EOS

EOS price

$0.70350

-$0.00020

(-0.03%)

Price change for the last 24 hours

How are you feeling about EOS today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

EOS market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$1.07B

Circulating supply

1,516,885,789 EOS

72.23% of

2,100,000,000 EOS

Market cap ranking

47

Audits

Last audit: 29 Dec 2021

24h high

$0.70900

24h low

$0.66410

All-time high

$23.2880

-96.98% (-$22.5845)

Last updated: 29 Apr 2018

All-time low

$0.39720

+77.11% (+$0.30630)

Last updated: 5 Aug 2024

EOS Feed

The following content is sourced from .

Crypto子棋

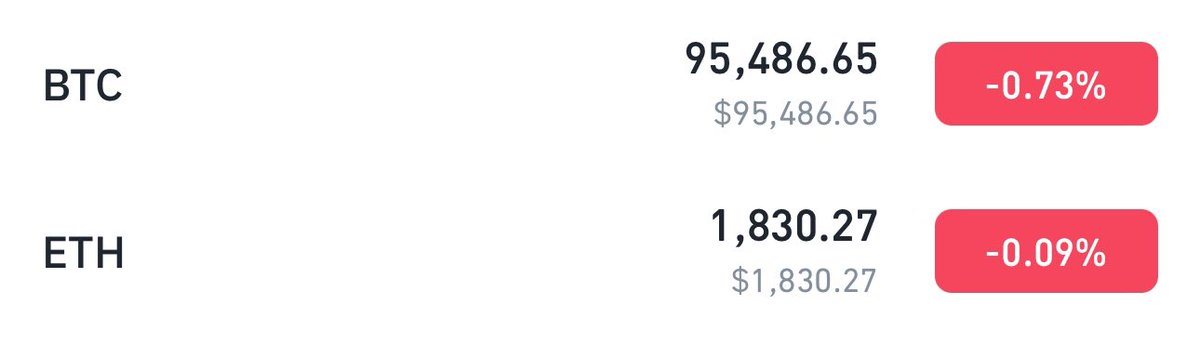

The previous pullback was around 3000u, and if the rhythm remains unchanged this time, it is expected to stabilize at $94800 and it will be time to rebound!

The core rhythm of the near future is Thursday's Federal Reserve meeting, which will determine the state of the market for almost a month.

Crypto子棋

As long as ETH is not stable, all copycat rebounds are just a flash in the pan, so don't worry, the general direction is to look for BTC, and if you want to make money, then look for ETH.

ETH must still have a big wave, whether you believe it or not, even if garbage such as EOS, the peak of the big bull market can still be hard once, not to mention that ETH has passed the spot ETF, dry!

19.33K

23

Lux(λ) |光尘|空灵|GEB

Bitcoin's Moat: The Emergence of Three Formal Systems and the Innovation Dilemma of Cryptocurrency

In the starry sky of cryptocurrency, #Bitcoin is a shining star, and its groundbreaking design continues to profoundly influence the direction of the entire industry today. However, throughout the history of cryptocurrency, we have rarely seen the emergence of innovative products that can truly match #Bitcoin. The reason for this, as mentioned above, may be that the essence of #Bitcoin is not well understood. The unique charm of #Bitcoin is not just a single technological breakthrough, but its clever integration of three types of formal systems to build a complex and adaptive ecosystem.

First, #Bitcoin has established its unique position in the digital world through the decentralization brought about by individual sovereignty. The UTXO (Unspent Transaction Output) model is at the heart of this philosophy. Unlike the account model, UTXOs treat each transaction as an independent, indivisible "coin" whose attribution is entirely controlled by their owner's private key. This design fundamentally gives users absolute control over their assets, eliminates dependence on centralized institutions, and builds a truly decentralized value transfer network. This realization of individual sovereignty is the cornerstone of #Bitcoin's resistance to censorship and openness.

Secondly, #Bitcoin introduces the perceptual reality formed by P/NP asymmetric solution and verification, i.e., the proof-of-work (POW) mechanism. The beauty of POW is that it takes advantage of computational asymmetry: finding a hash that satisfies a specific difficulty requirement (solving, NP problem) requires a lot of computational resources and time, but verifying that the hash value meets the requirements is very quick and easy (validation, P problem). This mechanism not only ensures the immutability of transactions and the security of the blockchain, but more importantly, it converts energy consumption into an objective "proof of work", thus establishing a trustless consensus mechanism in a decentralized network. This way of "perceiving reality", although controversial in terms of energy consumption, anchors the trust of the digital world through the cost of the physical world, and lays the foundation for the value consensus of #Bitcoin.

