Everyone’s quoting the “$26.6M in 2025” line, but the fun part here is how @arbitrum is starting to look like an actual economic engine, not just “big DAO, big bag.”

Messari’s “Arbitrum Everywhere: Beyond the Limits” breaks it down: roughly $20.5M of 2025 revenue (~92.5%) still comes from core execution (Arbitrum One + Orbit fees), with Timeboost already ~$4.5M, ~20.5% of this year’s revenue after launching in April. That’s sequencer/MEV flow being captured for the DAO instead of leaking to random bots.

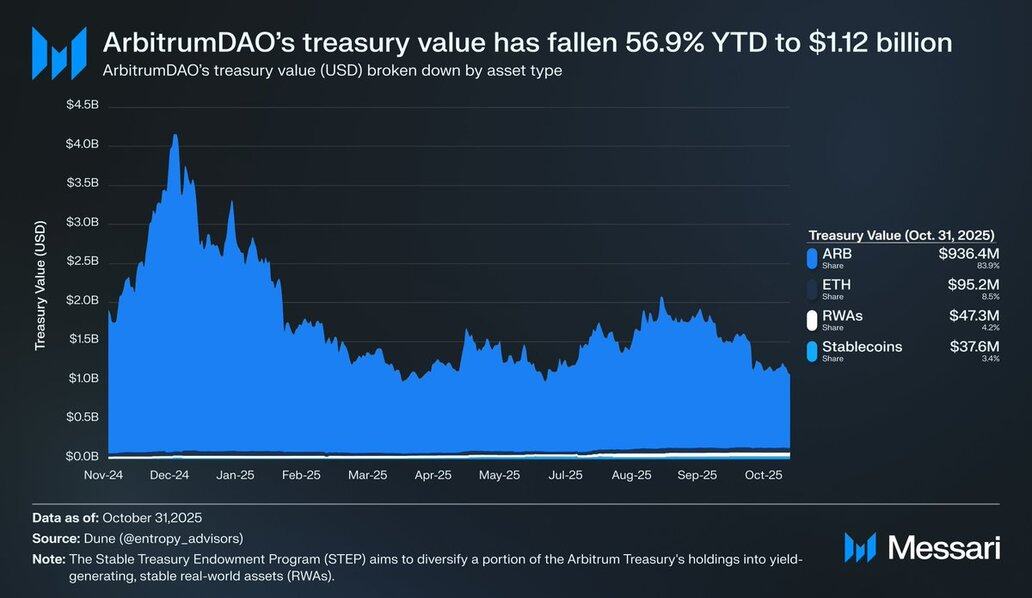

At the same time, the same report shows the treasury down ~56.9% YTD to ~$1.12B, still 83.9% ARB, 8.5% ETH, 4.2% RWAs, 3.4% stables so you’ve got a cash-flowing L2 whose balance sheet is still very reflexive and mostly long its own token.

What I like in this “Digital Sovereign Nation” framing is that revenue isn’t just piling up passively it’s being cycled into programs like DRIP, STEP, AGV to spin up new “economic zones” in perps, money markets, and RWAs instead of just bribing TVL.

The way I’m sanity-checking this:

❯ track protocol revenue vs. ARB emissions over the next 12–18 months

❯ watch how much of the treasury shifts from ARB into yield-bearing RWAs + ETH strategies

❯ see if DRIP-style programs actually move fees, not just dashboards

On the “Digital Sovereign Nation” claim: still early, but a DAO with real, growing cash flow, a billion-dollar treasury and a live playbook for reinvesting into its own economy is at least playing a different game than most L2s. I’m watching how fast non-ARB income and RWA yield share grow from here

4,306

113

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。