1/ 🌍 If you missed last week's Amberdata Digital Asset Snapshot:

Geopolitics, regulation, and volatility all collided. From a politically charged $90M hack to record stablecoin flows and shifting ETF dynamics — here’s what you need to know 👇

2/ 💥 A politically motivated hack on Iran’s Nobitex exchange wiped out $90M in assets. Carried out by pro-Israel group Predatory Sparrow, the attack highlights how crypto is now a frontline tool in global cyber warfare.

3/ 💵 On the regulatory front, the U.S. Senate passed the GENIUS Act, pushing the stablecoin market cap to $251.7B. Institutions are taking note — clearer rules and strict 1:1 backing requirements are reshaping the landscape.

4/ 📉 Markets dipped as the Fed held rates steady but stayed hawkish. Add Iran-Israel tensions, and risk sentiment took a hit. Total crypto market cap dropped slightly to ~$3.25T.

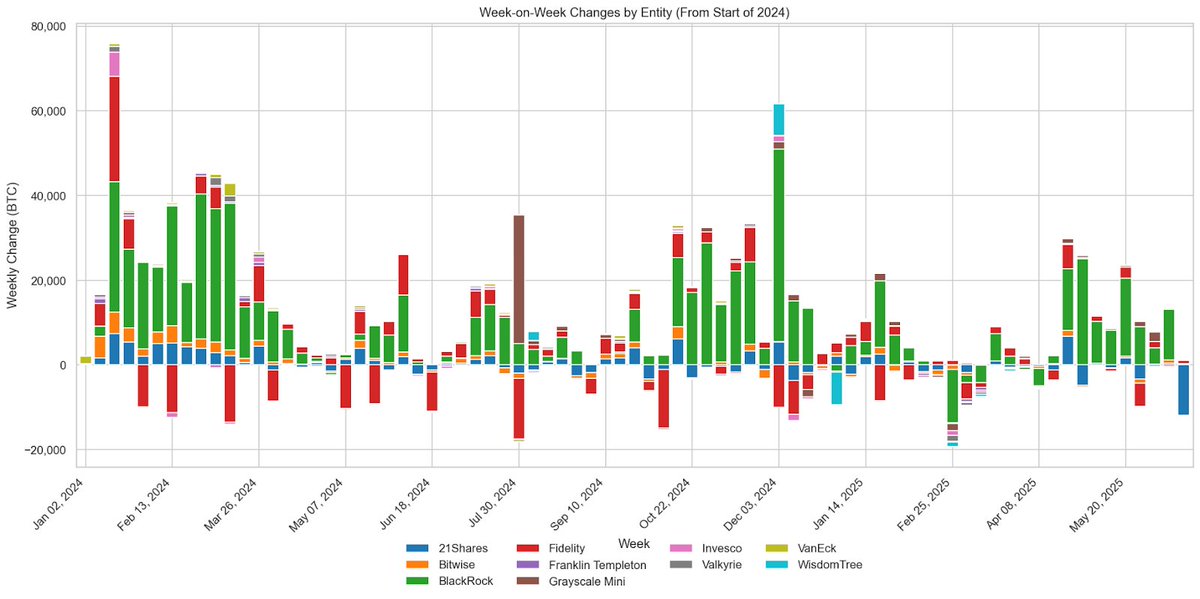

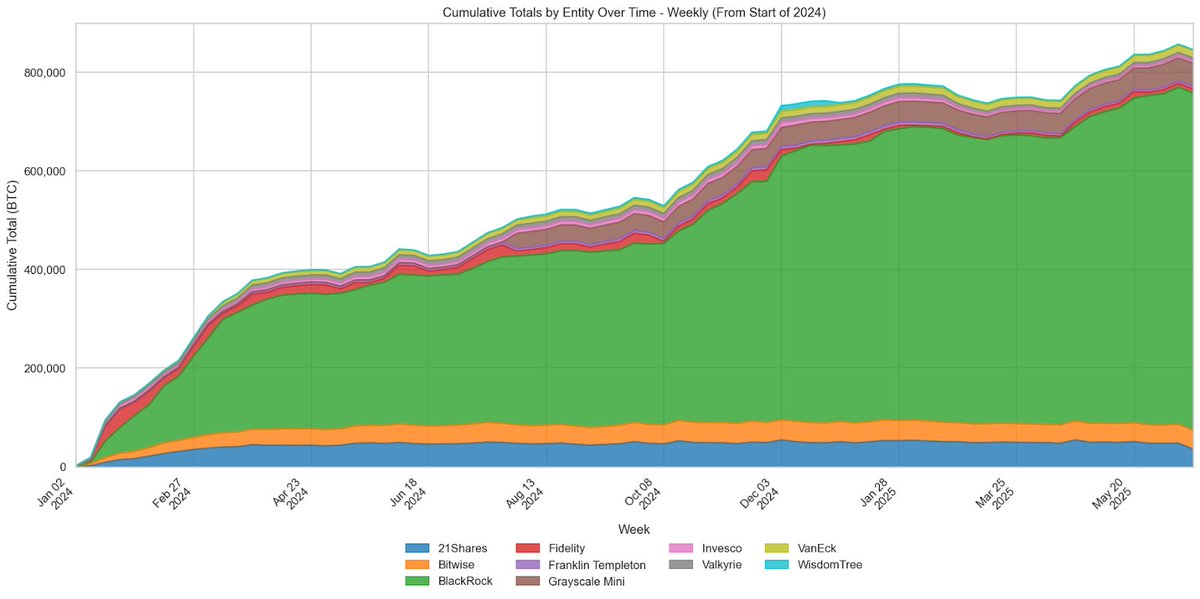

5/ 📊 Despite headwinds, Bitcoin ETF flows told a nuanced story:

@BlackRock: 🟢 Steady accumulation

@Fidelity: 🔄 Tactical repositioning

@21Shares: 🔻 Significant outflows institutions are cautious, but not retreating.

6/ 📈 Ethereum formed a triple-bottom around $2,500 — a bullish pattern signaling a possible rebound to $3,000. But macro pressure could still weigh heavily.

7/ 🔓 Meanwhile, the ALEX Protocol on Stacks was exploited for up to $16M. Yet another reminder: DeFi risks remain real, even on Bitcoin-adjacent chains.

