A new pre-deposit vault has gone live on @katana ⚔️

@EtherFi have released a new vault managed by @SentoraHQ + @MorphoLabs which offers:

A 5bps share of $KAT

A share of 125k $ETHFI rewards

Plus the competitive 5% $ETH staking rewards if you're holding weETH (wrapped Etherfi ETH)

What you need to know: 👇

✅No lockups, fully withdrawable anytime (but you forfeit rewards)

✅$KAT + $ETHFI rewards

✅Rewards start on deposit

✅You can deposit weETH or WETH into the new vault

✅Vault deposits must be held for 30 days post Katana mainnet launch to qualify for rewards

The deposit cap is $50M but it's not even close to that yet, so you're still early.

If you're holding @EtherFi staked ETH (eETH) and you want to earn some extra yield, check out their vault here:

@Muh__Toyeeb @katana @EtherFi @SentoraHQ @MorphoLabs Absolutely sir, enjoy:

Katana is here⚔️

Finally, the official announcement for @katana has dropped. Read on for Pre-deposit airdrop opportunities 🪂

What's Katana?

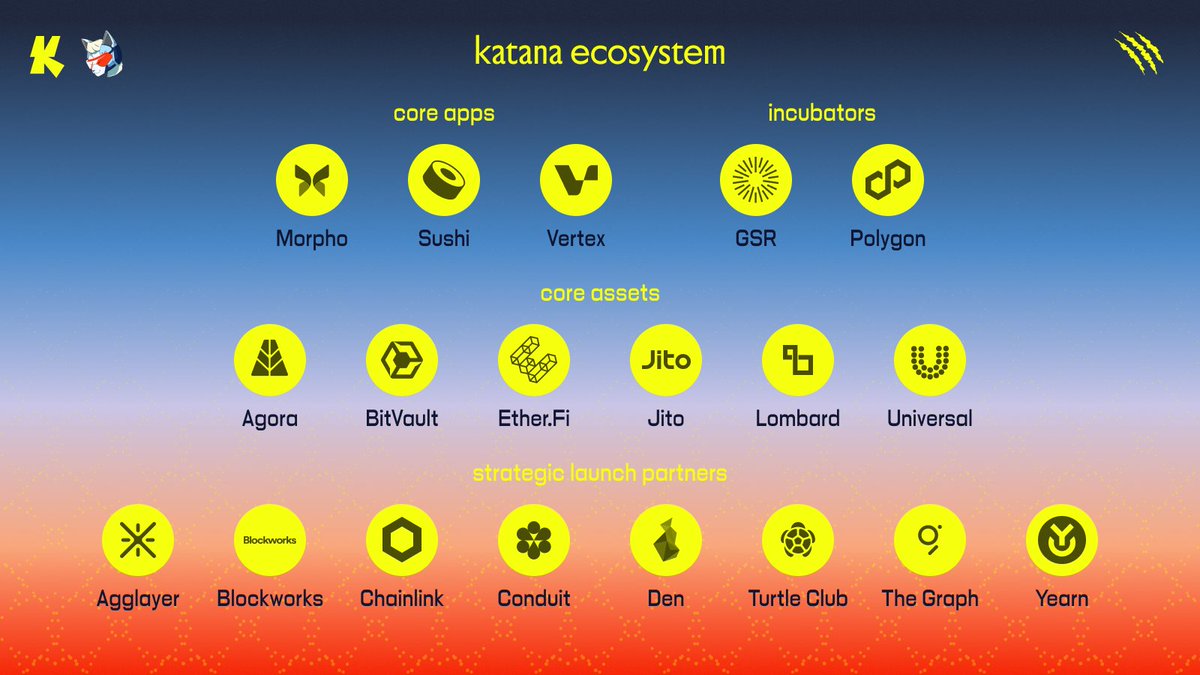

Katana is an L2 backed by @0xPolygon and @GSR_io that focuses exclusively on DeFi.

I know 'not another L2' - well no, actually, this is completely different. Katana isn't a multi-purpose generic L2, it's a bold and experimental new approach to what I'm calling:

'sector specific L2's'

What does that mean? Well on all other L2's you can do basically anything, it's a jack of all trades, master of none approach and within DeFi this leads to fragmented liquidity and non-productive TVL.

Unlike other L2's, Katana focuses on something called 'core apps' which means only the core apps will receive yield from vaultbridge.

