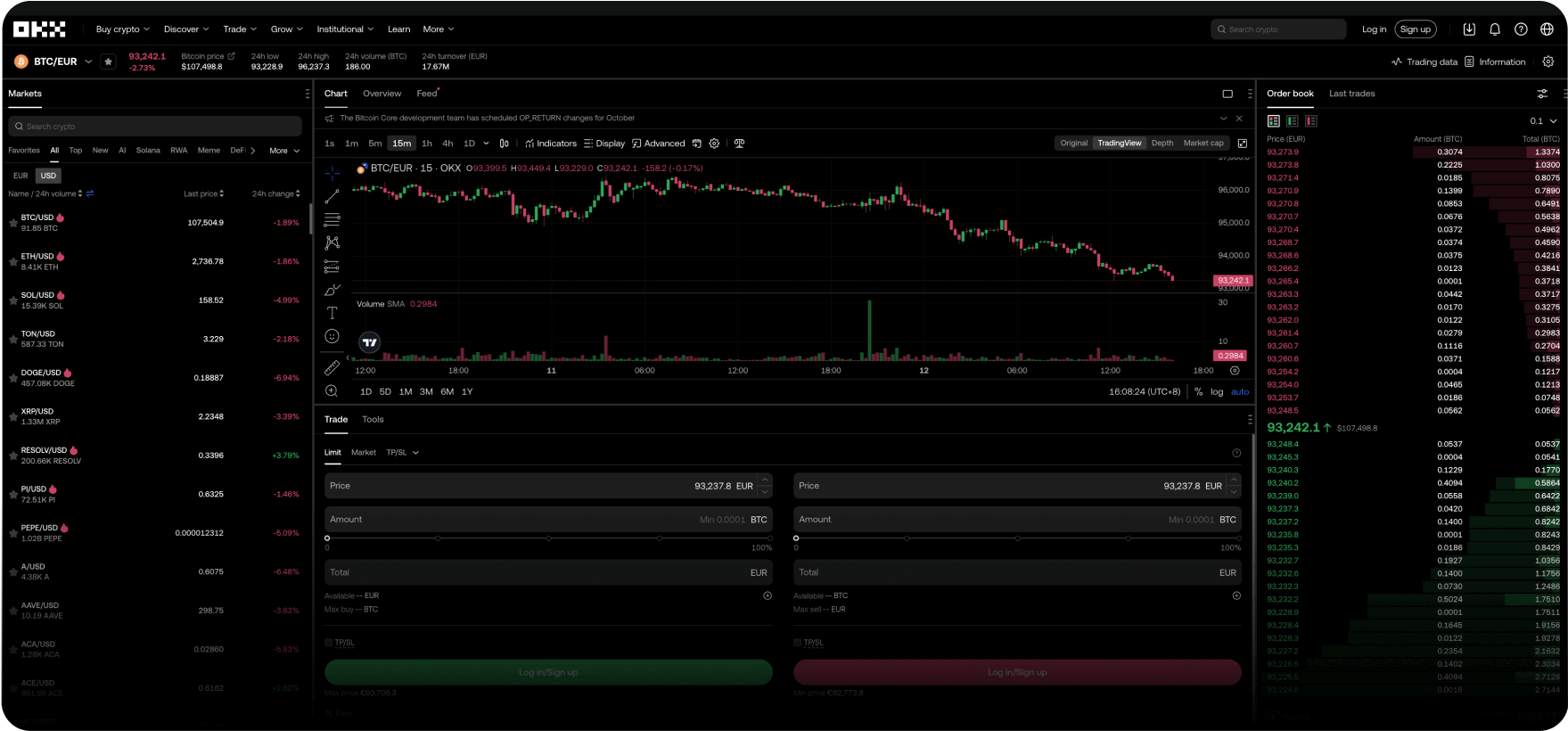

Handla som ett proffs

Få våra lägsta avgifter, snabba transaktionerna, kraftfulla API:er och mer.

Vi är med dig under varje steg på vägen

Vi kommer att guida dig genom processen från att göra din första kryptohandel till att bli en erfaren handlare. Ingen fråga är för liten. Inga sömnlösa nätter. Ha förtroende för din krypto.

Tränaren Pep Guardiola

Förklarar "galna fotbollsformationer"

Transformera systemet

Välkommen till Web3

Snowboardåkaren Scotty James

Tar med sig hela familjen

Frågor? Vi har svar.

Vilka produkter tillhandahåller OKX?

Hur köper jag Bitcoin och andra kryptovalutor på OKX?

Var är OKX baserat?

Kan EU-medborgare använda OKX?