Solana "Efficiency KPIs" for Q2:

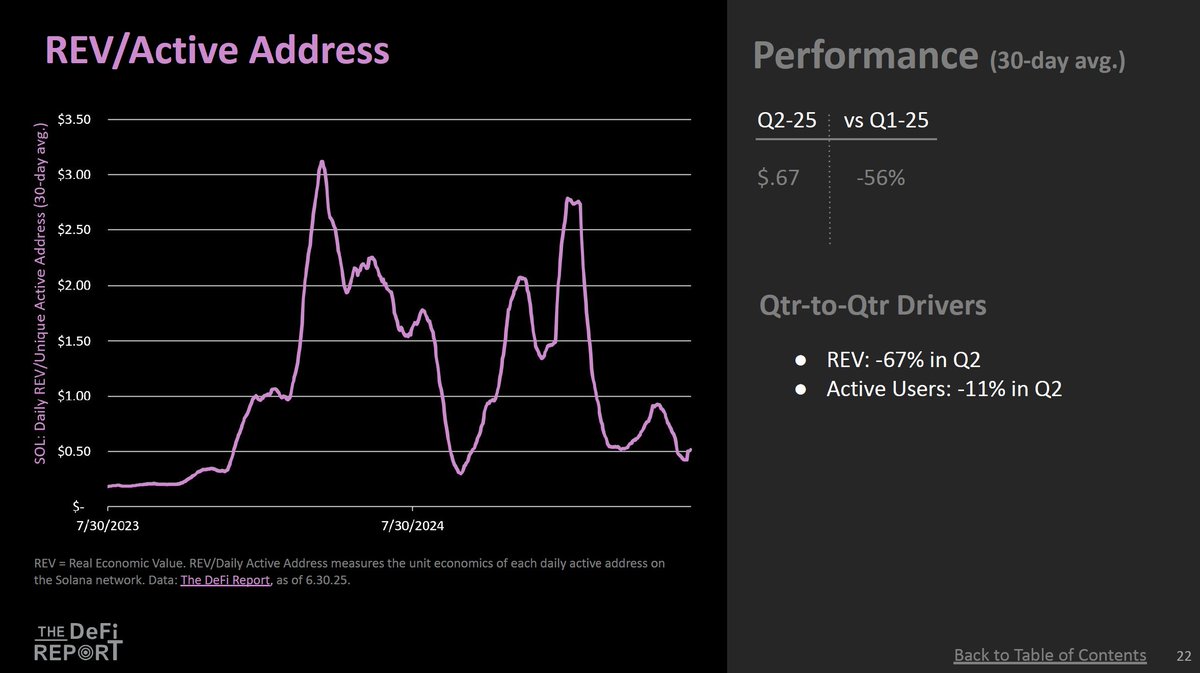

- REV/Active Address: -56% in the quarter due to 66% drop in Jito tips (MEV)

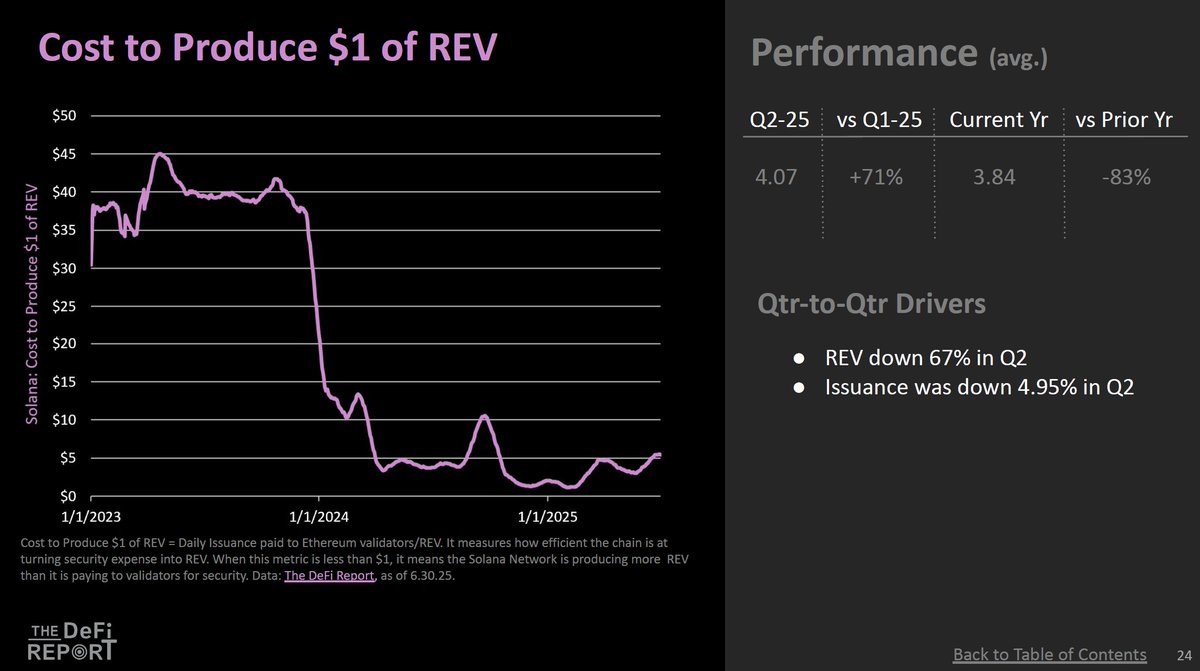

- Cost to Produce $1 of REV: +71% due 67% drop in REV (issuance was down 4.9% in Q2)

