The problem with self-proclaimed uneducated paid shills is that they will say anything to either get views or get paid. This is one such post.

Let me share some perspectives and numbers to refute and prove it:

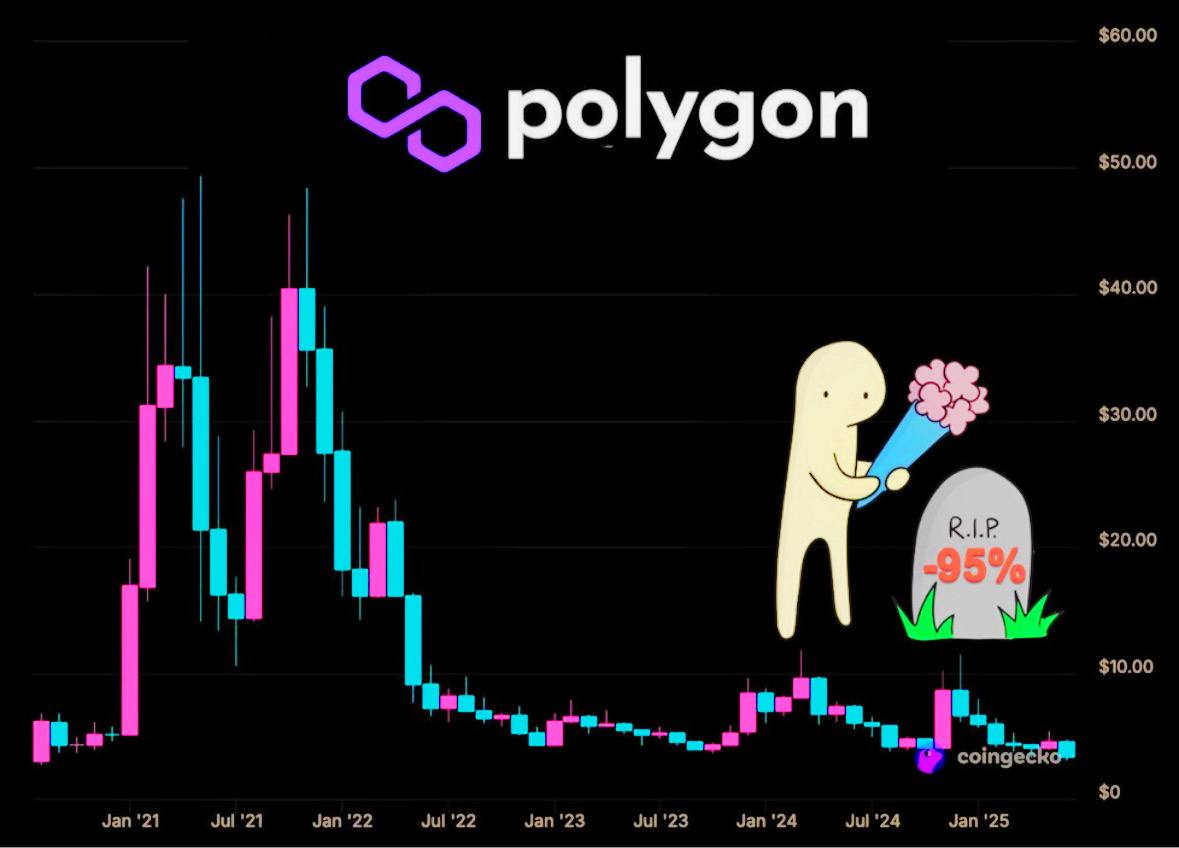

1. It says Polygon lost 85% of its value. So did the market. If you are comparing us with other L2's like Arbitrum (which is approx 86% down from ATH) and Optimism (which is approx 90% down from ATH). Tell me a more liquid L2 in the market which is not at this point?

