EOY 2025 Ethereum Price Scenarios (Current Price: $2,400)

Repricing the ETH Thesis in a Fear-Driven Market

Recalibrated Core Metrics:

Annualized Protocol Revenue: ~$7.3B (Source: Token Terminal)

Circulating Supply: ~120.1M ETH (Source: Etherscan)

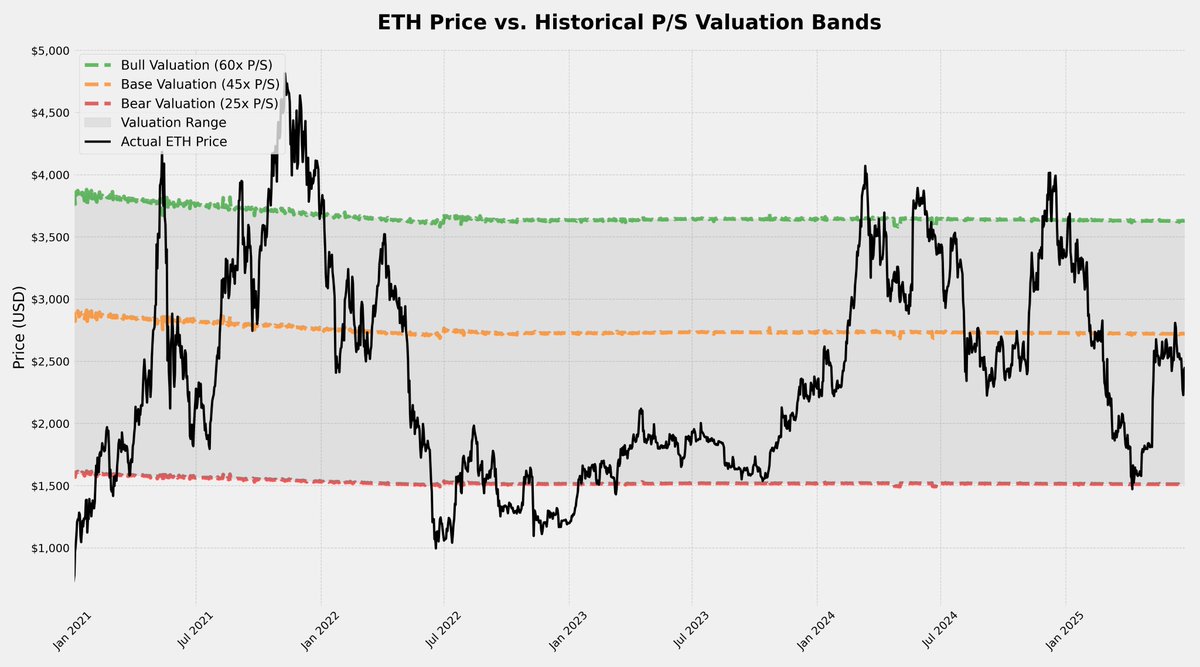

Implied P/S Multiple: At $2,400, ETH trades at ~40x P/S — a level that reflects high uncertainty and defensive positioning.

This revised baseline reframes our forward-looking price bands within a market pricing in fear, not fundamentals.

A. Bear Case — "The Washout"

Narrative:

ETF demand evaporates. Macro risk-off dominates. On-chain activity contracts, and forced liquidations cascade. The crypto market enters a new downcycle led by capitulation, not valuation.

Assumptions:

Fee Revenue: -20% → $5.84B

P/S Multiple: Contracts to 25x

Price Target:

→ ($5.84B × 25) / 120.1M = $1,216

Implication:

A break of structural support. ETH trades near cycle lows, despite underlying infrastructure improvements. Institutions step back. Retail exits.

B. Base Case — "The Slow Re-Accumulation"

Narrative:

ETH finds equilibrium. $2,400 proves to be a long-term accumulation zone. Institutional inflows persist at a measured pace. On-chain revenue gradually improves with ecosystem stability and renewed developer activity.

Assumptions:

Fee Revenue: +15% → $8.40B

P/S Multiple: Recovers to 45x

Price Target:

→ ($8.40B × 45) / 120.1M = $3,147

Implication:

A measured repricing. No hype-driven surge, but steady conviction rebuilds. ETH regains momentum as a productive, institutional-grade asset.

C. Bull Case — "The Spring-Coil Effect"

Narrative:

The market has overshot to the downside. ETH supply is thin across exchanges. A macro or sector-specific catalyst—such as regulatory clarity, AI-on-chain, or explosive ETF inflows—releases pent-up demand. The market re-rates ETH rapidly.

Assumptions:

Fee Revenue: +50% → $10.95B

P/S Multiple: Expands to 60x

Price Target:

→ ($10.95B × 60) / 120.1M = $5,470

Implication:

This is a sharp and aggressive rally—reclaiming new highs not through hype, but by a fundamental mismatch between price and on-chain performance.

The Analyst’s Thesis:

At $2,400, ETH is trading at pessimistic multiples last seen during distressed phases. But the fee base remains strong, and institutional structures (ETFs, staking, custody) are in place. This creates clear asymmetry:

Downside to Bear Case: -49%

Upside to Base Case: +31%

Upside to Bull Case: +128%

The setup favors accumulation, not euphoria. The repricing is a function of fee trajectory and capital rotation—not hope.

This is the new post-hype reality. And that’s where disciplined capital wins.

Show original

2.55K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.