📽 It’s time for another weekly crypto roundup!

@mattzahab and @Rachelwolf00 are back with Episode 51, breaking down the latest crypto headlines.

Don’t miss out — tune in now 👇

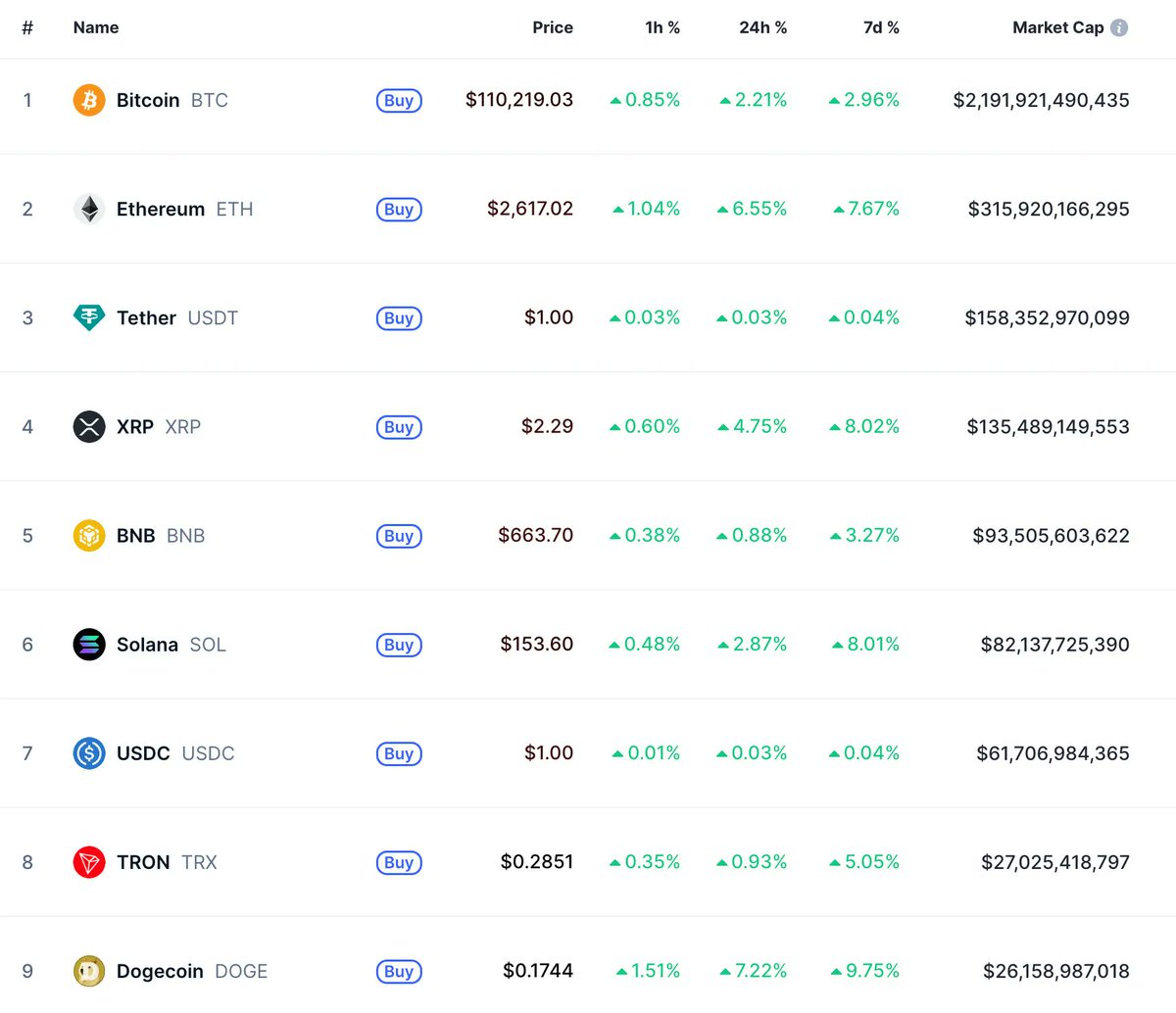

📌 Price Action

📌 Robinhood Launches Stock Tokens and L2 Blockchain To Expand Crypto Offerings in EU and US

Vlad Tenev, CEO and chairman of Robinhood, announced today at Robinhood Presents: To Catch a Token event in Cannes, France, that the firm is launching US stock and exchange-traded fund (ETF) tokens.

“Our latest offerings lay the groundwork for crypto to become the backbone of the global financial system,” Tenev stated.

📌 Gemini Tokenizes Saylor’s Strategy Stock

Gemini has launched tokenized Strategy stock for EU investors. The service promises 24/7 trading, lower fees, and easier access compared to traditional stock markets.

Platforms like Robinhood, Kraken, and Coinbase are also moving to offer tokenized US equities.

📌 “Going Vertical”: Coinbase Closes at Record High Despite Analyst Uncertainty

Coinbase Global Inc. (COIN) ended last Thursday’s trading session at a new all-time closing high of $369.21, sparking excitement among investors and mixed reactions from analysts.

The stock rose 3.89% on the day and nearly 40% over the past month, marking a 3.3% gain over its previous record of $357.39 set in November 2021.

📌 SEC ends ‘regulation through enforcement,’ calls tokenization 'innovation'

The US Securities and Exchange Commission (SEC) now sees tokenization as an “innovation” to be encouraged in the marketplace, according to Chair Paul Atkins, who pointed to a clear regulatory shift since former SEC Chair Gary Gensler’s tenure ended.

“Tokenization is an innovation,” Atkins said in a CNBC interview on Wednesday. “And we at the SEC should be focused on how do we advance innovation in the marketplace.”

📌 XRP Surges as Ripple CEO Garlinghouse Signals End to SEC Dispute

XRP surged last Friday after Ripple’s CEO announced plans to drop the cross-appeal against the SEC. A federal court recently denied Ripple and the SEC’s bid to reduce a $125 million penalty.

Ripple’s legal team emphasized that XRP’s status as not a security remains unchanged, easing investor concerns.

📌 Nine UK-Listed Companies Embrace Bitcoin Treasury Strategy Amid Global Trend

At least nine UK-listed firms have announced Bitcoin treasury plans in the past week. Companies like Tao Alpha, Smarter Web Company, and Panther Metals saw share prices soar after Bitcoin buys. The trend comes as the UK eyes a crypto hub future.

📌 Crypto Funds Attract $2.7B in 11th Straight Week of Inflows Amid Geopolitical Jitters

Digital asset funds saw $2.7 billion in inflows last week, extending an 11-week streak. The US led the surge with $2.65 billion in inflows, while Bitcoin captured 83% of total allocations.

Bitcoin ETFs outpaced gold ETFs, attracting $3 billion compared to $1 billion in gold outflows over five days.

📌 H1 2025 Crypto Losses Outpace 2024; CertiK Counts 344 Onchain Heists, $187M Recovered

The firm’s “Hack3d: Web3 Security Report for Q2 + H1 2025” outlines a shifting threat environment, with wallet compromises and phishing attacks leading the pack.

According to the report, between January and June, a total of $2.47 billion was lost across 344 incidents. Wallet-related breaches alone accounted for $1.7 billion across just 34 attacks.

Phishing followed as the second most expensive threat, with over $410 million stolen in 132 incidents.

📌 Design Giant Figma Goes Public, Reveals $70M Bitcoin ETF Holdings and $30M Ready to Buy More

Design giant Figma goes public revealing $70M Bitcoin ETF holdings and $30M ready to buy more as corporate Bitcoin adoption hits 141 companies holding $91B.

Figma has filed for its initial public offering with the SEC, revealing substantial Bitcoin exposure, including $69.5 million in Bitcoin ETF holdings and an additional $30 million earmarked for future cryptocurrency investments.

📌 Peter Thiel, Tech Billionaires Back New Bank for Start-ups, Erebor, After SVB Collapse

Erebor was formed in response to SVB’s March 2023 collapse, which disrupted funding for start-ups and the broader innovation economy.

Peter Thiel has joined a group of prominent tech billionaires backing a new US bank called Erebor, aimed at replacing the role once filled by Silicon Valley Bank, whose collapse in 2023 left a vacuum in financing for start-ups and crypto firms.

10.68K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.