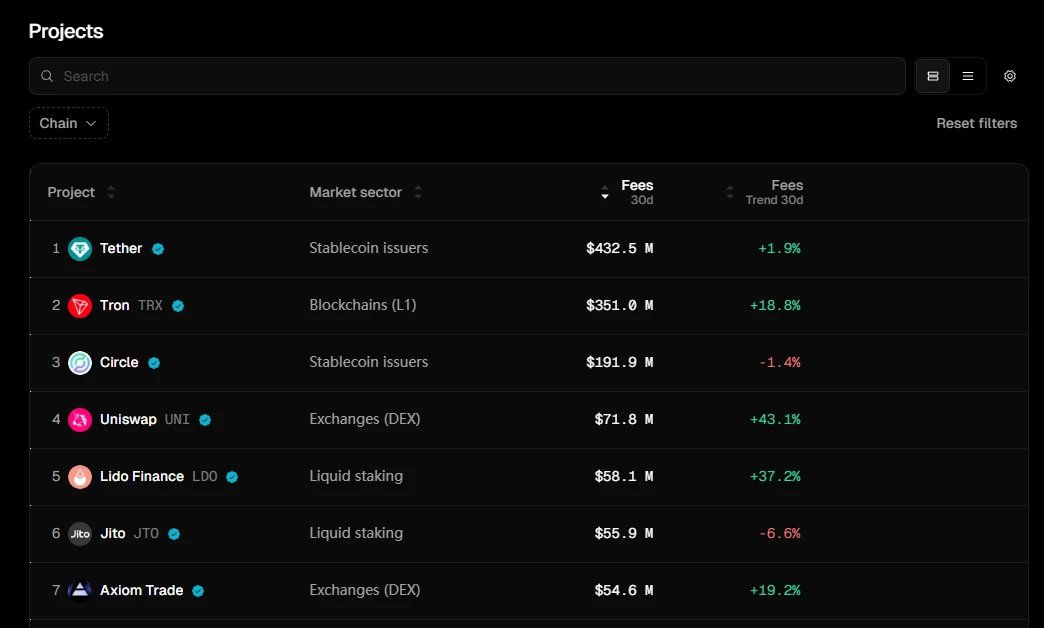

TRON Builds a Stablecoin Empire: Value Restructuring Under Scale Advantages and Ecological Synergy

In the global stablecoin market landscape, the TRON network has established an unshakeable dominant position. According to the latest on-chain data, the issuance of USDT on the TRON network has surpassed 78.7 billion, accounting for half of the global stablecoin circulation. This figure not only far exceeds that of traditional public chains like Ethereum but also signifies that TRON has become the preferred infrastructure for institutions and individual users for cross-border payments and asset allocation. The high penetration rate of stablecoins is not coincidental but a direct result of the TRON network's high throughput and low fee characteristics—its average daily transaction volume has long remained at the tens of millions level, with an average transaction fee of only $0.1, providing an optimal solution for large-scale capital flows.

This scale advantage has spawned a unique network effect. The significant liquidity accumulation makes the trading depth of stablecoins on the TRON chain notably superior to other networks. In the DAO protocol, stablecoins like USDT can not only serve as collateral for lending but can also be transformed into network resources through the innovative "energy leasing" mechanism, allowing users holding stablecoins to simultaneously earn interest and governance rights. This composite revenue model is a first in the industry.

Synergistic Innovation in the DeFi Ecosystem: Systematic Design Behind High Returns

The total locked value (TVL) of the TRON DeFi ecosystem has long ranked among the top five global public chains, currently reaching $5 billion. Its success stems from a deeply synergistic protocol matrix design. Unlike fragmented public chains, the core protocols within the TRON ecosystem form a tightly complementary relationship:

The lending protocol JustLend DAO has become the liquidity hub of the ecosystem with a TVL of $3.61 billion. Its innovation lies in deeply integrating traditional lending business with the characteristics of the TRON network—while users stake stablecoins to earn interest, the system automatically matches idle funds to

The ecological synergy is particularly evident in the operation of stablecoin USDD 2.0. As a decentralized stablecoin with an issuance exceeding $437 million, USDD adopts an over-collateralization mechanism, with its reserve assets including BTC, TRX, and various TRON ecosystem tokens. Holders not only enjoy price stability but can also through

Technical Breakthroughs and Value Capture of Flagship Products

The flagship products of the TRON ecosystem showcase unique technical breakthroughs.

The "energy leasing" market of JustLend DAO represents an innovation in the resource allocation mechanism of public chains. Users can lease idle bandwidth and energy resources to high-frequency traders, with the system automatically matching and distributing profits through smart contracts. The daily trading volume of this market has surpassed $20 million, creating a stable passive income stream for resource holders. This design cleverly transforms network infrastructure into tradable assets, forming a unique value cycle.

At the asset issuance level, the SunPump platform lowers the creation threshold for Meme coins to just 3 minutes through standardized smart contract templates. However, its core value lies in the built-in anti-rug-pull mechanism: the funds raised by the project party are released linearly, and 5% of the liquidity must be permanently locked. These risk control measures have led to the emergence of high-quality projects like MMM on the platform, which once saw weekly trading volumes exceeding $120 million, demonstrating TRON's proactive governance capability over speculative bubbles.

Infrastructure-Driven Financial Paradigm Upgrade

The explosion of the TRON ecosystem is essentially an inevitable result of its underlying architectural advantages. Based on the DPoS consensus mechanism, the network can stably support a throughput of 2000 TPS, with a gas fee price fluctuation coefficient of only 0.03 (compared to Ethereum's 0.82). This certainty is particularly important for institutional investors. On-chain data shows that the number of new institutional accounts on TRON has increased by 320% year-on-year over the past six months, with hedge funds accounting for 41%. They mainly participate in stablecoin arbitrage and DeFi portfolio strategies.

The network effect is forming a positive cycle. More institutions entering bring deeper liquidity, which in turn reduces trading friction for ordinary users—currently, the median transfer time for stablecoins on the TRON chain is only 8 seconds, with a failure rate of less than 0.001%. This industrial-grade reliability, combined with

From a macro perspective, the value proposition of the TRON ecosystem has transcended mere high returns, instead constructing a self-consistent financial operating system. The USDT held by users is both a payment tool and an interest-generating asset; the staked TRX serves as network fuel while also generating rental income; even the created Meme coins can be integrated

TRON: The DeFi Ecosystem Engine Behind the "Stablecoin Dominator" from @OdailyChina

@justinsuntron #TRONEcoStar #TRON

Show original

49.47K

28

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.