Finally, the cornerstone of #Bitcoin also includes the transparency of trust code, which is aided by its underlying Blockchain technology. As a distributed ledger technology, blockchain records every transaction openly and transparently, and uses cryptography to ensure the immutability of data. #Bitcoin's code is open source and anyone can review its operating logic, which makes the trust foundation of the system no longer dependent on a centralized authority, but built on open and transparent code and decentralized consensus. This transparency of trust greatly enhances the user's confidence in the system.

On the other hand, later public chain projects such as EOS and Ethereum often focus on the Blockchain technology itself, trying to build a new ecosystem through a more efficient consensus mechanism and more powerful smart contract functions. However, they sacrifice to some extent the individual sovereignty and P/NP perception of reality that #Bitcoin emphasizes. For example, some high-performance public chains may introduce centralized governance mechanisms or consensus algorithms that are more susceptible to human intervention in order to increase transaction throughput, thus weakening their decentralization. In addition, due to the lack of a mechanism like POW to anchor real-world costs, these blockchains face significant challenges in safely and securely "oracleing" interactions with physical assets in the outside world, and it is difficult to form an endogenous value consensus based on energy consumption like #Bitcoin.

Looking at emerging public chains such as #ADA and #SUI, they have innovated on the UTXO model or similar data structures in an attempt to achieve stronger individual sovereignty and scalability at the data level. However, they also fail to effectively address the reality perception of P/NP, leaving a gap between the connection of their systems to the real world. However, a project like Bittensor that attempts to perform linear reality perception through consensus is fundamentally different from the #Bitcoin P/NP-based nonlinear emergence mechanism, and it is difficult to achieve the same security and robustness.

It is precisely because #Bitcoin skillfully combines these three types of formal systems that it produces an "emergent" effect that goes beyond the superposition of simple technologies. The UTXO model guarantees individual sovereignty, the POW model anchors trust through asymmetric computational costs, and the Blockchain technology provides a transparent and trustworthy ledger. These three are interdependent and mutually reinforcing, and together they form the unique security and value foundation of #Bitcoin.

Since the development of the cryptocurrency industry, countless technological innovations and concept iterations have emerged, however, there are very few projects that can truly understand and replicate #Bitcoin such complex adaptive system design from the underlying logic. Most projects tend to focus on the optimization and improvement of one or a few local features of the #Bitcoin, and ignore the systematic innovation of the as a whole. This phenomenon of "seeing the forest for the trees" has led to a long-term stagnation of the industry narrative on the imitation and bifurcation of local #Bitcoin technologies, making it difficult to achieve true innovation from 0 to 1.

Therefore, future cryptocurrency innovation should perhaps return to a deep understanding of the core design concept of #Bitcoin, and re-examine the internal logic and interaction of the three pillars of individual sovereignty, P/NP reality perception, and trust code transparency. Only when we can truly understand the essence of #Bitcoin as a complex adaptive system, and make more systematic and forward-looking innovations on top of it, will it be possible to create a next-generation cryptocurrency that can truly match or even surpass #Bitcoin. This requires not only technological breakthroughs, but also in-depth thinking and exploration of fundamental issues such as currency, trust, and decentralization.

Lux(λ) |光尘|空灵|GEB

#Bitcoin's cryptocurrencies include three broad categories of formal systems

- 1, Decentralization brought about by individual sovereignty. (UTXO model)

- 2, P/NP asymmetric solution and verification of the resulting perceptual reality. (POW model)

- 3, Trust the transparency of the code. (Blockchain technology).

EOS/Ethereum only focuses on Blockchain technology, so it leads to centralized trust in the people behind the rules behind the deployment code, so that the system has its own security vulnerabilities, and the product is hacked because the person deploying the code has no motivation to actively hack or whether they have the ability to write code to defend against hacker attacks. Furthermore, both of these have lost the perceived reality module of P/NP, and the physical objects of the external world cannot be safely Orcacl from the consensus level to the blockchain, and the blockchain cannot understand reality.

There are a series of public chain projects behind it, which more or less have implemented one of the three major categories of technologies of #Bitcoin.

