🗞 Beig Chain Weekly Report - Top Escape Series (Thirty-Three)

💡 This week's weekly report format will change

I released the risk signal update series for "Top Hunting Plan (One)" on Friday,

To avoid overlapping content with the series, I want to publish each signal in a separate post,

So that I can fully present the content of the signals. Therefore, this week's report will be slightly simplified,

Data that hasn't been updated will be updated daily starting tomorrow 🫡

//

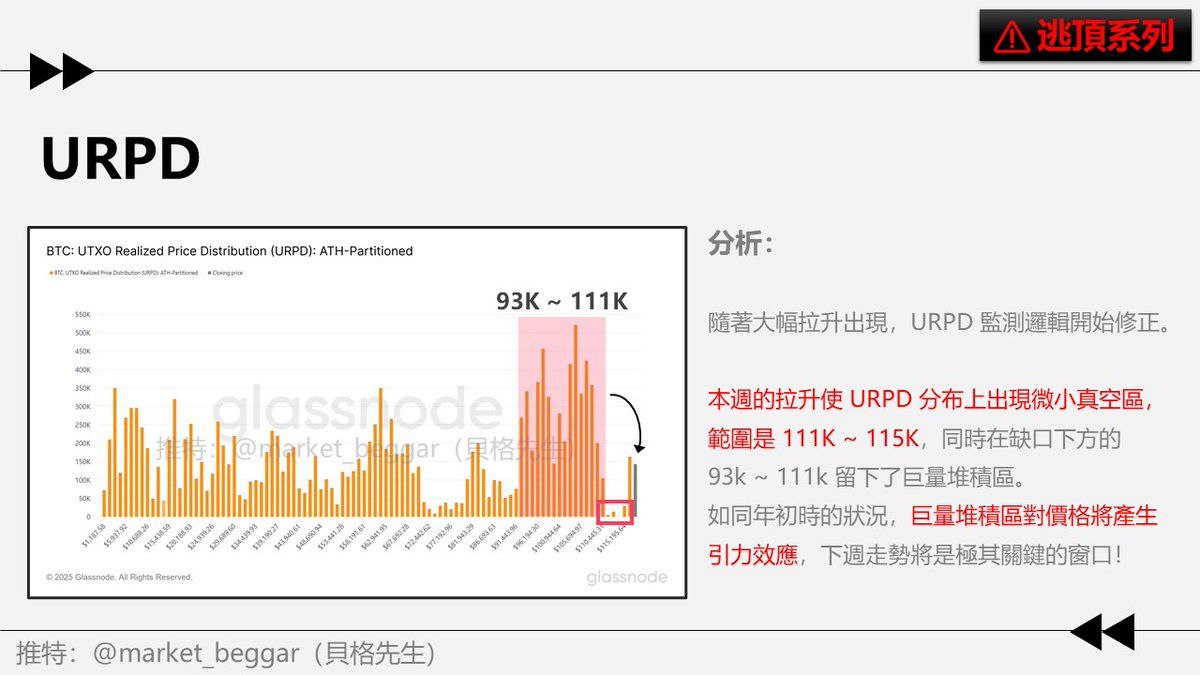

1) URPD

⭐️ The focus of this week's report is primarily on the analysis of the URPD chip structure.

As BTC prices have reached new highs as expected, some noteworthy signals have emerged in the chip structure.

First is the "URPD vacuum gap" caused by a significant surge:

1️⃣ The current gap ranges from 111K to 115K, which is not a very large gap.

2️⃣ More than 300,000 BTC have accumulated above the gap, indicating a rapid distribution.

3️⃣ Below the gap, there is a massive accumulation zone located between 93K and 111K, activating the gravitational effect.

I have written many posts explaining the concept of URPD,

Including the impact of URPD gaps on the market and the gravitational effect of massive accumulation zones.

In simple terms:

➡️ URPD gaps without chip accumulation have very poor support when prices return to the gap.

➡️ Massive accumulation zones will have an "attraction" effect on prices.