Core apps are:

Lending protocol @MorphoLabs

Spot DEX @SushiSwap

Perp DEX @vertex_protocol

This unique and DeFi centric approach concentrates liquidity and creates productive TVL for greater yields.

It also massively simplifies the UX. No more loading up a DEX to find they don't have enough liquidity for that pairing and moving onto the next one. 🥳

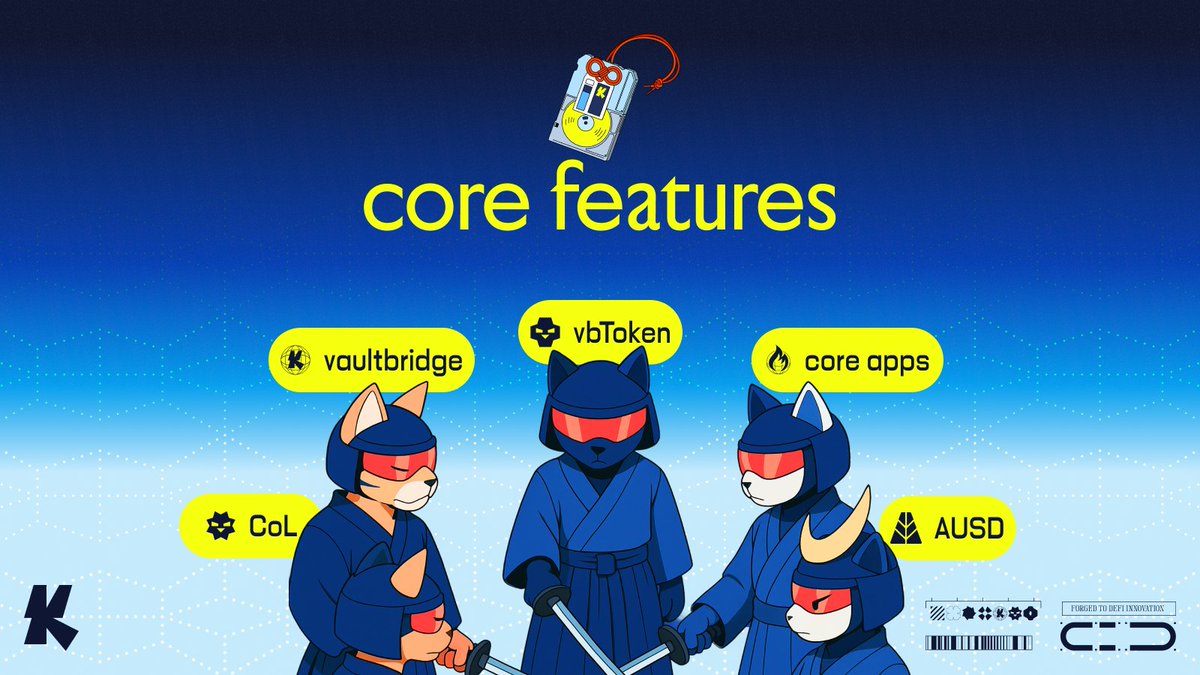

There are 3 core features that make Katana work:

1) Vaultbridge - bridged assets earn yield on Ethereum and rewards flow back to @katana ecosystem for boosted yield in DeFi.

2) Core app - user activity creates revenue that cycles back into the ecosystem to form deep concentrated liquidity.

3) Chain-owned liquidity (CoL) - sequencer fees and a portion of app revenue are deployed to create a base layer of liquidity.

I'm going to do deep-dives on these in the future but the general idea is: more rewards = deeper liquidity = more activity = more rewards etc. Katana is basically one massive flywheel effect.

OK, sounds good, I'm in, but how do I get exposure to this?

You can earn $KAT the @katana native token right now as pre-deposits are now live.

Just deposit ETH, USDC, USDT or wBTC to earn Krates.

Krates are mystery containers which contain up to 10M $KAT, a cryptopunk, $AUSD, $SUSHI & $MORPH tokens.

I deposited $12.3k worth of $ETH earlier today and earned 1,006 $KAT tokens. The more $ you deposit the more krates you earn and the higher your chances for rarer rewards.

Any $KAT rewards will be locked for 9 months and pre-deposits will be available late June.

Pre-deposit with shameless ref-link shill:

Good luck with those krates!

@0xAsta @katana @EtherFi @SentoraHQ @MorphoLabs @turtleclubhouse @MitosisOrg Oh wait you mean matrix vault?>

31

4K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.