DeFi is quietly building again.

After reviewing the latest data on @DefiLlama, a few trends caught my attention:

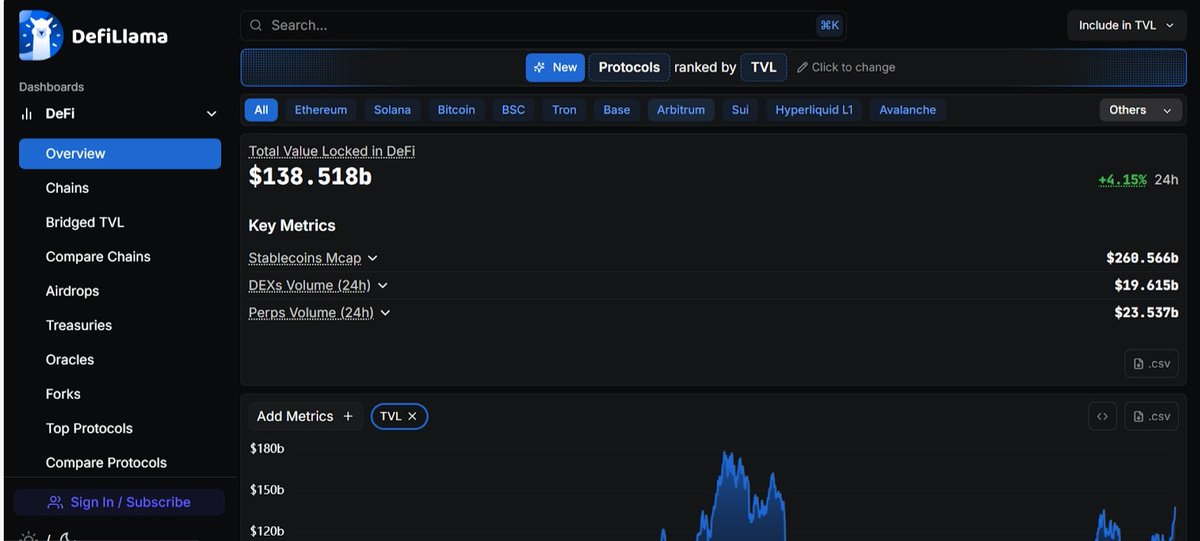

• DeFi’s total TVL is currently sitting at $138B

• Stablecoins MC sits at around $260B

• RWA has secured almost $13B in TVL

• Restaking TVL is exploding, with @eigenlayer securing over $17B in TVL

You don’t need to be a genius to see what’s happening here:

DeFi is transitioning to infrastructure-grade finance.

What’s even more interesting is coming from core primitives that are actually useful.

Check:

→ Lending protocols like @aave

→ Restaking protocols like @eigenlayer

→ Yield markets like @pendle_fi

→ RWA platforms @OndoFinance

The trend is clear:

Capital is flowing towards structured yield, and TradFi players like Fintechs are starting to pay attention to DeFi again.

This is a very different DeFi than what we saw in 2021.

You can fade the hype, but you shouldn’t fade the infrastructure.

Show original

7.44K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.