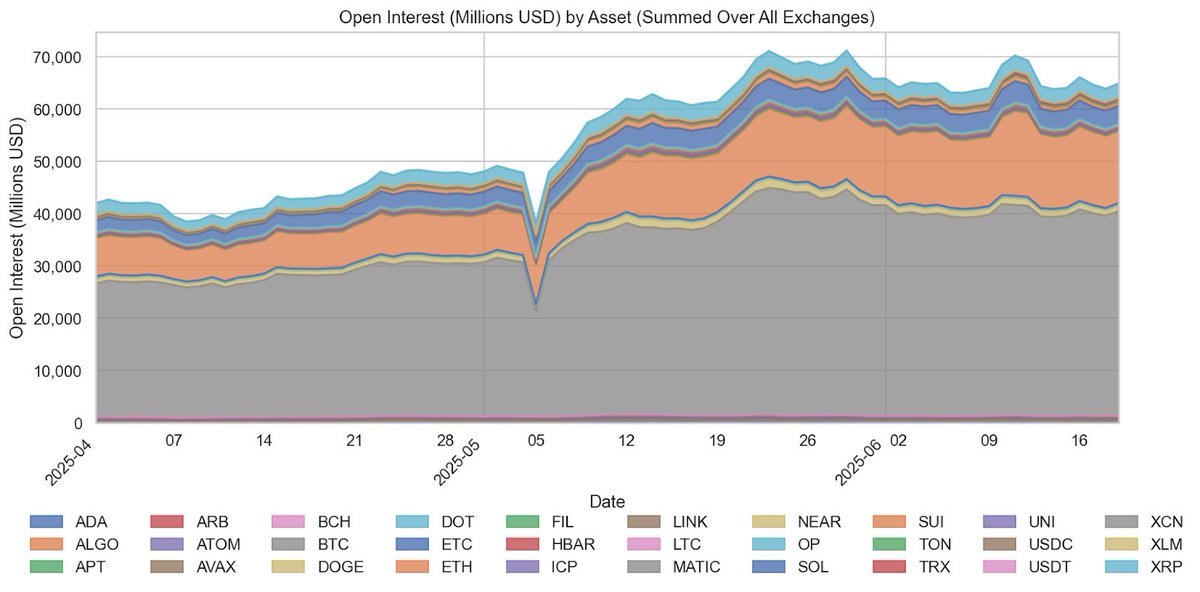

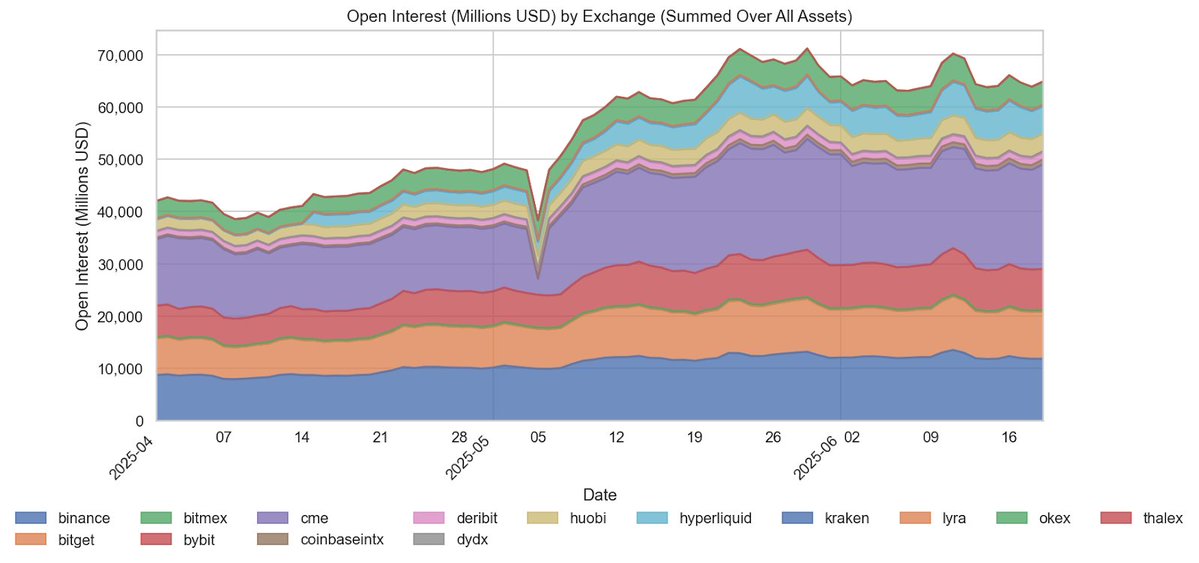

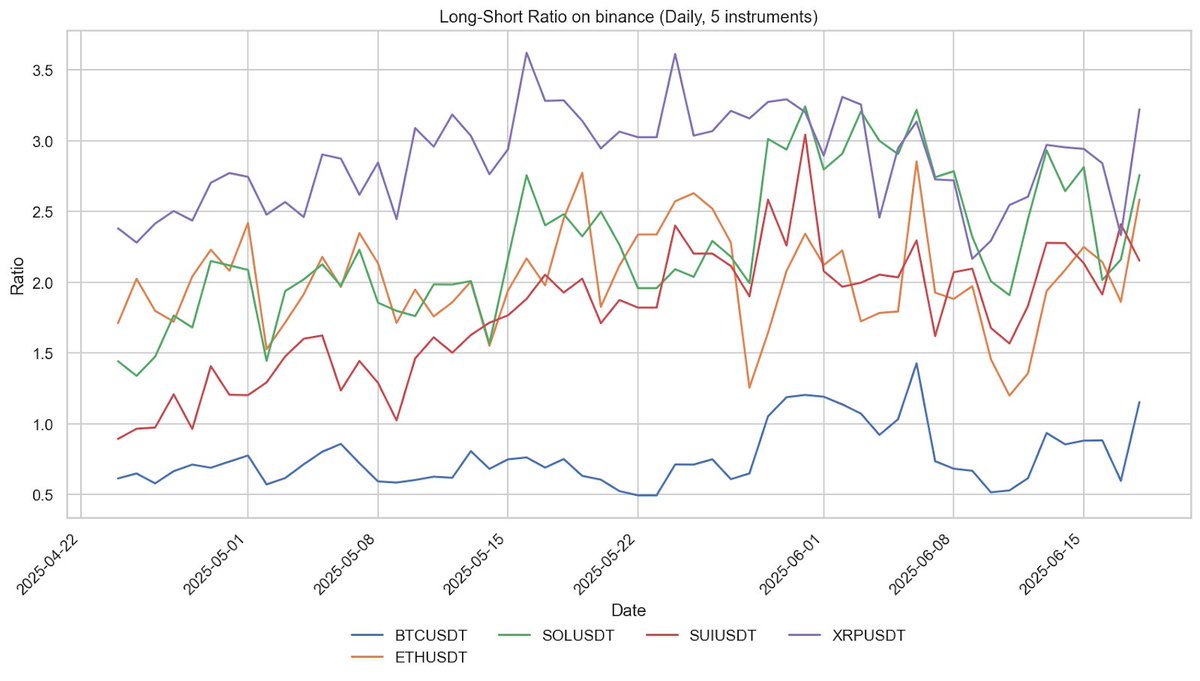

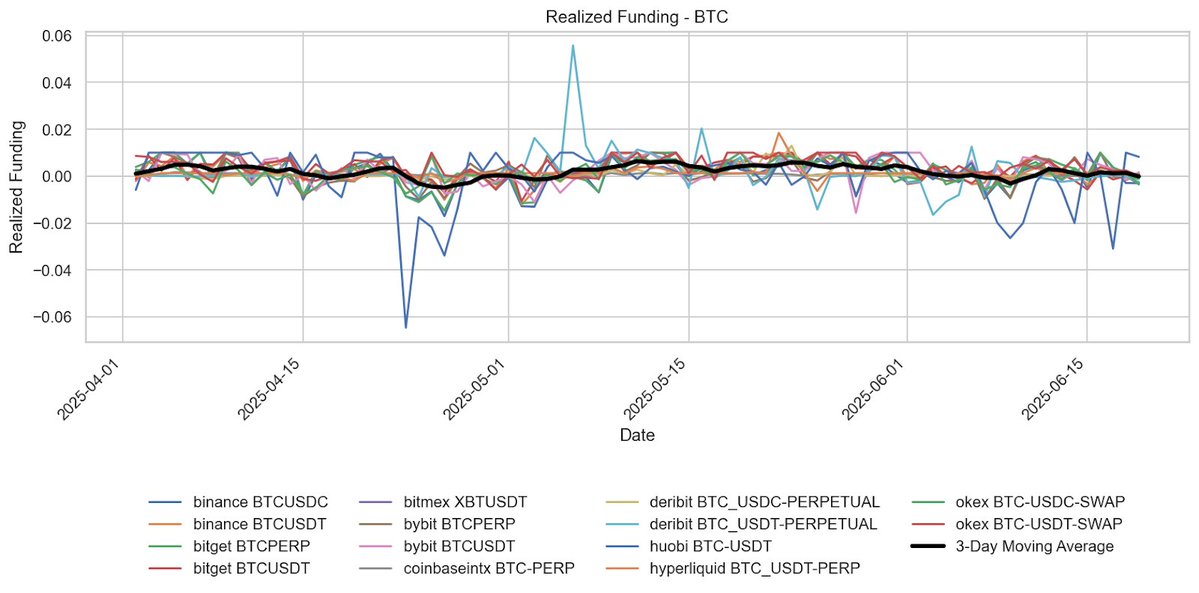

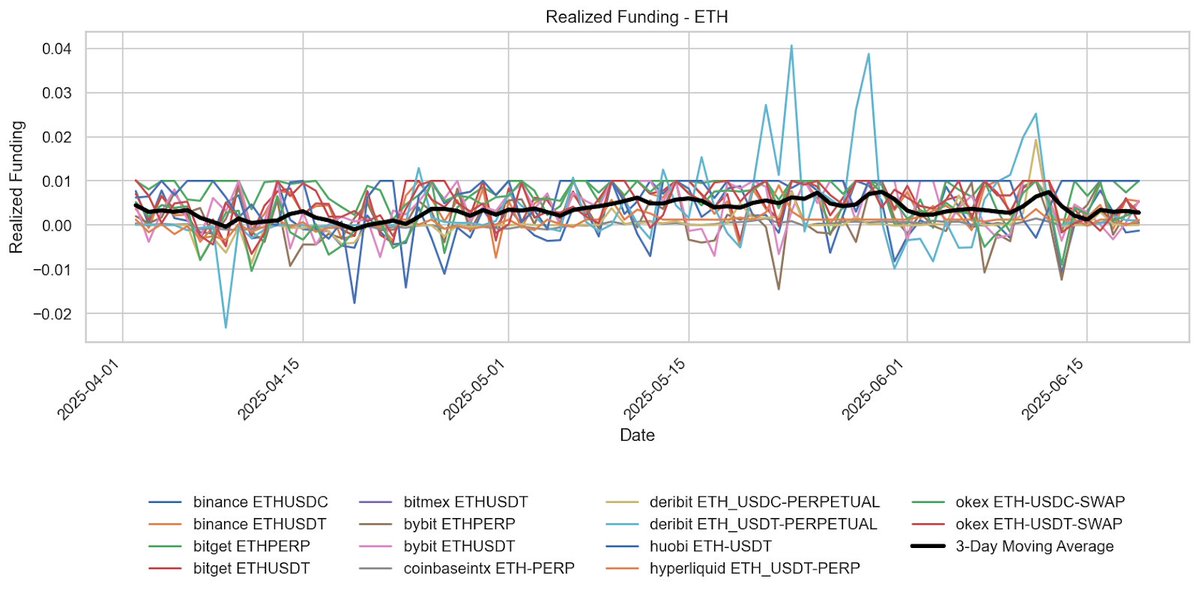