For detailed conceptual explanations, please refer to the following two articles:

📖 URPD Gaps and Periodic Distribution

📖 Discussing the Largest Potential Chip Structure Risks in URPD

Given the current market situation, the massive accumulation zone between 93K and 111K has settled,

If future prices cannot strongly surge again to escape the massive accumulation zone,

Then the accumulation zone between 93K and 111K will begin to generate a "gravitational effect,"

Pulling prices back into that accumulation range.

The principle is: "Currently, the large amount of chips between 93K and 111K has become floating profit,"

Their profit-taking selling behavior is likely to "drag down the price";

Unless there is a significant surge that puts them in a state of secure holding, the gravitational effect will always exist.

//

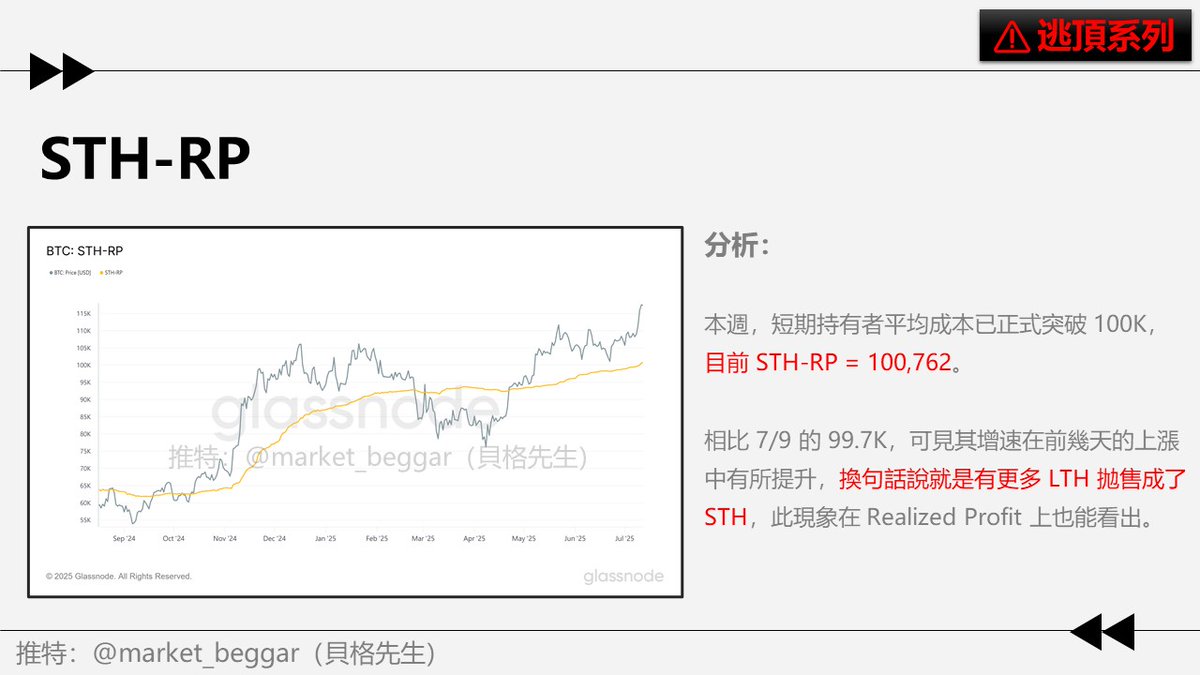

2) STH-RP (Short-Term Holder Average Cost)

📊 The current STH-RP = 100,762

This week, the average cost for short-term holders has officially surpassed 100K.

It is worth noting that the STH-RP was only 99.7K on 7/9,

In just three days from 7/10 to 7/12, the growth rate of STH-RP showed a significant increase,

Indicating that many LTHs sold off during these three days, becoming STHs,

Resulting in a relatively rapid increase in the STH-RP value.

