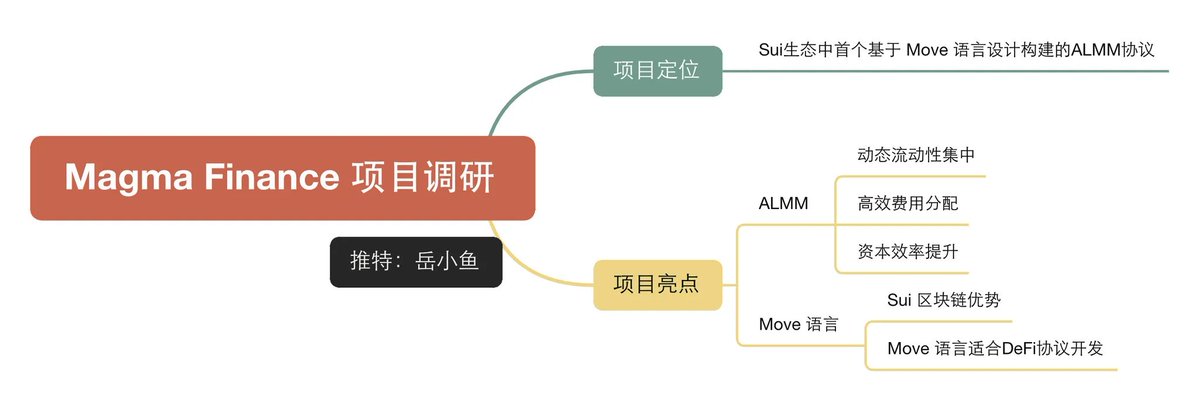

[Let's talk about Magma Finance, the first ALMM protocol on the SUI chain]

Magma Finance is the first ALMM protocol on the SUI chain, this project is still very representative, we can see the development process of DEX from this project, we can talk about this project in depth.

1. Review the development process of DEX liquidity mechanism

In fact, the liquidity mechanism of DEXs has gone through several generations of revolutions.

From the first AMM to CLMM, and then to the latest ALMM, the core is to continuously improve the efficiency of capital utilization.

By analogy, we can look at the differences between these mobility mechanisms:

(1) Traditional AMM (such as Uniswap V2): You evenly fill the stall with all the fruits such as apples and bananas, but many fruits are not bought, wasting space (capital efficiency).

(2) CLMM (e.g. Uniswap V3): You only place popular fruits (e.g. apples), but you have to manually pick the price range (e.g. 10-12 yuan per catty), if the price changes (e.g. rise to 15 yuan), your apples cannot be sold, and the stall is empty (liquidity is invalid).

(3) ALMM: Like an "intelligent vendor robot", it will automatically observe the market and put your fruit (liquidity) in the most popular price range in real time (for example, apples are automatically adjusted to 15-16 yuan), without your manual operation, which is both worry-free and can sell better (low slippage, high efficiency).

So, to put it simply, ALMM (Adaptive Liquidity Market Maker) can solve the limitations of traditional Automated Market Maker (AMM) and Centralized Liquidity Market Maker (CLMM).

ALMM dynamically adjusts liquidity allocation through intelligent algorithms, which can improve capital efficiency, reduce transaction slippage, and simplify user operations.

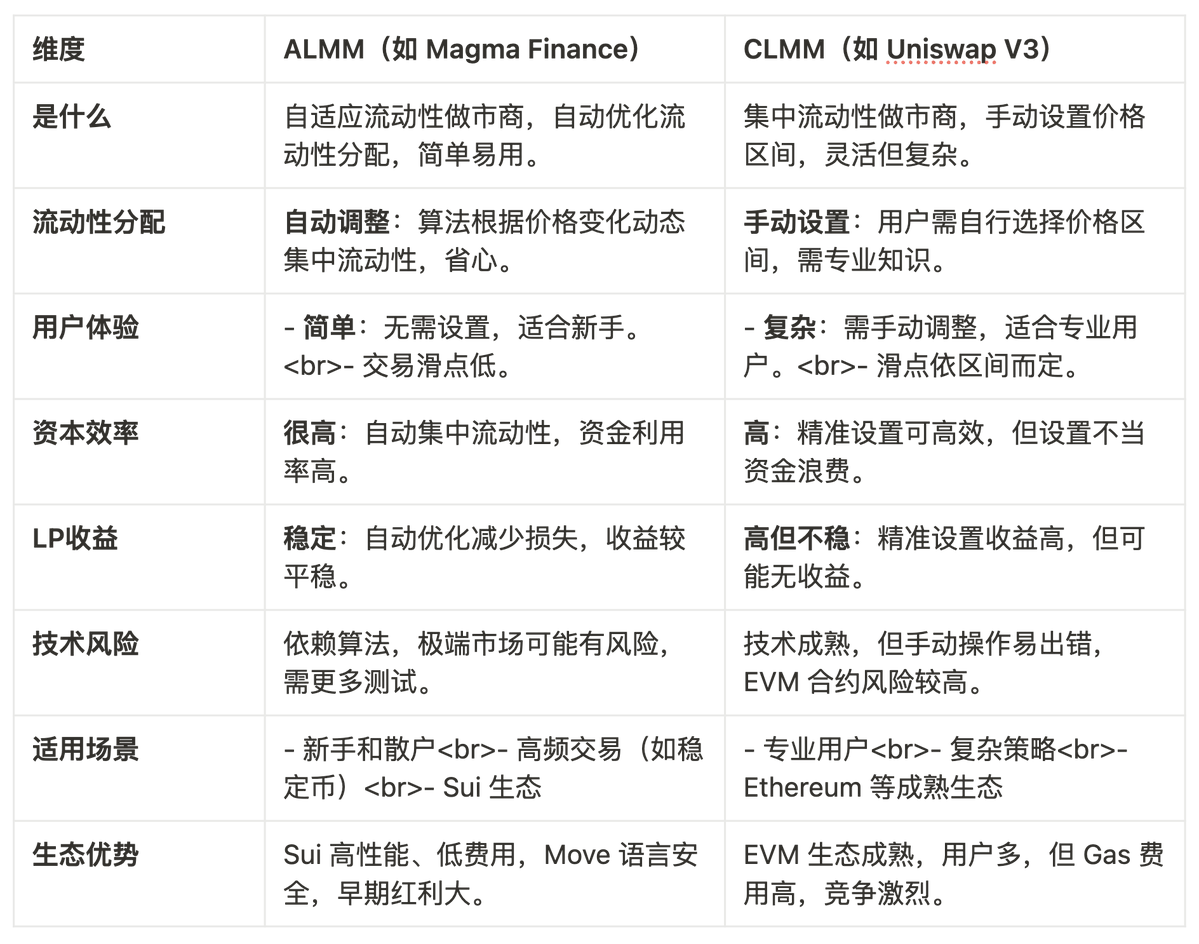

Here's a detailed comparison of ALMM and CLMM in tabular form:

2. What exactly is Magma?

After talking about ALMM, we can find that ALMM is a new generation of liquidity mechanism.

Magma is the first ALMM protocol in the Sui ecosystem based on the Move language design. @Magma_Finance

Magma has two main highlights:

(1) The ALMM mechanism is adopted

The adaptability of ALMM not only improves the user experience, but also lowers the barrier to entry for DeFi.

Traditional CLMM (such as Uniswap V3) requires users to set a precise price range, which is not friendly to novices.

ALMM's automated design allows the average user to enjoy high capital efficiency, potentially expanding Magma's user base.

(2) Move language

The Move language is not only a technical choice, but also a strategic barrier for Magma.

Compared to the Solidity of the EVM ecosystem, Move's security reduces the risk of smart contract vulnerabilities, which is especially important for institutional users and risk-sensitive LPs.

Sui's high performance makes Magma a "low-latency exchange for DeFi", similar to the high-frequency trading platforms in traditional finance.

3. Learn new projects in practice

How can we get involved in this project?

Magma has launched the S1 phase of the task, which can be social mining or transaction mining: go to the official website to add liquidity or do a few transaction operations to obtain Magma Points, and of course, you can also get zero points by signing in.

Learn as you go.

Interested partners can participate and feel the convenience of the ALMM mechanism.

Show original

16.29K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.