📽 It’s time for another weekly crypto roundup!

Matt Zahab and Rachel Wolfson are back with Episode 72, breaking down the latest crypto headlines.

Don’t miss out — tune in now!👇

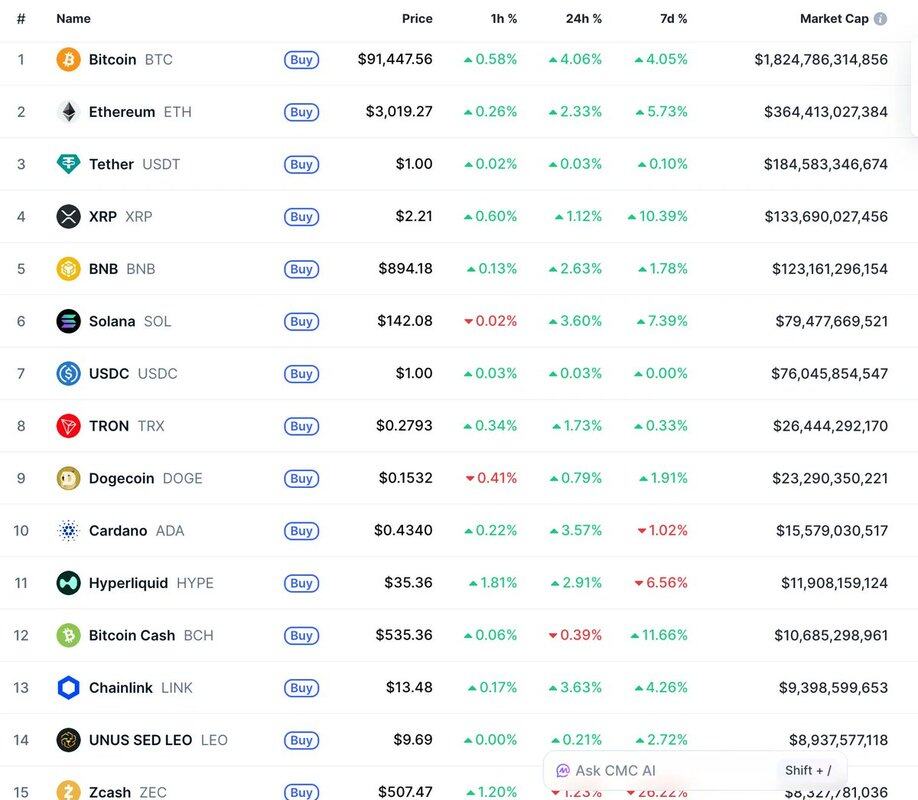

📌 Price Action

📌 Vitalik Buterin Warns X’s Location Feature Creates ‘Easy to Fake’ Security Risk

Ethereum co-founder Vitalik Buterin has raised serious concerns about X’s newly launched location-tagging feature, warning that sophisticated actors will easily circumvent the system while legitimate users face privacy risks.

The feature, which displays the country or region where accounts are based, rolled out globally on November 22 through the platform’s “About This Account” section, accessible by tapping the signup date on user profiles.

Buterin’s critique centers on the feature’s vulnerability to manipulation, predicting that within six months, foreign political troll accounts will successfully spoof their locations to appear as though they operate from the United States or the United Kingdom.

📌 Grayscale Targets First U.S. Zcash ETF as Privacy Coin Explodes 1,000%

Grayscale Investments has moved to capitalize on one of the most explosive crypto rallies of the year, filing to convert its long-running Zcash Trust into a U.S.-listed exchange-traded fund.

The Wednesday submission to the Securities and Exchange Commission marks the firm’s latest attempt to expand its ETF lineup into the fast-moving privacy-coin sector at a time when Zcash has surged nearly 1,000% over the past year.

If approved, the product would become the first U.S. ETF to offer regulated exposure to Zcash, a cryptocurrency built around zero-knowledge proofs that allow users to conceal transaction details.

📌 Cathie Wood Loads Up $93M More in Crypto Stocks — Circle, Coinbase, Block and Bullish

The timing of these purchases challenges the narrative of panic in the market, suggesting a deeper conviction in crypto-equity fundamentals.

Cathie Wood’s ARK Invest pushed deeper into the crypto sector this week, adding another wave of purchases across several beaten-down digital-asset-linked stocks as the broader market continued to slide.

The investment firm spent more than $93 million on Tuesday alone, extending a month-long pattern of buying into weakness as crypto equities struggle to recover from sharp November losses.

📌 Robinhood, Susquehanna Strike Deal to Acquire LedgerX For Prediction Market Expansion

Robinhood Markets and Susquehanna Group have agreed to buy 90% of regulated exchange LedgerX from Miami International Holdings, in a deal that pushes the US retail trading giant deeper into event-driven crypto markets as interest in prediction platforms accelerates.

The partners plan to run LedgerX as an independent exchange through a new joint venture, with Robinhood as the controlling partner.

Miami International Holdings will keep a strategic 10% stake. Financial terms of the deal remain undisclosed.

📌 Trump Eyes Kevin Hassett For Fed Chair, A Candidate With Notable Links to Crypto

Kevin Hassett has reportedly moved to the front of the pack in President Donald Trump’s search for the next Federal Reserve chair, putting a longtime ally with deep crypto ties within reach of the top job in global monetary policy.

Bloomberg reported Tuesday that the White House National Economic Council director now ranks as the leading candidate as Trump enters the final stretch of his Fed search.

Trump’s advisers and allies reportedly describe Hassett as someone the president knows well, trusts on rate policy and believes would lean more quickly toward cutting interest rates than the current chair, Jerome Powell.

📌 Klarna Moves Into Stablecoins via Stripe-Backed Tempo Blockchain in Sweden

Swedish fintech giant Klarna is entering the stablecoin market, marking one of its biggest strategic shifts since going public.

The company said on Tuesday that it will launch a U.S. dollar-backed token called KlarnaUSD, positioning the move as a step toward faster and cheaper global payments at a time when the stablecoin sector is expanding under growing regulatory scrutiny.

📌 Co-Founder Denies $436M Cash-Out Claims, Cites Internal Transfers

’s co-founder denied claims of a $436M cash-out, saying the USDC transfers were routine treasury movements. On-chain data shows still holds over $855M in stablecoins and $211M in SOL. Analysts and community members remain divided.

5,457

3

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。