For example, #ADA and #SUI use the derived UTXO data structure respectively, and the Object structure realizes the decentralization brought by individual sovereignty. However, the reality perception of P/NP is not considered at all, so the system still cannot achieve mutual perception and landing with reality.

For example, bittensor is doing linear perception of reality through consensus, but it does not use P/NP nonlinear technology to perceive reality, and it cannot achieve emergent results.

Why hasn't the cryptocurrency industry made anything like #Bitcoin for so long in #Bitcoin?

Here's why: no one understands #Bitcoin.

Each project can achieve a lot of results after learning only one and a half tricks of #Bitcoin.

And the narrative that we really want to do should go back to the complex adaptive technology that #Bitcoin has emerged by combining three types of formal systems. That's how we can make a cryptocurrency that is comparable to #Bitcoin.

This is the industry's real 0-to-1 innovation. Rather than letting the entire industry narrative stagnate on the local technology of various fork #Bitcoin.

24.25K

2

Crypto子棋

As long as ETH is not stable, all copycat rebounds are just a flash in the pan, so don't worry, the general direction is to look for BTC, and if you want to make money, then look for ETH.

ETH must still have a big wave, whether you believe it or not, even if garbage such as EOS, the peak of the big bull market can still be hard once, not to mention that ETH has passed the spot ETF, dry!

Show original36.21K

56

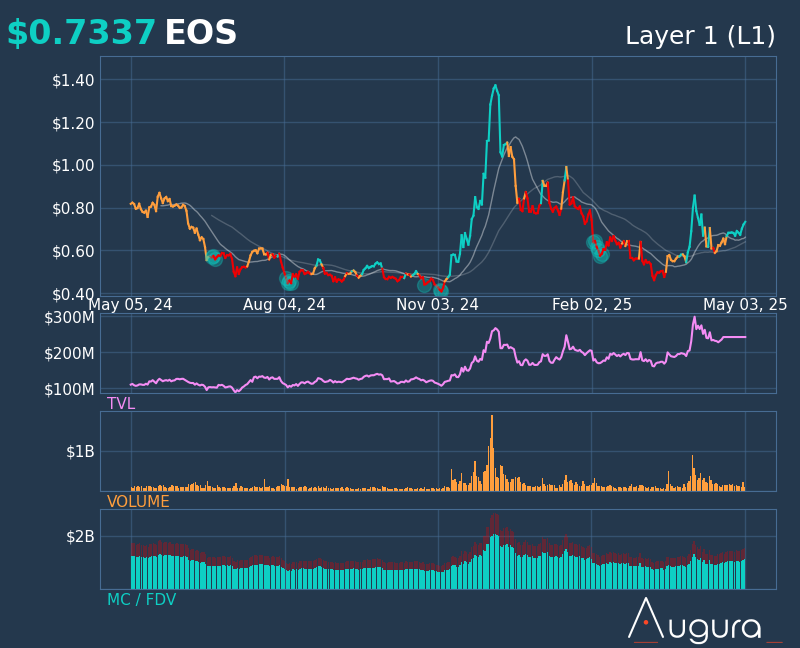

EOS price performance in USD

The current price of EOS is $0.70350. Over the last 24 hours, EOS has decreased by -0.03%. It currently has a circulating supply of 1,516,885,789 EOS and a maximum supply of 2,100,000,000 EOS, giving it a fully diluted market cap of $1.07B. At present, the EOS coin holds the 47 position in market cap rankings. The EOS/USD price is updated in real-time.

Today

-$0.00020

-0.03%

7 days

+$0.024200

+3.56%

30 days

-$0.02490

-3.42%

3 months

+$0.12650

+21.92%

Popular EOS conversions

Last updated: 07/05/2025, 09:29

| 1 EOS to USD | $0.70310 |

| 1 EOS to AUD | $1.0810 |

| 1 EOS to PHP | ₱38.9616 |

| 1 EOS to EUR | €0.62001 |

| 1 EOS to IDR | Rp 11,558.44 |

| 1 EOS to GBP | £0.52657 |

| 1 EOS to CAD | $0.96831 |

| 1 EOS to AED | AED 2.5825 |

About EOS (EOS)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

EOS FAQ

How much is 1 EOS worth today?

Currently, one EOS is worth $0.70350. For answers and insight into EOS's price action, you're in the right place. Explore the latest EOS charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as EOS, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as EOS have been created as well.

Will the price of EOS go up today?

Check out our EOS price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials