Lombard: Emerging as Core Liquidity in BTC-Fi

@Lombard_Finance is establishing itself as a foundational layer, aiming to make Bitcoin a central asset in DeFi ecosystems

Let's dive in 🧵

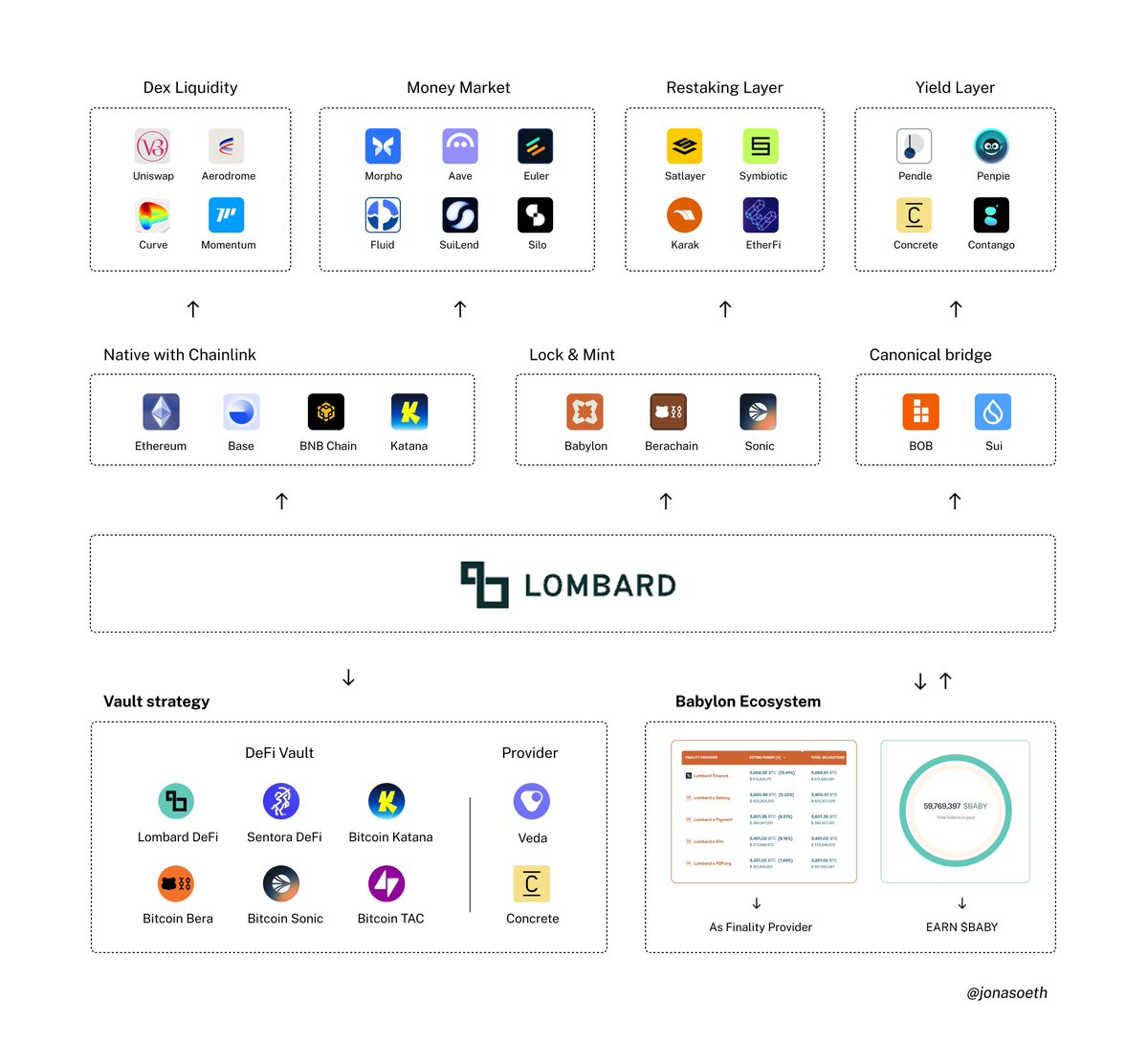

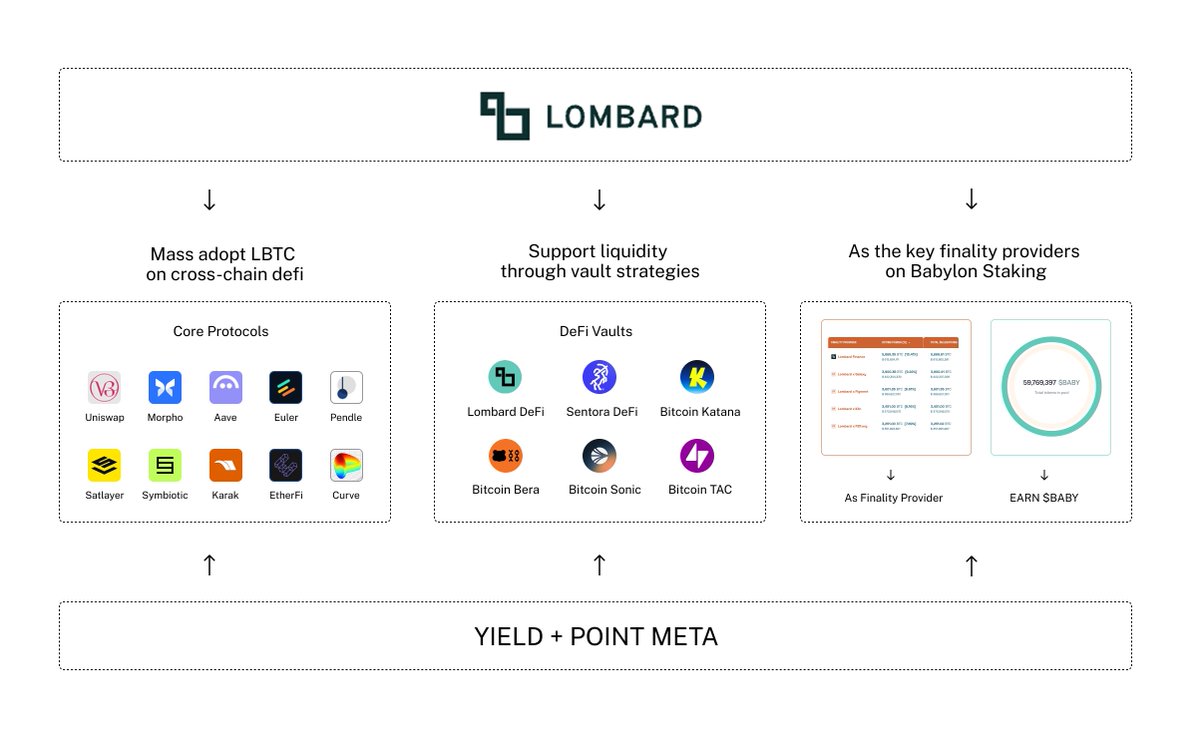

1 - Lombard’s Core Development Strategy

Lombard’s strategy revolves around three primary pillars ↓

➛ Mass Adoption of LBTC in Cross-Chain DeFi

LBTC, a yield-bearing Bitcoin, allows BTC to engage in DeFi apps like lending, farming, and trading across multiple blockchains

➛ Early Support Liquidity for Ecosystems via Vault Strategies

LBTC is in auto-compounding vaults, enhancing capital efficiency and encouraging long-term liquidity

➛ Key Finality Provider for @babyloneco

Lombard crucially supports @babylonlabs_io's Bitcoin staking, bolstering economic finality and security with efficient BTC capital use