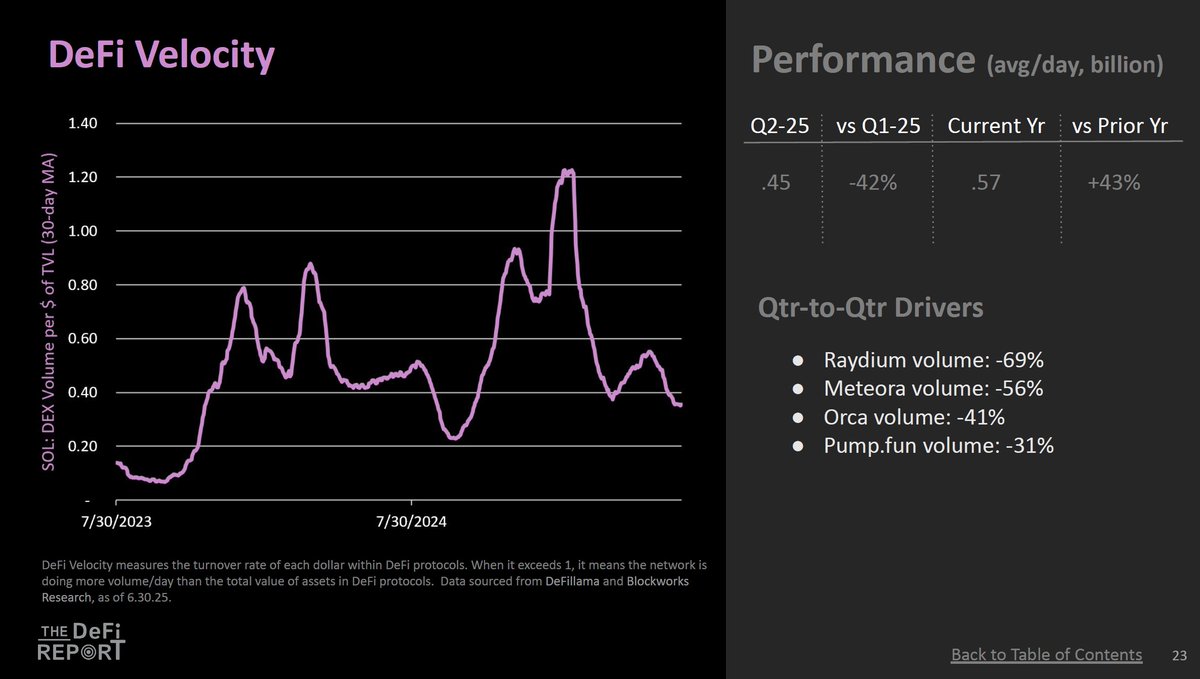

- DeFi Velocity: -42% due to declines in DEX volumes (down 50% in Q2)

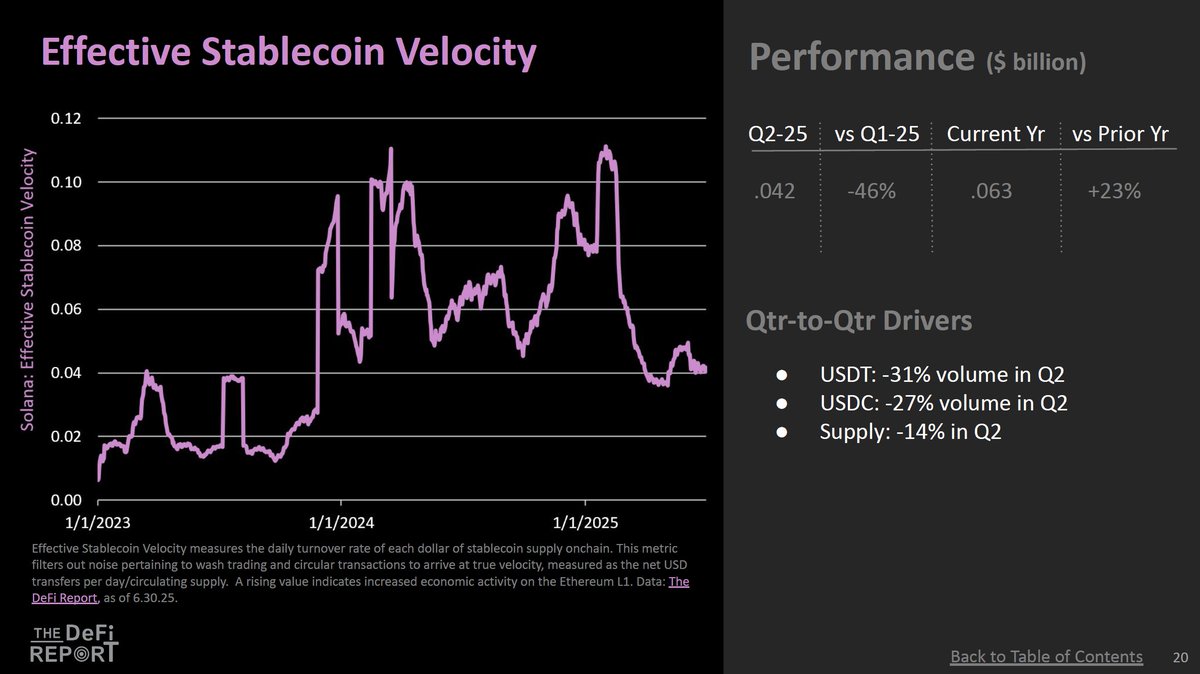

- Effective Stablecoin Velocity: -27% due to 31% drop in USDT volume and 31% drop in USDC volume

----

If you care about revenue, yield, token economics, chain efficiency KPIs, store of value KPIs, fair value KPIs, and correlations — we made The SOL Report for you.

Download the Q2-25 edition (+ access to 9 @Dune dashboards covering the entire ecosystem) below.

No noise, hype, or analyst opinion. Just fundamentals, core KPIs, and qtr-to-qtr explanation 👇

Show original

5.53K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.