privileged to get an early access to theoriq's beta, so I decided to have fun with the agents

won't lie, had high expectations going in, especially as someone who has played with several other agentFi platforms

my feedback

in alphaswarm

I started with the simplest prompt to get the hang of things

my prompt: how can I stake my kaito tokens?

it gave me a clear and concise guide, with the correct link to the staking platform

went on to give me additional useful info like the benefits of staking, and the correct links to the token doc and tokenomics (yea I know i keep emphasizing on the correct links)

went ahead to ask for a simple flow chart of the staking process, but the portal agent instead directed me to the knowledge agent, and it still couldn't generate it. fair to say image generations aren't live

also this was how I got to know about the function of the portal agent

the portal agent delegates tasks to other agents in the swarm, meaning that agents are assigned specific tasks, cool stuff

asked about the latest news from the solana ecosystem

the prompt: what's the latest news from the solana ecosystem?

the agent asked me to check with a solana agent, as it only deals with kaito, from this i got that there'll be specific agents for each ecosystem

also discovered that you start with alphas warm, and alpha studio if you wanna go back to your sessions, wasn't too clear at first

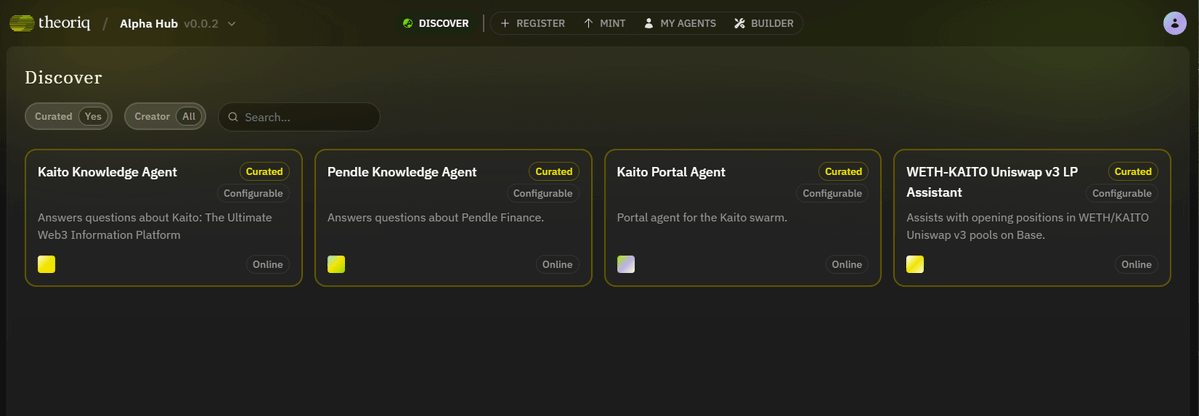

in alpha hub

think this is where theoriq starts to really differentiate itself

here is where you can register and mint agents for public use, or even build them from scratch

on the dash, you can find the portal agent, knowledge agent, and the weth-kaito uniswap v3 LP assistant

.

.

I asked the LP assistant to help me find the best pool to open a position

prompt: what's the best pool to open a position in?

the agent compared two pools and recommended the better one

I love its logic here, the better one has lower fees per trade but much higher volume, which should result in more fee income

it also pointed out to me that I hold 0 kaito and would need to swap some ETH for it before I proceed (it really called me out for not holding kaito)

asked it to plan a liquidity position in the chosen pool, and also on getting some kaito tokens

it gave me multiple options and recommended the most optimal route, even explained how to enter with my current eth balance, worked the math and broke it down like im 5

overall thoughts

it looks promising, which is a good sign, also can't wait for onchain txns and the alpha hub features to be fully functional

other stuff im hoping to see soon

knowledge agents for other popular ecosystems (rn, it is just kaito and pendle)

money market assistant, this would be a banger addition alongside LP assistant

portfolio agent: monitor yields, rebalance positions, basically become the porty manager

reading things that some of these features are already on their way, eager to see how goodly the team will ship

Show original

8.91K

95

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.