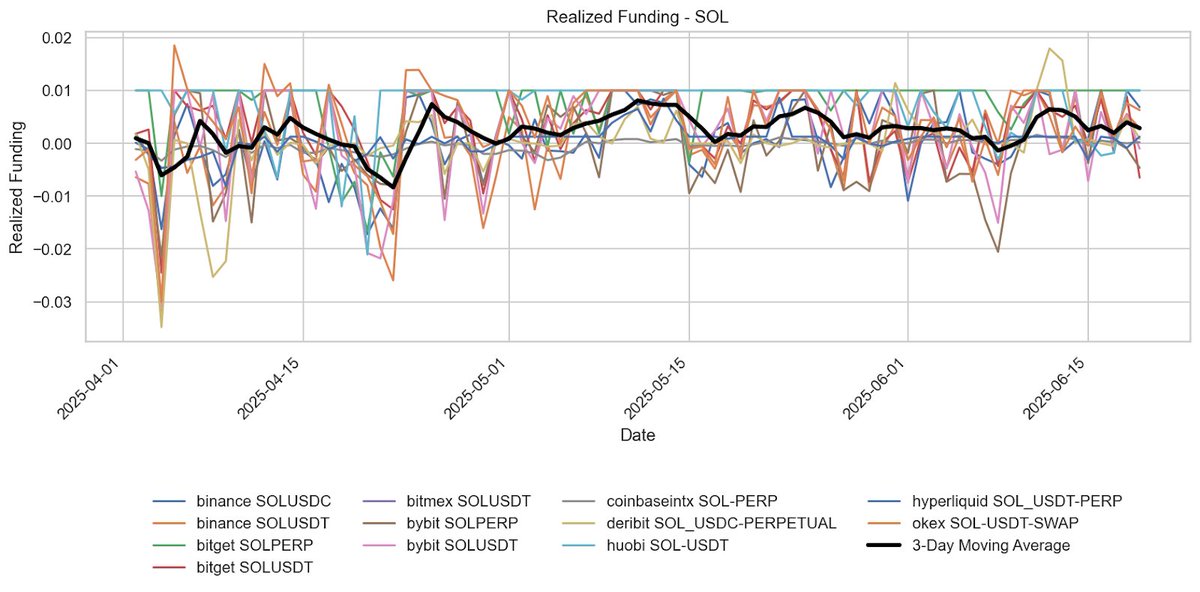

8/ 📈 BTC, ETH, and SOL futures open interest and funding rates show tactical positioning:

- Long/short ratios bounced back

- ETH & SOL saw strong bullish bias

Funding rates swung wildly with sentiment shifts

9/ ⚖️ TL;DR: Crypto markets are walking a tightrope between macro uncertainty, regulatory clarity, and on-chain risks. But under the surface, institutional conviction remains strong.

10/ 📬 Stay ahead of the curve with real-time market metrics and institutional-grade insights from @Amberdataio.

Dive deeper here:

924

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.