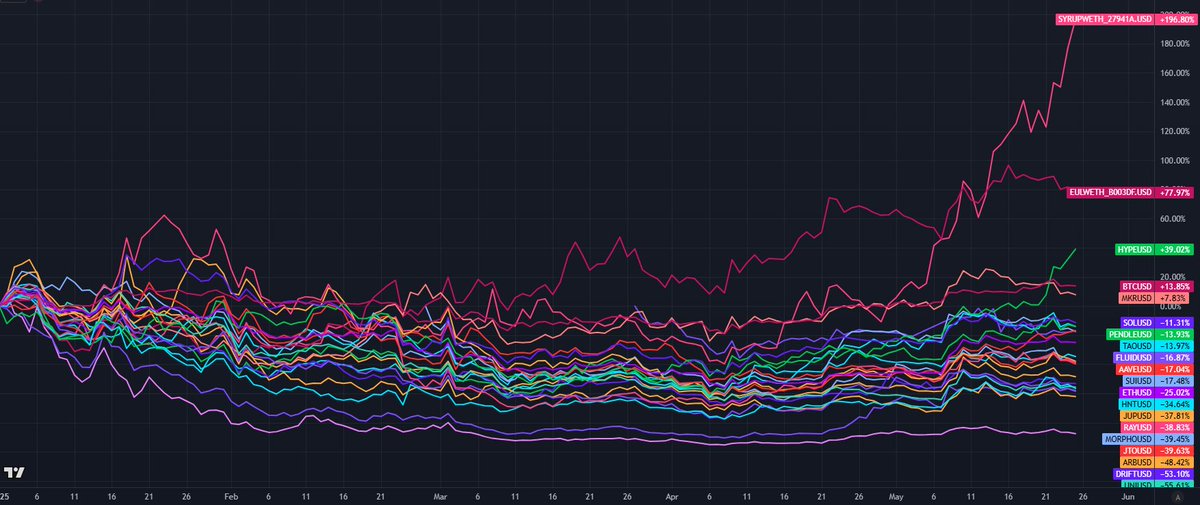

The only tokens I track that are up on the year are

SYRUP, EUL, HYPE, FARTCOIN, MKR, BTC

Each one of these had a large idiosyncratic driver that wasn't easily priced in

1. SYRUP: launch of lstbtc, spark deposit, large influx of borrow demand, annual revenue ramp to $10mm+

2. EUL: 10x'd tvl, launched on many new chains, onboarded a number of risk curators, asset issuers, and protocols

3. HYPE: took meaningful share of perp market, users remained sticky, increased monetization, increased builder activity

4. FARTCOIN: became a bluechip memecoin in the wake of the memecoin market collapse

5. MKR: turnaround in rebrand sentiment, DAI supply ramped from Ethena deployment, turned on buyback

6. BTC: Dollar devaluation story is picking up in the wake of a pivot from Liberation day

Market is becoming more efficient, and that's not a good thing for average token returns in the mid-term. Gotta pick winners, otherwise the natural drift is lower for a lot of this stuff.

Show original

38.22K

176

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.