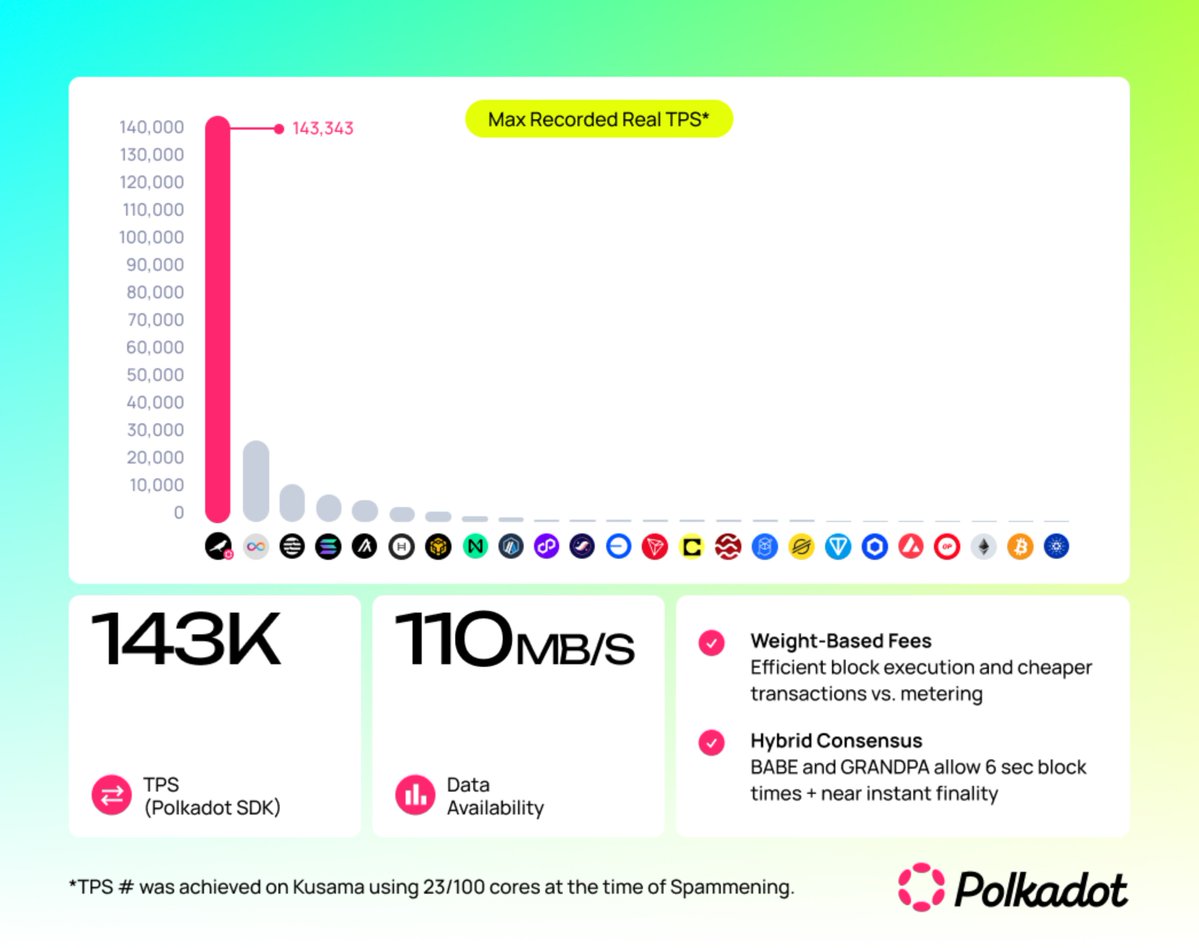

Polkadot's scalable architecture handled 143K TPS using a fraction of total capacity.

VISA averaged 7.4K TPS last year, per its annual report.

Web3 for the world is here. Humans need only use it.

In 2024, Visa processed 234 billion transactions.

That works out to 7.4k TPS on average.

Polkadot did 100k+ during the Spammening.

The takeaway: resilience and scalability are not mutually exclusive.

Sure, it's easier to do massive TPS if the entire chain is hosted by a single provider.

But then why bother with Web3?

A breakdown of how Polkadot scales without sacrificing its Web3 principles ⤵️

Parallel Execution: app-specific rollups run in parallel + process their own txns, enabling high throughput.

Dynamic Resource Allocation: rollups can acquire more compute power (coretime) as needed with Elastic Scaling, reducing latency during high demand.

While Agile Coretime makes the network more efficient by allowing apps to scale up or down based only on resources they use.

Shared Security: All rollups benefit from shared security so new chains don't have to bootstrap their own security, allowing for rapid deployment and scaling without security tradeoffs.

This isn't theoretical either.

@kusamanetwork, Polkadot's sister network, hit 143k TPS in the wild using just a fraction of its capacity with the same tech.

💡 Learn more about Polkadot scalability:

931

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.