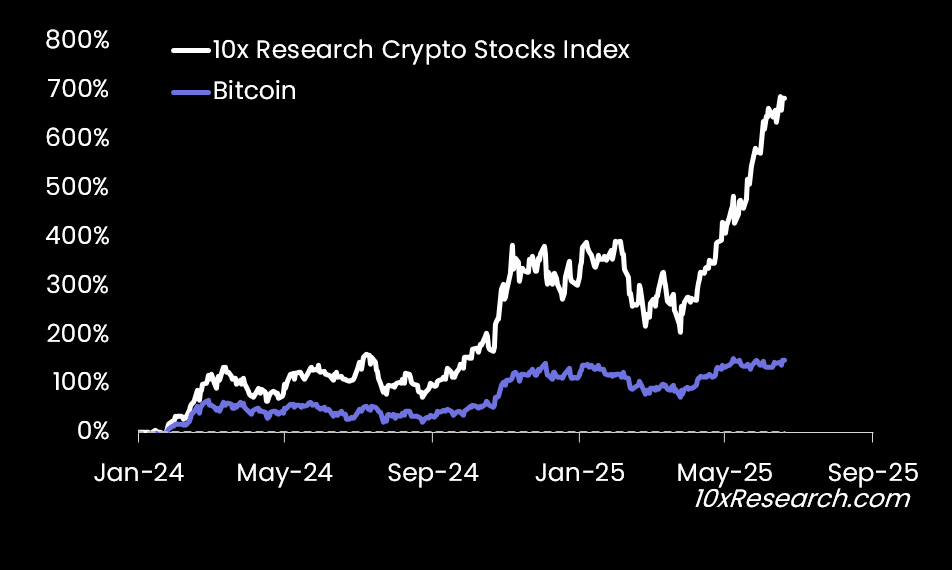

Crypto Stocks: Understand What is Moving in the Market and Why.

Strategize Your Digital Asset Investment Strategy

Bitcoin (BTC): Bitcoin climbed to $110K, buoyed by ETF inflows, corporate demand, and macro optimism from trade developments and new ETF products. Its technical trend remains bullish above key moving averages.

MicroStrategy (MSTR): MSTR rose with Bitcoin’s surge and Q2 optimism, though insider sales raised concerns. Its aggressive BTC accumulation and profit expectations supported strong momentum.

Marathon Digital (MARA): MARA soared 19% as optimism over BTC holdings and growth plans outweighed short-term mining declines. Strong call volume reflects bullish sentiment.

Riot Platforms (RIOT): RIOT jumped on a big YoY production gain despite a MoM dip, bolstered by favorable sales and power credits. The overall outlook is positive with strong profitability drivers.

Bitfarms (BITF): Bitfarms gained on restructuring plans and institutional optimism, though legal issues and share sales caused brief setbacks. A pivot toward AI boosted outlook.

Bitdeer Technologies (BTDR): BTDR rallied on strong BTC accumulation, an AI innovation award, and surging call volume. Momentum remains supported by its operational strength.

Cipher Mining (CIFR): Cipher exploded higher after smashing hashrate expectations and expanding its infrastructure. Investor confidence surged on execution and scale.

CleanSpark (CLSK): CLSK rallied on new divisions to monetize BTC holdings and major infrastructure expansions. Call options spiked alongside sentiment and stock price.

Galaxy Digital (GLXY): Galaxy rose on a successful fundraise, AI partnerships, and Solana ETF optimism. Heavy call activity reflected rising institutional and retail confidence.

Coinbase (COIN): COIN rose on acquisitions and regulatory hopes despite a temporary Ark Invest selloff. New U.S. regulated futures further supported its momentum.

HIVE Digital Technologies (HIVE): HIVE rallied strongly on booming AI earnings and robust financial results, despite an earnings miss. Call volume reflected investor excitement.

Hut 8 (HUT): HUT surged on major power agreements and a record mining site launch. Strong fundraising added to bullish investor positioning.

Iren (IREN): Iren rose sharply on record revenues, major GPU investments, and leadership changes. Its AI-focused strategy fueled investor enthusiasm.

TeraWulf (WULF): WULF spiked as BTC gains boosted its mining value and infrastructure developments increased capacity. Investor sentiment was highly bullish.

Robinhood Markets (HOOD): HOOD hit a record on tokenized stock offerings and crypto product expansion. Call activity and analyst upgrades signaled bullish momentum.

Metaplanet (3350.T): Metaplanet climbed on BTC purchases, zero-interest bond financing, and strong earnings. Regulatory concerns in Japan slightly tempered gains.

Northern Data (NB2.FT): Despite a weekly decline, Northern Data’s AI data center plans and energy partnerships sparked optimism. Market reaction was cautious amid energy cost concerns.

Bit Digital (BTBT): BTBT rallied on Ethereum staking plans and strategic shifts despite short-term uncertainty. Insider buying and IPO plans supported long-term confidence.

Core Scientific (CORZ): CORZ surged on acquisition rumors and a massive AI deal with CoreWeave. Investor excitement is evident in sharp price gains and heavy call trading.

Circle (CRCL): Circle dropped on JPMorgan’s downgrade but rebounded on stablecoin leadership optimism. Mixed analyst sentiment and insider activity created volatility.

The full breakdown - and what is likely to happen next - is available exclusively in our latest subscriber 'Strategy' report.

Click the link in our bio to access the full analysis.

Show original

1.87K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.