Hyperion FDV 72 million does not lose money, corresponding to a single currency value of 0.72U

I think the value after the opening should be between 0.5-0.8

Then, after a week of smashing, the market maker sucks up the cheap chips and pulls them again

The plot has already been 👀 written

What will Hyperion's FDV be? What are its expectations?

Previously, the highest cost of obtaining points through trading was estimated to be around 110 million for its FDV.

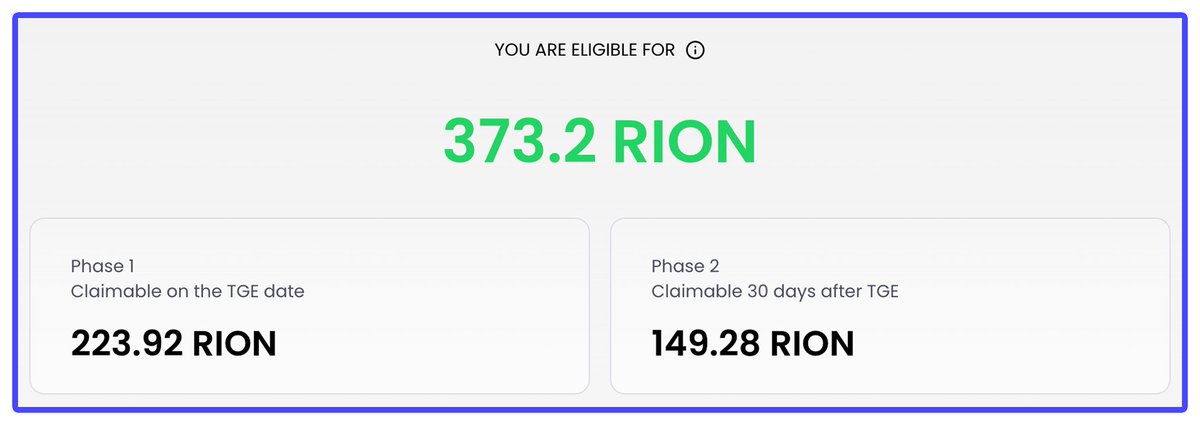

However, based on my actual Drips points to ROIN token ratio of 72:1, even at the highest point cost, as long as the FDV is above 72 million, everyone who earned points through trading can make a profit.

So, as a DEX, how many people are just grinding for points?

From a cost perspective, at least DeFi players receive their points for free, and even pure point enthusiasts can reduce their point costs by half in the subsequent xBTC double points event.

Moreover, Aptos has always needed an opportunity to restore its reputation, and Hyperion, as the most important DEX protocol on the public chain, has its TGE as an excellent opportunity. Therefore, I speculate that its TGE will allow everyone involved in building its ecosystem to profit.

Additionally, Hyperion's performance truly lives up to its status as Aptos's backbone!

When I started mining on it at the end of April, its TVL had just surpassed 10M, and now it has reached 113M. Due to its APR flywheel design, its trading volume has consistently exceeded its TVL.

However, for valuation analysis, people are more accustomed to looking for comparison objects, such as frequently comparing SUI, which belongs to the same MOVE system as Aptos.

➤ Currently, @SuiNetwork has two protocols that can be used for comparison.

1️⃣ The already issued Sui leading DEX @CetusProtocol: If Cetus hadn't been hacked, it wouldn't be a good comparison object since Sui is significantly stronger than Aptos. But after the hack, Cetus is still a suitable comparison object; its market cap has dropped from a peak of 490 million to now 100 million, while still bearing debts (as it slowly compensates user losses).

2️⃣ The strongest competitor among the unissued Sui leading DEXs @MMTFinance: Rumor has it that MMT's last round of financing was valued at around 170 million USD, so to ensure investors do not lose money, MMT's FDV needs to be above 170 million.

Through the comparison of these two protocols, it can also be seen that Hyperion's estimated FDV is not an exaggerated figure.

However, I prefer to believe in Aptos's determination to do well in its ecosystem this time.

On one hand, the market cap needed to break even on points is 72 million; if it cannot reach that, Aptos will be drowned in criticism again!

On the other hand, during the past two months of Hyperion's data surge, many new DeFi protocols have emerged on Aptos, continuously exposing some core protocols in the APR flywheel, which can revitalize the entire Aptos DeFi ecosystem. If Hyperion cannot maintain a good image/market cap, then Aptos's hopes will be dashed!

That's all. I hope @hyperion_xyz's TGE goes smoothly, and I also hope @Aptos develops well, as only then can I have more mines to dig!

Note: The above is for information sharing only and is not investment advice. Please do your own research!

DeFi enthusiast: BitHappy

9.64K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.