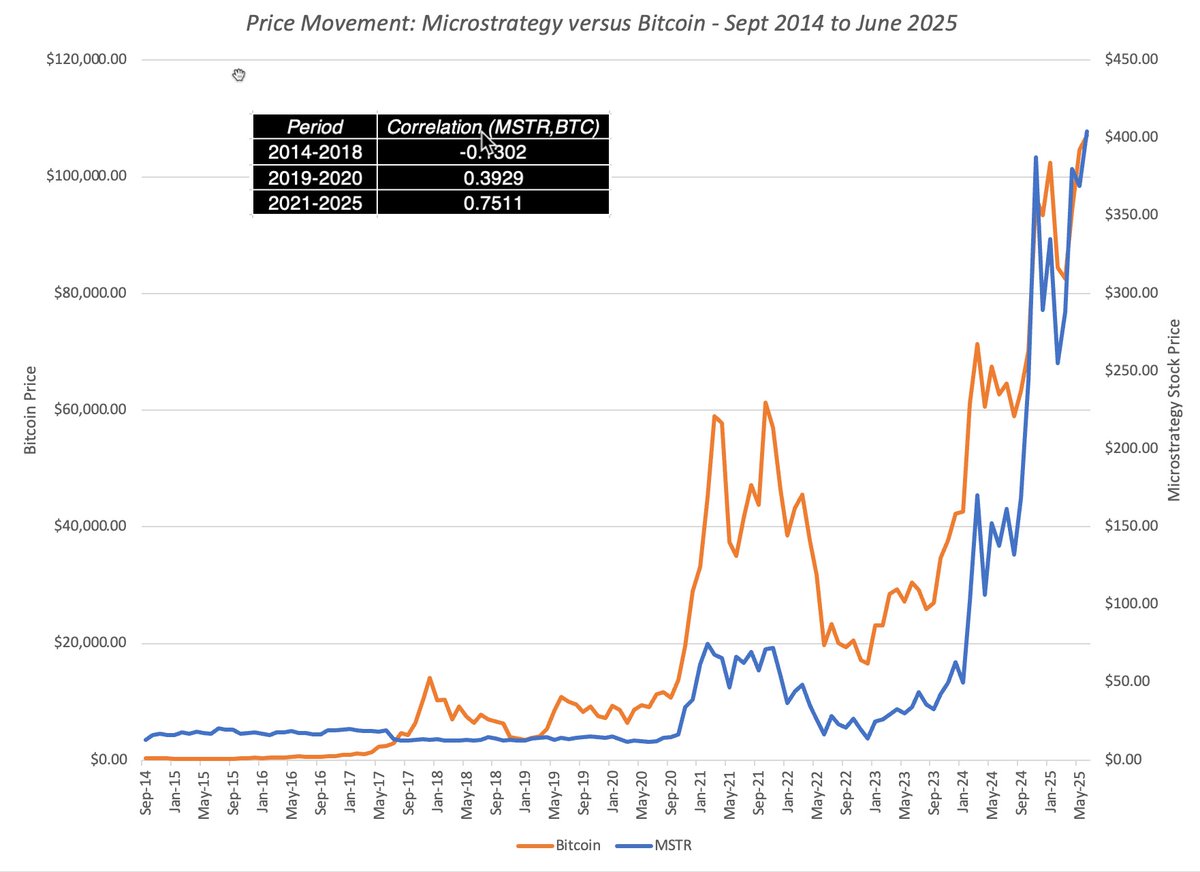

In the last few years, MicroStrategy has become a Bitcoin SPAC, with investors attributing savant-like status to Michael Saylor. Its success has led some to push companies to shift their cash into bitcoin. As a general principle, this is a bad idea, but there are four carveouts.

The second is companies that need bitcoin for day-to-day business (PayPal and Coinbase), but the bitcoin holdings should be proportional to bitcoin transactions, and operate more like working capital than investing bet.

The third is companies in countries with failed fiat currencies, where bitcoin is less volatile and more likely to hold its value than the domestic currency.

19.16K

180

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.