This conclusion can also be derived from Realized Profit, which I will not elaborate on here,

You can look forward to the upcoming "Top Hunting Plan" series 👀

//

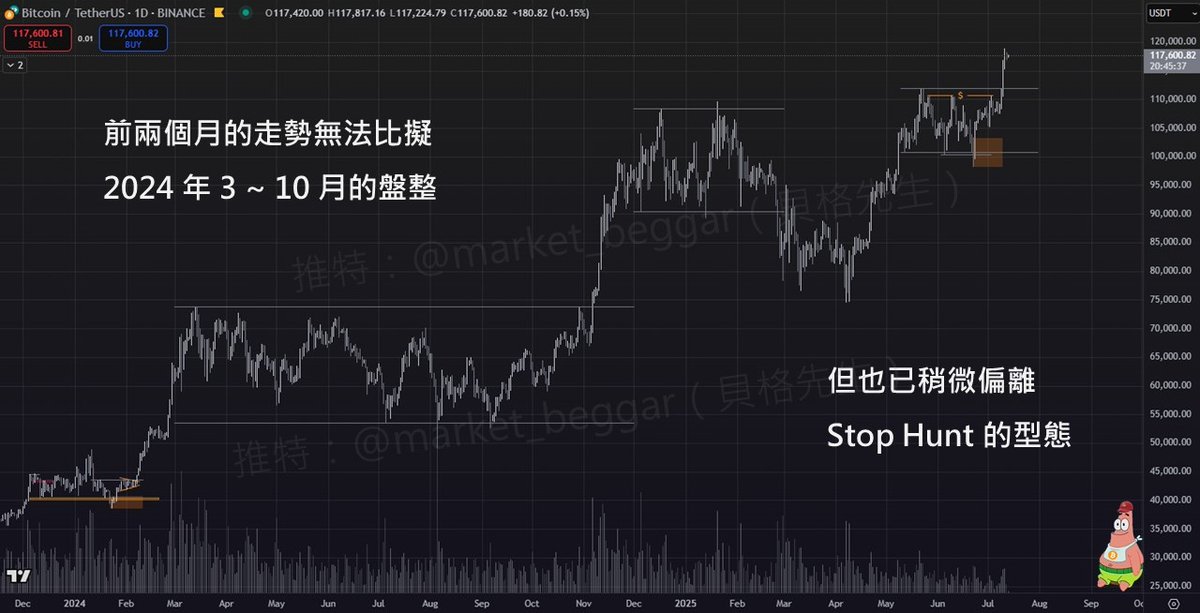

3) Technical Chart

I won't elaborate much on this part, mainly to answer a question.

There are many opinions comparing the consolidation structure of the past two months to the consolidation from March to October last year,

And based on this, they claim that "the next wave of main upward movement is about to arrive."

From a technical analysis perspective, I do not agree with this view,

The reason is that "the past consolidation lasted only 2 months,"

The time span cannot be compared to the consolidation from March to October 2024.

Consolidation is itself a process similar to building momentum; the longer it lasts, the greater the force it generates.

Two months of consolidation time clearly cannot be compared to eight months,

Not to mention that last year's March to October was merely the stage of "the first large-scale distribution" in the cycle,

Subsequently, one could expect a wave of main upward movement, which is clearly different from the current situation.

However, given the current state of the chart, it has indeed deviated from my initial Stop Hunt expectations.

I will update the detailed content in next week's "Top Hunting Plan" series.

4) Conclusion

📝 Key Points Summary:

1️⃣ URPD: A small vacuum area has appeared, next week is a key window.

2️⃣ STH-RP: Has surpassed 100K, with a significant increase in growth rate.

3️⃣ Technical Chart: The past 2 months of consolidation cannot be compared to last year's March to October.

-

This concludes the thirty-third issue of the on-chain weekly report. I hope it helps everyone~

Below, I will attach all analysis articles related to the "Second Escape Top" during this period in the comments section for everyone to study and reference.

As usual, feel free to ask any questions, and I wish everyone a pleasant weekend 🛍

-

📚 This Week's Article Review

80,000 BTC ancient giant whale causing massive Realized Profit

Exploring the technical analysis strategies of a "700 times in 4 months" god-level trader

AVIV Heatmap data update: An alternative way to assess the top

BTC reaches new highs as expected, has it peaked?