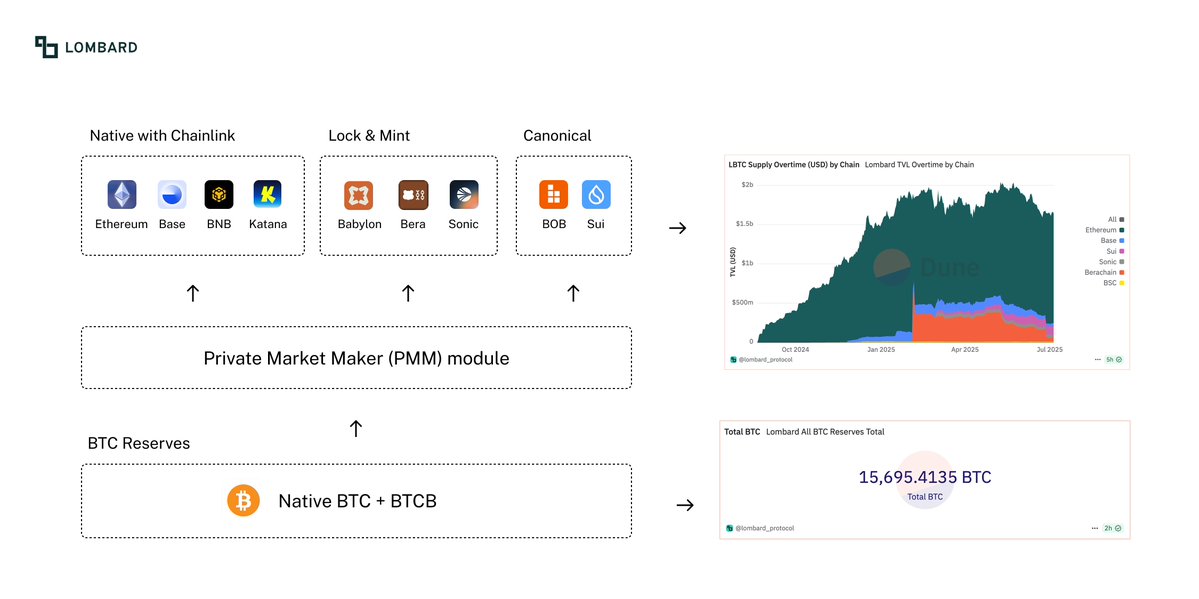

2 - Unlocking Bitcoin Across Blockchains

Lombard Now Holds 15,700 BTC in Reserve, valued at $1.6B

Lombard has issued LBTC across 9 different blockchain ecosystems, utilizing three distinct minting/reserve mechanisms:

➛ Native with Chainlink: Ethereum, Base, BNB Chain, Katana

Bridging is to Lombard Protocol's security standards, requiring both the Security Consortium and Chainlink CCIP to approve all bridging transactions.

➛ Lock-to-Mint Mechanism: Babylon, Berachain, Sonic

Bridging is possible in a limited-capacity. Liquidity is locked on the source chain like Ethereum

➛ Canonical Bridge: BOB, Sui

Bridging is possible via a third-party only

LBTC Ownership Types ↓

• Lombard Protocol: LBTC contracts are owned and fully upgradable by Lombard. Full integration with native BTC staking and bridging.

• Community: LBTC deployed by the chain itself. Early access only, not yet fully integrated with Lombard’s staking or Security Consortium.

• Third-Party: LBTC deployed by an external project. No direct connection to Lombard’s protocol or staking infrastructure

→ Thanks to its flexible minting mechanisms, LBTC has become the #1 Bitcoin LST in terms of DeFi coverage.

It provides yield-bearing Bitcoin across multiple blockchain ecosystems, enabling BTC to be actively used in DeFi strategies such as lending, liquidity provision, and restaking

PoR:

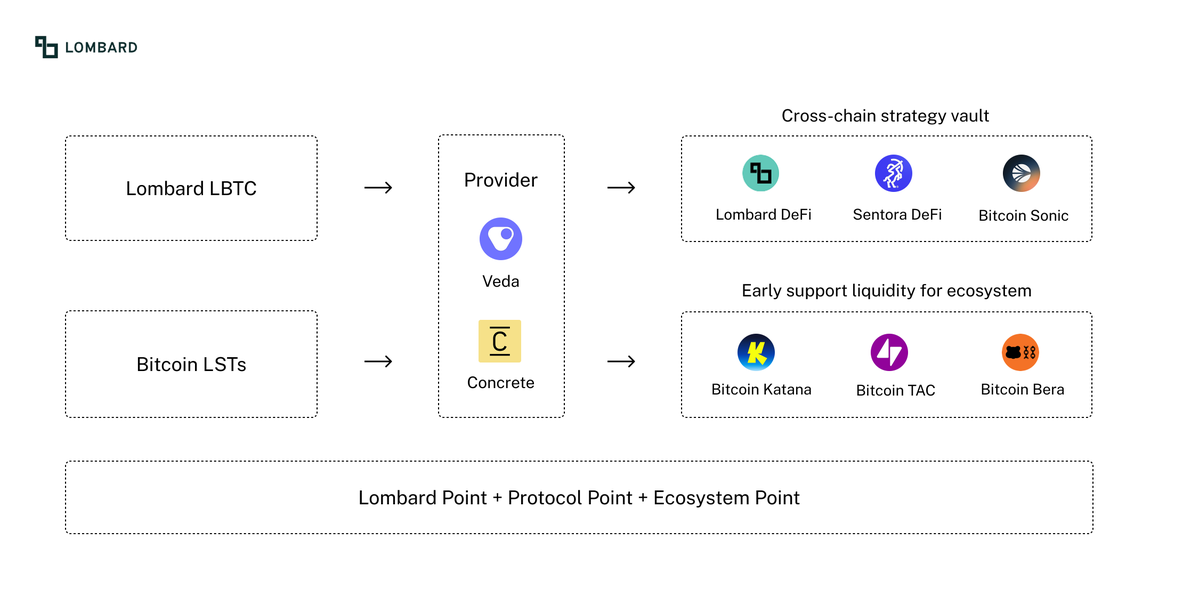

4 - Boost BTC Yield with Vault Strategies

The Vaults are built using the @veda_labs and @ConcreteXYZ infrastructure, protocols that tokenize and simplify access to native yields for DeFi users.

As an early contributor, Lombard consistently supports liquidity for new emerging chains, including @berachain, @TacBuild, and now is @katana.

Deposit LBTC and other BTC LSTs into the vault to receive LBTCv, a token that tracks your share of the vault’s value (principal + yield + rewards).

LBTCv updates hourly and earns you Lombard Lux 4x, Veda Points 3x, Babylon Points 1x, Concrete 4-5x, Sonic 2x-4x, Turtle 1x, 15M KAT and Bera BGT.

The vault uses your BTC to earn yield via ↓

• Liquidity on Uniswap, Curve

• Lending on Gearbox, Morpho

• Yield trading on Pendle

→ Rewards are auto-compounded, boosting your position.

The vault uses many DeFi strategies to earn yield, so it doesn't rely on just one. This helps lower risk and increase potential returns.

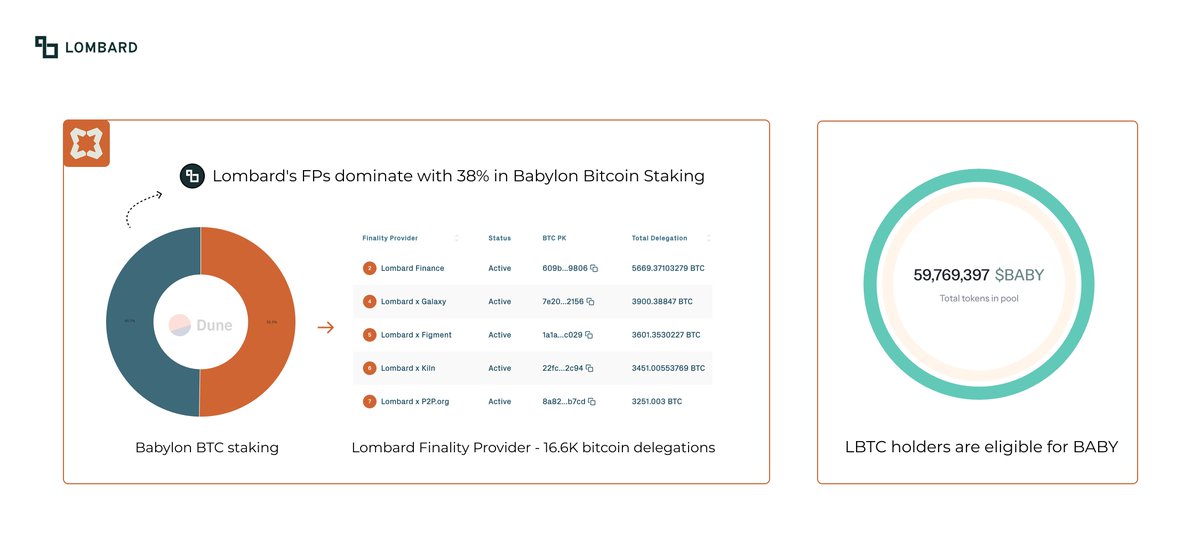

5 - LBTC Leads as Key Finality Provider on @babylonlabs_io

Lombard’s Finality Providers now dominate 38% of Babylon’s Bitcoin staking, playing a critical role in securing both the Babylon Genesis chain and the growing network of Bitcoin Secured Networks.

