· Bitcoin (BTC): Bitcoin dipped following Israeli airstrikes on Iran despite initial gains from U.S.-China trade optimism. GameStop’s large BTC purchase highlights ongoing institutional interest.

· MicroStrategy (MSTR): A board member sold his entire stake amid broader insider selling and declining stock prices. The lack of insider buying raises concerns about company sentiment.

· Marathon Digital (MARA): Despite boosting BTC holdings, the stock dropped due to high short interest and dilution concerns. Institutional support and expansion created volatility.

· Riot Platforms (RIOT): Stock gained with Bitcoin’s rise and strong May production. Stake reduction in Bitfarms and speculative options activity influenced sentiment.

· Bitfarms (BITF): Shares fell due to lawsuits and insider selling despite strong hashrate and BTC rally. Legal issues overshadowed operational progress and AI pivot.

· Bitdeer Technologies (BTDR): BTC production increase and mining rig shipment lifted shares temporarily. Ongoing losses and AI diversification drew mixed investor reactions.

· Cipher Mining (CIFR): Despite a major SoftBank investment, operational issues and valuation concerns hurt sentiment. Bitcoin holdings and market rally offered partial support.

· CleanSpark (CLSK): Strong BTC mining results and a JPMorgan upgrade boosted the stock. Short interest drop led to mixed investor outlooks.

· Galaxy Digital (GLXY): Partnerships and staking strategy aimed to attract institutions but didn’t overcome broader market concerns. High short interest and cash issues weighed on the stock.

· Coinbase (COIN): New products and partnerships, including a Bitcoin rewards card and Shopify integration, sparked optimism. However, price declined amid broader market weakness.

· HIVE Digital Technologies (HIVE): Hydro-powered expansion and solid BTC production encouraged optimism. Yet negative earnings and cash flow remained concerns.

· Iren (IREN): Convertible note offering and strong BTC mining drove price gains and speculation. High options activity signaled potential investor optimism.

· Robinhood Markets (HOOD): Exclusion from the S&P 500 hurt the stock despite strong May metrics. New product reveals brought temporary relief but couldn’t shift sentiment.

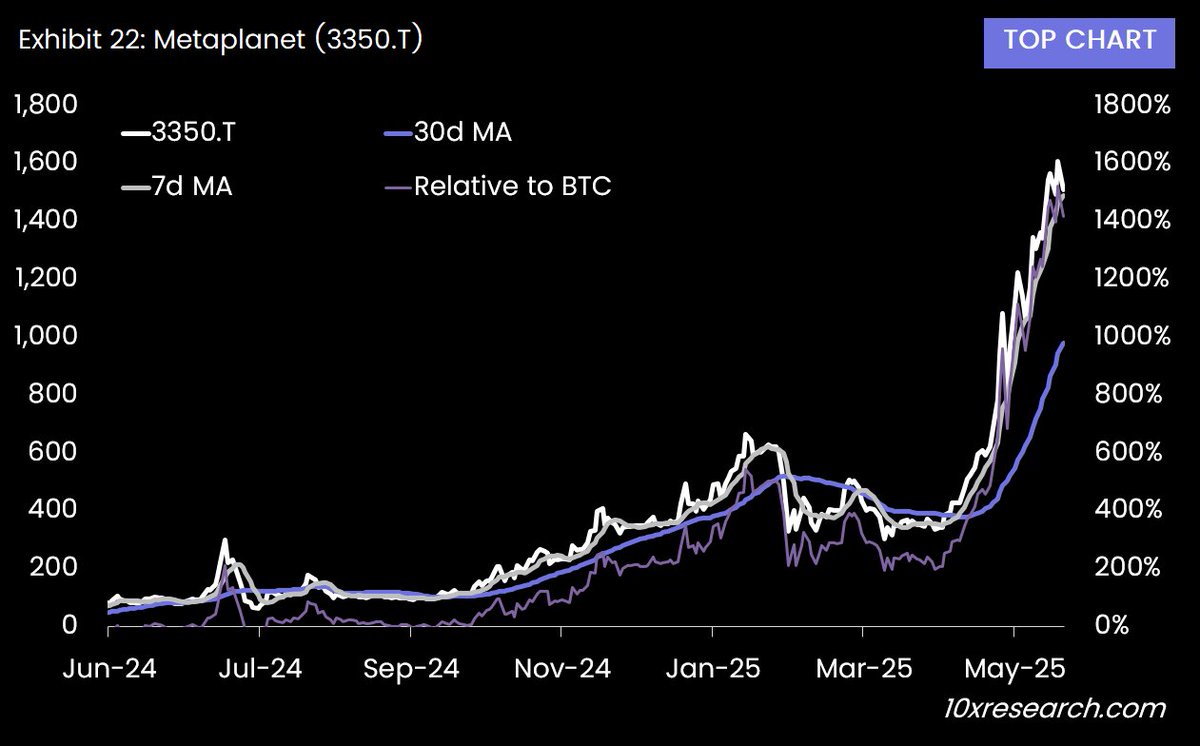

· Metaplanet (3350.T): Stock soared after announcing massive BTC acquisition plans and share issuance. Bitcoin rally supported the move but raised dilution concerns.

· Northern Data (NB2.FT): Data center expansion boosted growth expectations. Profitability concerns and high costs limited enthusiasm.

· Circle & Core Scientific (CORZ): Circle’s stablecoin growth faced valuation worries, while CORZ’s huge contract lifted hopes. Yet internal control issues and lawsuits offset gains.

Join our distribution list - link in bio....

Show original

9.16K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.