Top Hunting Plan (One): Divergence of US Fund Sentiment Curve

Crydit debit card promotional article.

🗞 貝格鏈上週報 - 逃頂系列(三十二)

本週 BTC 以上漲為主,一度重返 110K 之上。

目前價格已在 98K ~ 112K 之間震盪了接近 2 個月,

隨著 BTC 逐步逼近 ATH,我們不得不謹慎的檢視,

當前的上漲究竟是否可能復刻年初、甚至 2021 第二頂的狀況。

以下就讓我們一起本週「#逃頂 週報」的內容吧👇:

//

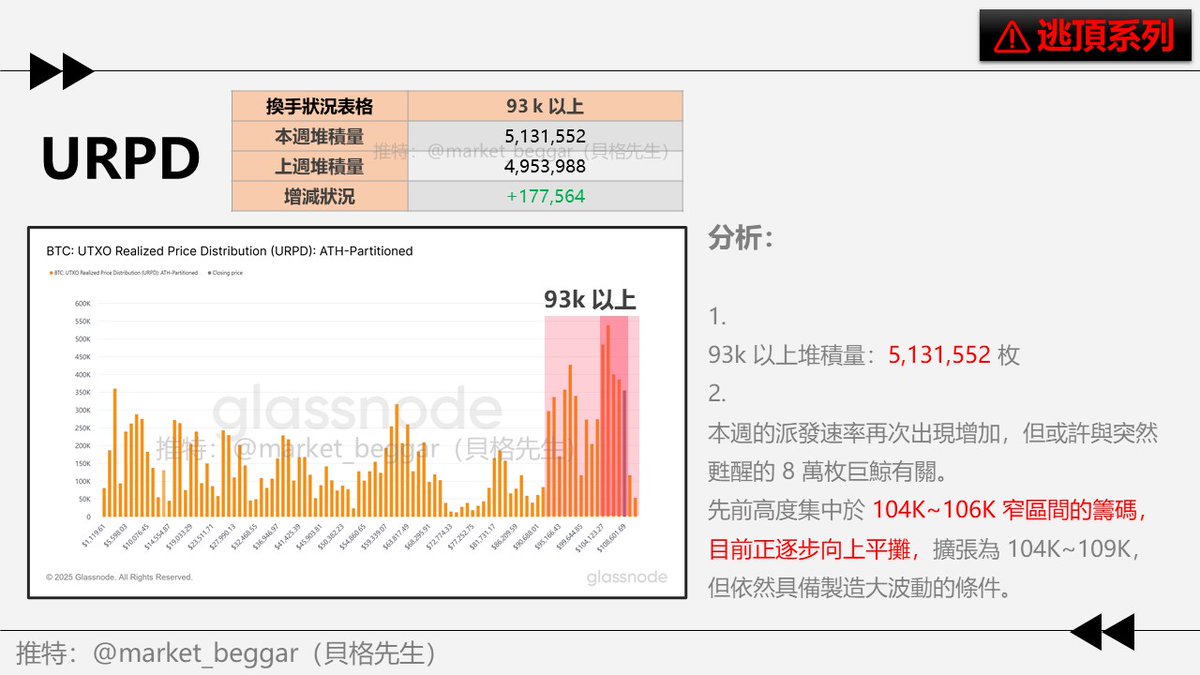

1)URPD

📊目前 93 K 上方的堆積量為 5,131,552 枚

本週派發至 93 K 上方的籌碼量再次出現增加,

或許和本週突然被激活的 8 萬枚 BTC 遠古巨鯨有關係。

