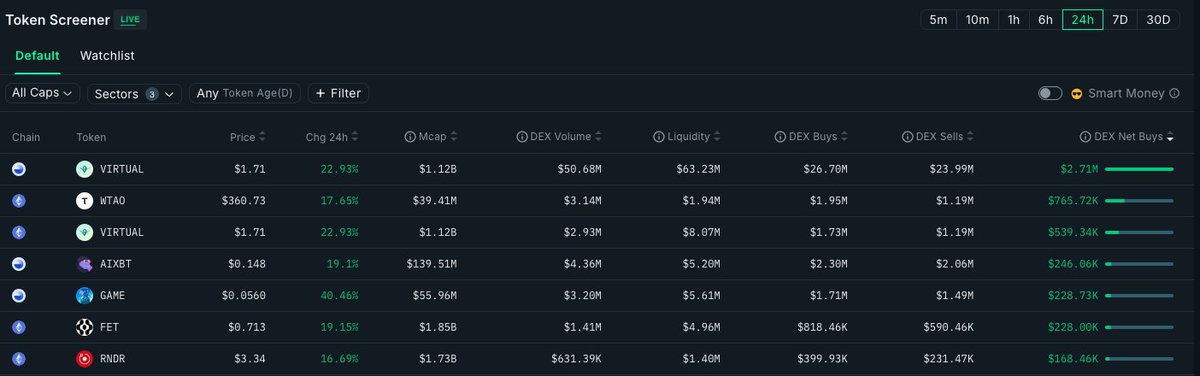

Nansen 7-day net inflows are coming in strong for AI coins containing real use cases.

Looking at the top four in order of ROI this week:

i) SERV @openservai

- Leading performer: up 57.22% this week with $868K in buys.

- $34.3M market cap, $1.59M liquidity.

Openserv recently teased its agentic applications (aApps) with the intention of creating a revenue first ecosystem.

Their Berlin hackathon saw 8 viable aApps developed in a single day. Other developments include:

- Browser Use: SERV SDK agents can now browse the internet like humans

- yCombinator for crypto x AI: The team are offering hands on financial and developer support to selected teams.

- aApp integration into Telegram

- My very own "Sammy Crypto x AI dashboard"

ii) GAME @GAME_Virtuals

- Up 47.16% over 7 days with $708.66K in net inflows.

- $60.6M market cap, $5.52M liquidity.

The GAME SDK is the Virtual's tech stack - with a lot of eyes on this ecosystem and Agent Commerce Protocol (ACP) expected to land imminently, GAME could be interesting to watch.

Ethermage highlighted the Agent 2 Consumer and Agent 2 Agent thesis powered on ACP; A2C runs through what they're calling a Butler Agent. The goal of this agent is to abstract UI away from the end user.

Virtuals also recently went live on Binance Wallet.

iii) REI @ReiNetwork0x

- Up 41.88% over 7 days with $808.66K in net DEX inflows.

- $113.6M market cap, $3.19M liquidity.

REI is one of the OG research agent infrastructures launched around the same time as @aixbt_agent.

It's live on both Base and Hyperliquid; two ecosystems set to explode this cycle imo.

Smaller labs (like REI) are gaining attention for innovative architectures amid the 2025 push for AGI breakthroughs.

Its "Bowtie" architecture's dual memory system reflects advances in cognitive science, inspired by human brain studies published in early 2025.

Smaller protocols aren't going to be able to compete with the warchests of the top research labs, so REI is taking a smart approach for AGI breakthrough.

iv) FET @Fetch_ai

- Up 15.31% this week with $136.04K in net inflows.

- $1.80B market cap, $5.02M liquidity.

Updates include:

- AI agents on ASI:One, including a Web3 Jobs Agent, Vaccine Hesitancy Insights Agent, and GitHub MCP Agent for streamlined coding tasks.

- $50M token buyback announcement to support ASI:One rollout

FETCH is core component of the Artificial Super Intelligence (ASI); a decentralized AI collective formed in 2024 through a merger of Fetch AI, SingularityNET, and Ocean Protocol.

It aims to advance AI beyond human cognitive abilities, with FET as its core token.

@openservai Data Source: @nansen_ai

36.41K

182

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.