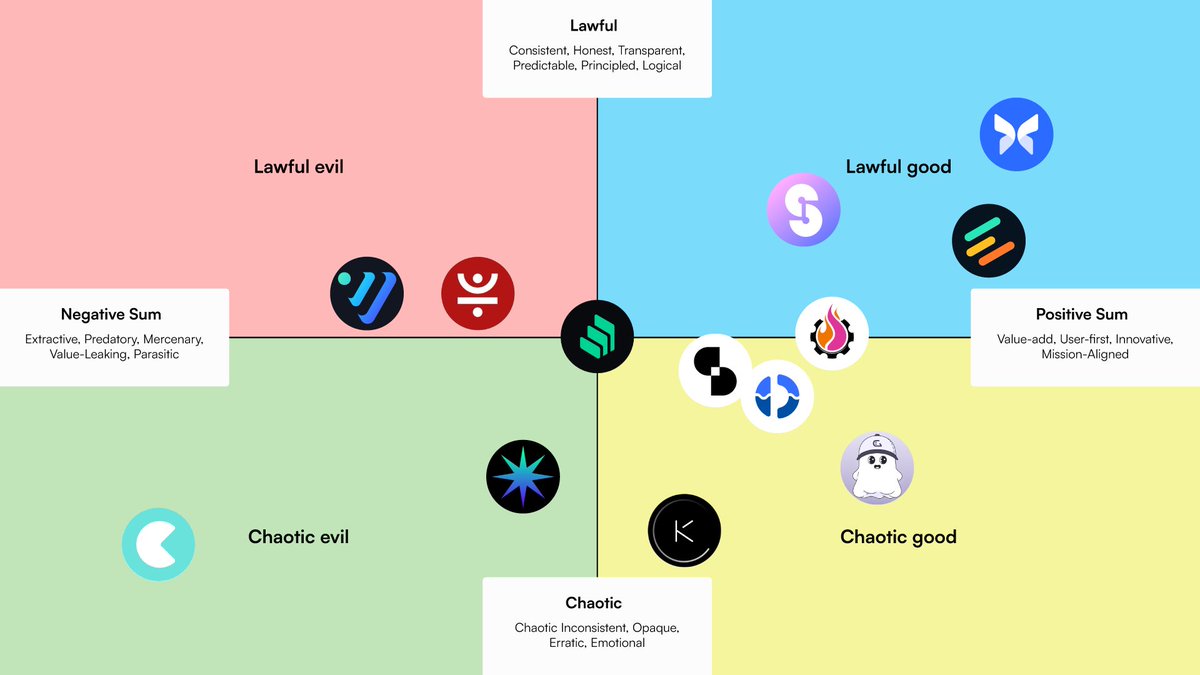

lending/borrowing alignment compass.

it is what it is.. 🫴🔮

Aave

Aave sits firmly on the "chaotic good" axis. It pioneered key innovations like flash loans, E-mode efficiency, and isolation mode, while maintaining the largest liquidity pools across more than 14 chains.

The integration of its GHO stablecoin and the Safety Module backstop reflects a commitment to sustainable infrastructure.

However, Aave’s conservative approach to onboarding new collateral types and maintaining strict risk parameters can limit its yield potential. Technologically, Aave is highly sophisticated and battle-tested through multiple market cycles.

𝗠𝗼𝗿𝗽𝗵𝗼

Morpho stands out as one of the most innovative lending protocols, with rapid growth despite being a late entrant. It’s positioned on the innovation axis due to its novel curator model.

Morpho Blue introduces a peer-to-peer matching layer that allows direct lender-borrower interactions with customizable risk parameters. The curator model shifts risk management from protocol-wide decisions to specialized vault strategies.

Morpho Labs currently operates the largest DeFi lending protocol on Base by active loans, indicating strong adoption of its unique architecture.

Compound

Compound continues to play a steady, foundational role in DeFi. While the cToken model can sometimes feel dated, the protocol’s token structure effectively distributes value to tokenholders in a sustainable manner.

Unlike other protocols that have expanded into adjacent features, Compound has maintained a strict focus on lending, borrowing, and governance. Its COMP distribution was groundbreaking in 2020, though now less central to the ecosystem.

Many users access Compound through third-party interfaces, signaling its transition toward being infrastructure rather than a user destination.

Venus

Venus is a long-standing protocol on the BNB Chain with considerable usage, though its reputation has been impacted by past governance issues. The shift to isolated pools has improved risk management relative to its original pooled architecture.

Venus Prime requiring 1,000+ XVS tokens to yield boosts appears more like enforced token utility than organic value accrual. While it serves BNB Chain users effectively, its cross-chain presence has seen limited growth.

Seamless Protocol

Seamless Protocol demonstrates strong alignment with sustainable DeFi practices. Its fair launch, robust DAO structure, and operational features like instant withdrawals and an enhanced user experience reflect a commitment to transparent and user-centric design.

The integration with Morpho Vaults shows strategic foresight—leveraging Morpho’s infrastructure while enhancing it with Seamless’s governance layer and SEAM incentives. Rather than pursuing high but unsustainable APYs, Seamless focuses on building durable yield strategies.

By concentrating efforts on the Base network, Seamless positions itself alongside the shifting center of DeFi activity. The protocol emphasizes long-term health and governance stability over short-term TVL growth, making it a notable entrant in the maturing DeFi landscape.

34.82K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.