我在上週、上上週所提及的「大量籌碼高度集中於 104~106K」的狀況,

在本週稍有緩解,部分籌碼量已向上擴張,

目前的高度集中區約落在 104~109K。

但雖有所擴張,卻依然屬於高度集中的狀態,

結合先前分享的波動率指標(目前依然位於低波動率區域),

下週出現大幅波動的可能性依然不小⚠️

//

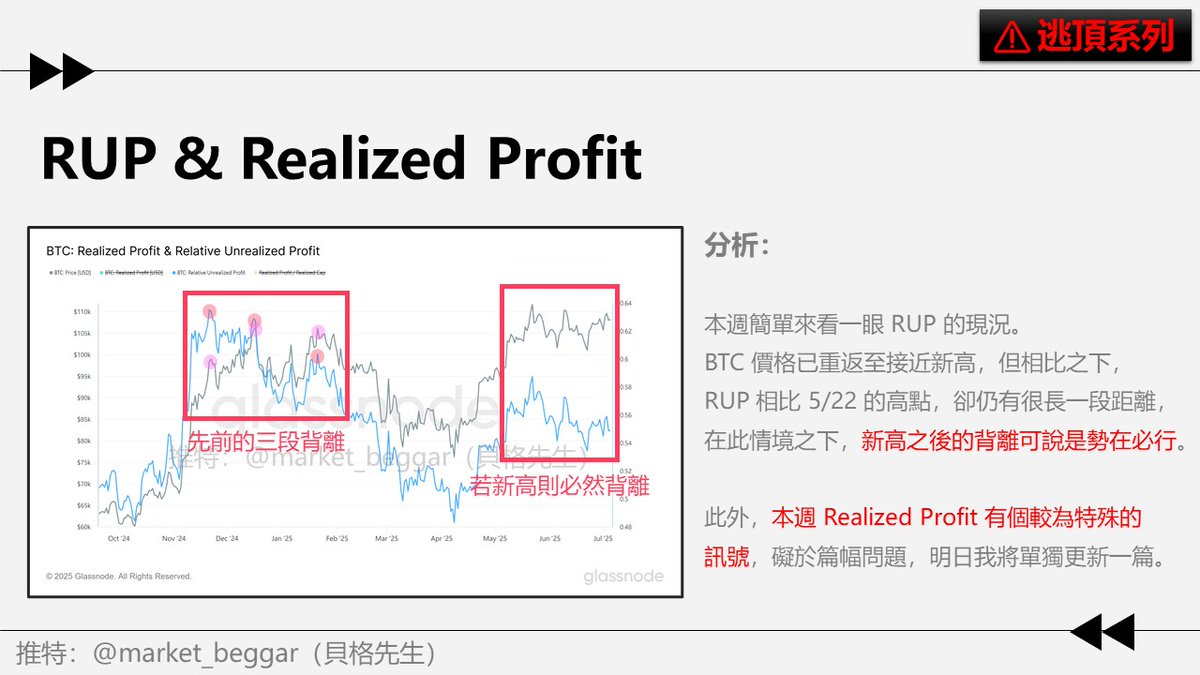

2)RUP & Realized Profit

關於 RUP 的分析邏輯,可參考下文:

關於 Realized Profit 的分析邏輯,可參考下文:

本週我們簡單的再次 review 一下目前 RUP 的概況。

可以看到:在過去 2 個月內的震盪中,價格的走勢相對「走橫」,

但 RUP 則走出了明顯的下降(右側紅框區)。

RUP 的下降是背離的前置條件,發生此類狀況的原因只有一個:

「低成本籌碼的派發」(詳細原理說明可參考上述連結)。

目前 BTC 距離前高也就不到 4% 的事,如同我先前反覆強調的,

一旦出現新高,只要沒有一鼓作氣沖到極高的位置,

RUP 新高之後的背離已是極高概率的事件‼️

此外,本週我在 Realized Profit 上看到一個較為特殊的訊號,

礙於篇幅的關係,我將於明天(7/7)單獨發布一篇帖子做說明,

請各位期待一下🫡

//

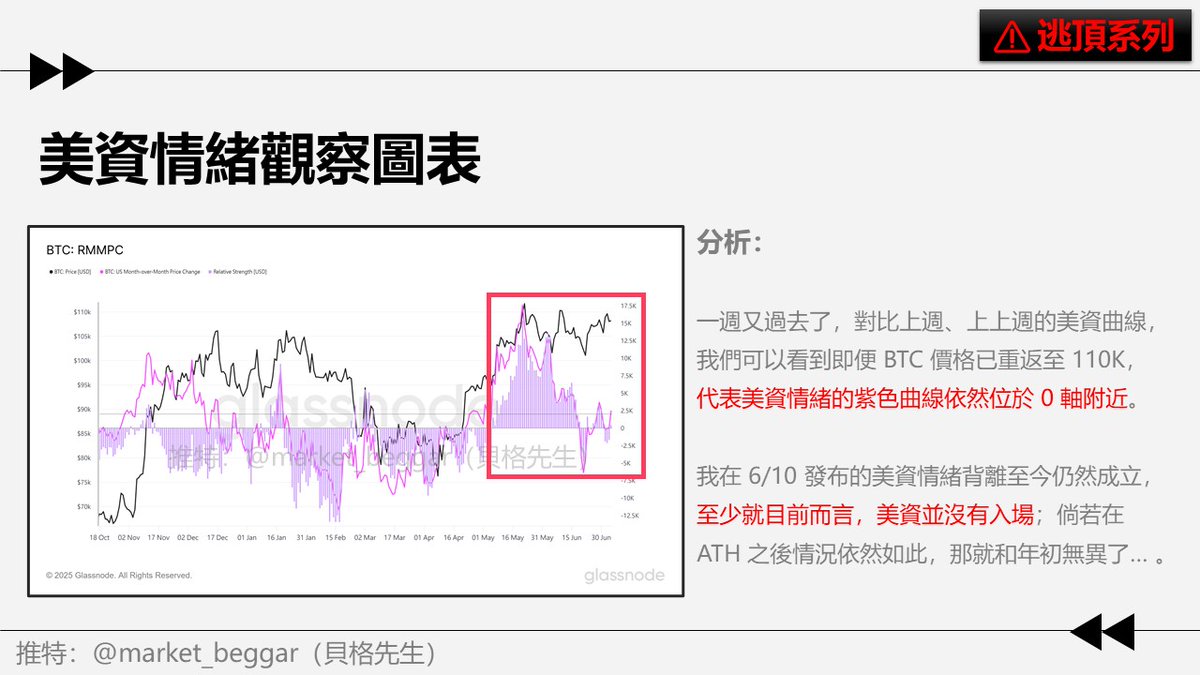

3)美方資金情緒監測圖表

關於美資情緒監測圖表的詳細說明,可參考先前更新的貼文:

本週的上漲,並沒有把代表美方資金情緒的紫色曲線一併帶上來,

紫色線依然位於 0 軸附近徘徊,說明美資情緒目前沒有修復的狀況。

只要紫色線沒有跟著價格迅速向上突突,

那我在 6/10 發布的美資背離訊號就依然保持有效:

依然是那句老話:新高之後就是決勝負的時刻了。

老美是否將在新高之後帶領大軍殺回市場拉盤?

或是復刻年初、2021 年兩次頂部的「拋售給亞洲人」的頂部劇本❓

下好離手。

//

4)結語

📝重點整理:

1️⃣ URPD:派發速率提升,大量堆積區稍有擴張,但依然是高度集中

2️⃣ RUP:背離勢在必行,Realized Profit 的更新文將在明天發布

3️⃣ 美資情緒:並未隨著價格上漲而修復,說明拉盤方不是老美

-

以上就是第三十二期的鏈上週報,希望對各位有幫助~

以下,我將在評論區附上這段時間以來,

「第二次逃頂」相關的所有分析文章,供各位研究、參考。

老規矩,有問必答,祝各位週末愉快🍡

-

📚本週文章回顧

暴風雨前的寧靜:表態將至的恐怖平衡

技術分析看法更新

交易答疑:個人合約波段系統中的 2 種進場方式

五大買方族群熱力圖更新:悄然改變的行為

新高勢在必行

23.81K

81

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.