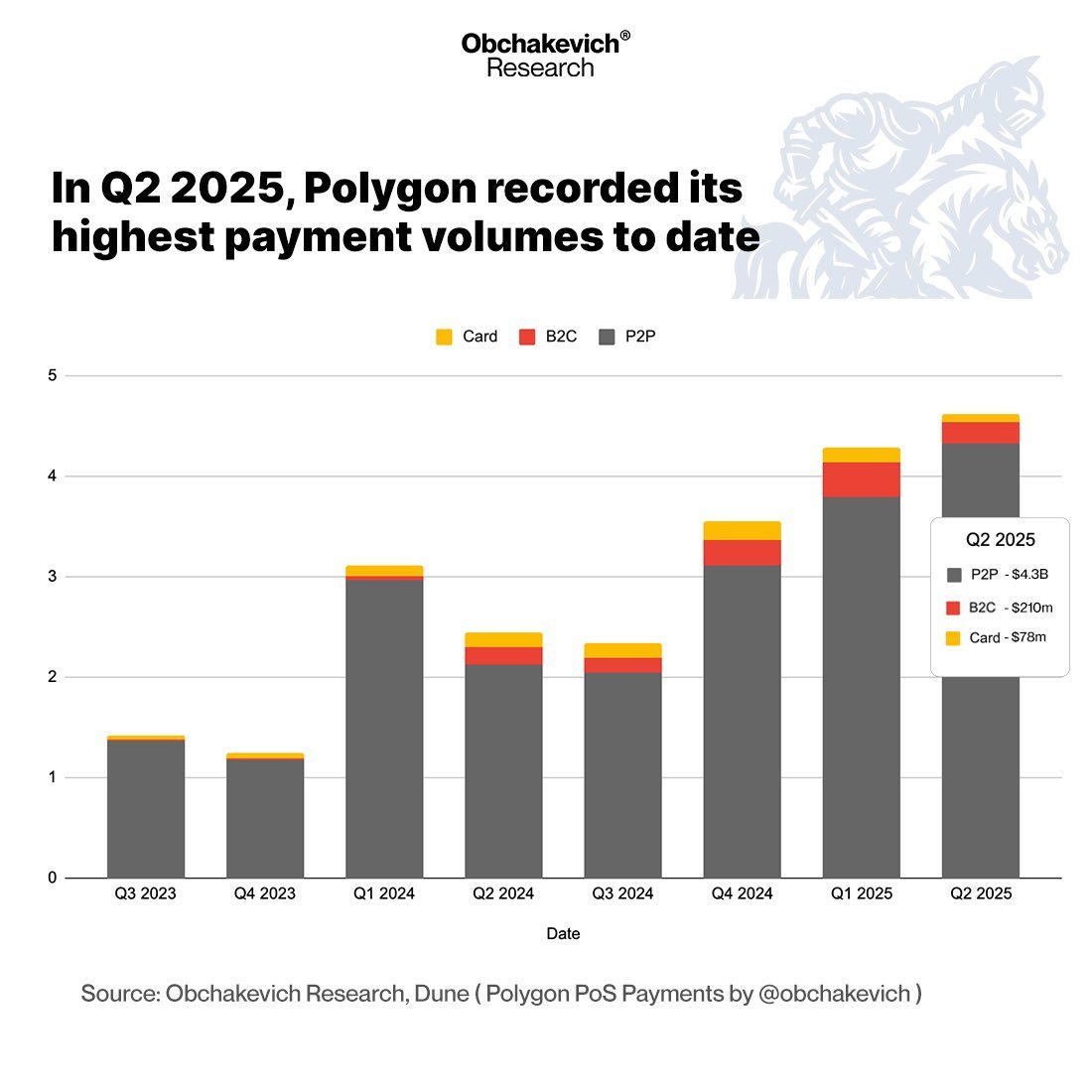

2. Quoting 2024 reports when we are halfway through 2025 is another sign that shows the author just wants to find a bad chart to push his alternative narrative of Polygon being dead. Let me educate your paid brain so that next time you see the numbers before crying like this:

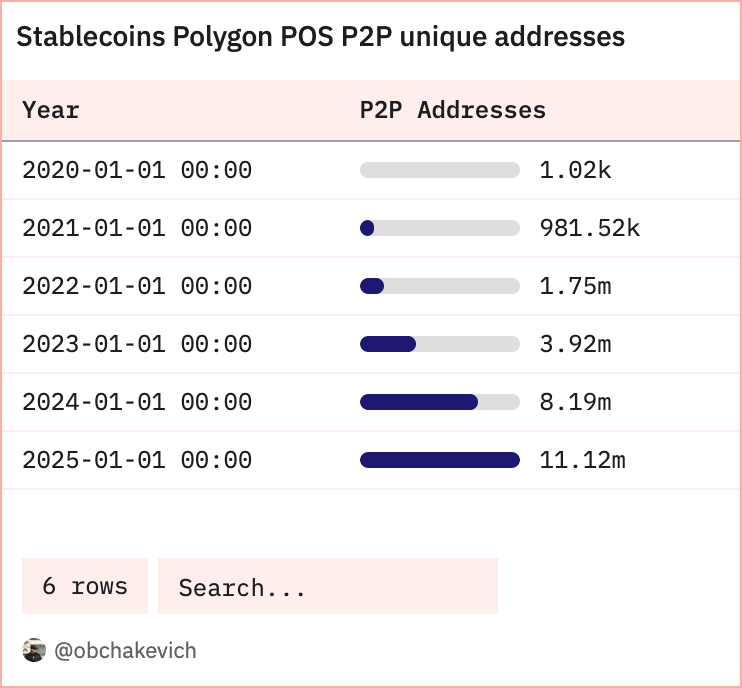

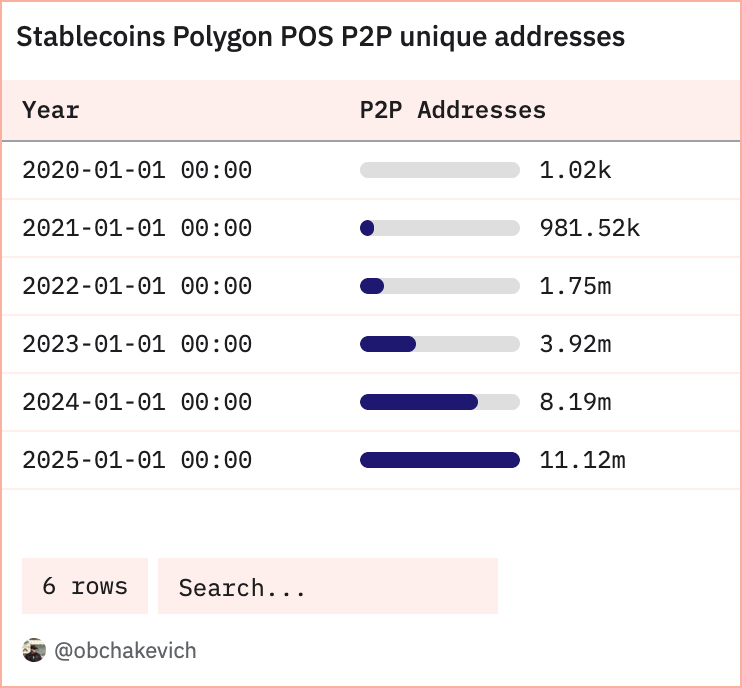

a) P2P numbers: The number of @0xPolygon stablecoins P2P addresses for 6 months of 2025 reached 11m addresses. This is more than in the whole of 2022 and 2024 combined.

Ref Tweet:

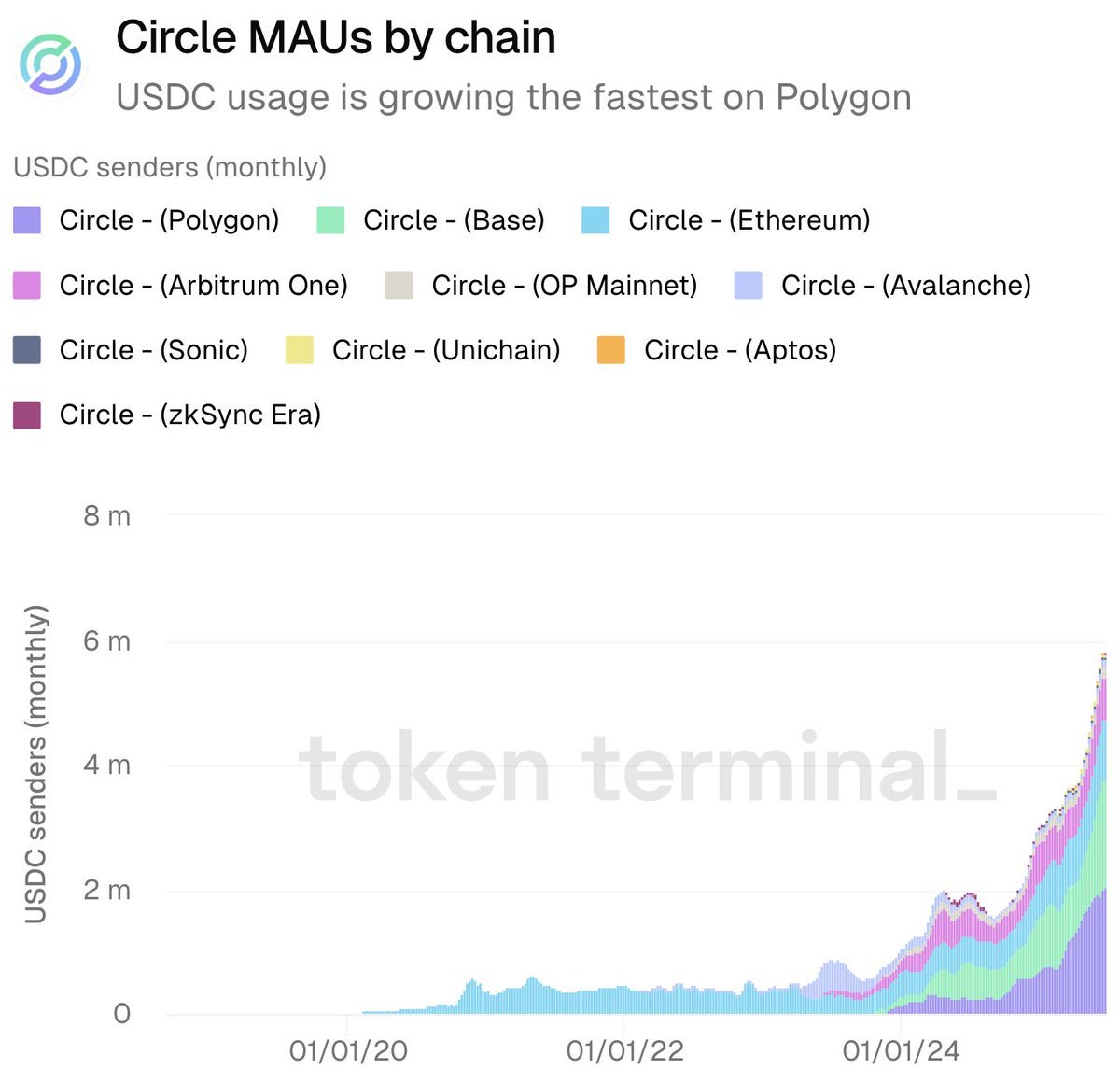

b) MAU's growth for Circle. You quoted an old Token Terminal Number. Let me quote you the latest by their team.

We are the top chain for user base for USDC in the entire industry and we keep growing. The numbers say that not us.

c) Tons of new teams building continuously on Polygon. We pivoted from noise to actual builders. Showing that there are 10,000 developers who hop from one chain to another for grants is something we didn't want to chase. Here is another tweet on it.

🔗Stablecoin summer on @0xPolygon!

Every month, Polygon attracts more and more new projects and merchants to its chain. Stablecoins on Polygon are used as payments by such projects as @blindpaylabs, @coinbase commerce, @wirexapp, @RedotPay, @Cypher_HQ_, @RevolutApp, @CoinflowLabs, @Nexo, @RequestNetwork, and many more.

At the moment, more than 40 projects use @0xPolygon for payments, which is great. The total volume of payments ranges from $130m to $250m every month, and it's just crazy.

You can see the details on the analytical dashboard created specifically for the Polygon community -

If you are already building your payment project on Polygon, please fill out this form -

We will be happy to build analytics for you and add it to the general analytical dashboard on @Dune.

This is just the beginning of the journey, more to come! Stay tuned for more news!

e) Another independent report here states we are having our best months on adoption:

f) When it comes to RWA Assets, we are the second biggest in terms of asset issuance on-chain, just behind Ethereum.

We are getting the team to update the data. Once done, you'll see us in the top 3 in TVL as well.

I can continue giving you the numbers, stats but let's also talk about the technology.

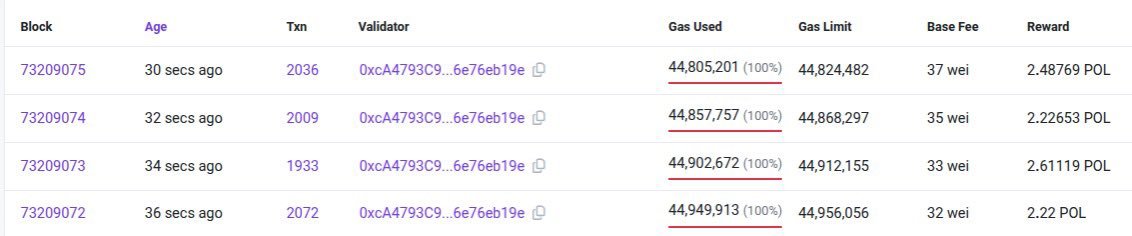

Without running a centralized sequencer, we just did 1,000 TPS in production. I'd bet on a side chain being validated by 105 validators than a chain which people run in their basement.

So you can continue to be a paid shill, for all I care but if you attack Polygon again trying to make a wrong narrative, I'll come for you and destroy you with stats.

11.77K

55

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.