→ When you hold $LBTC, the underlying BTC is automatically staked to Babylon.

You earn $BABY tokens as yield simply by holding. A total of 59M BABY is reserved for LBTC holders.

Flexible Yield Options ↓

• Hold your BABY

• Claim to your wallet

• Swap it for more LBTC and compound your position

→ Unclaimed BABY is re-distributed to recent LBTC holders after 3 months

LBTC holders will benefit from stacked yields across multiple networks.

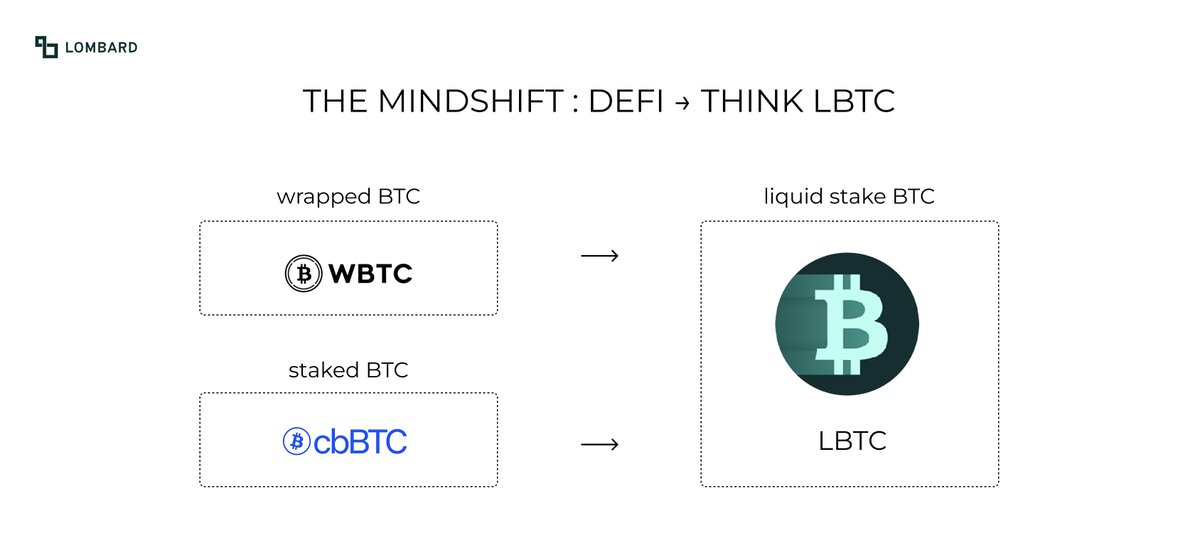

6 - The Mindshift: DeFi → Think LBTC

For years, when people thought of Ethereum staking, they thought of stETH and stETH became the core DeFi asset for Ethereum.

Now, when people think of Bitcoin in DeFi, they’re starting to think of LBTC.

LBTC is following a similar path for Bitcoin but with multi-chain reach and broader utility.

For a long time, WBTC was the de facto Bitcoin token in DeFi but it has clear limitations:

• No Yield

• No Points Meta

• Centralized Custody

• Limited Cross Chains

WBTC was built for liquidity. LBTC is built for capital efficiency.

With LBTC, Bitcoin is no longer passive. It is liquid, productive, composable, and multi-chain.

Strategic Thesis ↓

• Has potential to become the #1 BTCfi primitive

• Designed for long-term capital efficiency across chains

• LBTC = stETH-level utility + cross-chain liquidity + point-driven rewards

7 - Lombard CTs watchlist

Highly recommend following these CTs for Lombard’s latest insights:

▸ @JacobPPhillips

▸ @Maksym_Web3

▸ @0xCheeezzyyyy

▸ @ProofOfTravis

▸ @Eugene_Bulltime

▸ @dudu_bitcoin

▸ @theadvisorbtc

▸ @0x_xifeng

▸ @_SirJoey

▸ @defi_mago

▸ @DoggfatherCrew

▸ @marvellousdefi_

9.36K

160

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.