Curvance x Agora x Upshift: Stable Yield, Elevated

Curvance is partnering with @withAUSD (Agora) and @upshift_fi to bring two powerful stable-yield markets, sAUSD and earnAUSD, to Monad.

Over $90,000 in weekly rewards are live across both markets, plus 4x Upshift Points, Curvance Bytes, and Milestone Rewards for active participants.

Together, we’re introducing sustainable, real-yield opportunities for users to earn, loop, and grow directly within the Curvance ecosystem.

2/ sAUSD / AUSD: Real-World Yield, On-Chain Flexibility

sAUSD represents the savings version of AUSD, earning yield from short-term U.S. Treasury Bills.

Currently, with a market deposit APY of up to 43%. Supply or loop sAUSD in Curvance to stack passive T-Bill returns with Curvance incentives, including $MON, combining real-world yield with full on-chain composability.

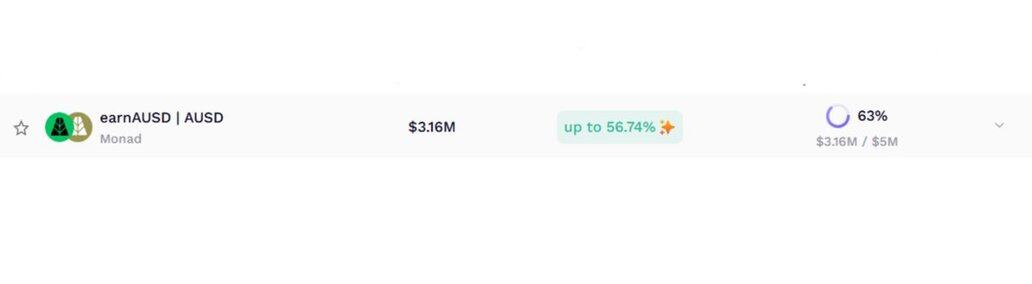

3/ earnAUSD / AUSD: Vault-Backed DeFi Yield (in collaboration with @upshift_fi)

earnAUSD initially channels yield from T-Bills and lending strategies, with additional mechanisms such as basis trading set to be introduced later.

With the market currently offering up to 62% APR, earnAUSD offers one of Monad’s most competitive stable-yield opportunities.

By supplying or looping earnAUSD on Curvance, users can compound Upshift’s vault yield with Curvance’s lending incentives, including $MON and $AUSD, for amplified returns.

4/ Loop, Earn, Repeat 🔁

Curvance’s one-click looping lets users compound stable yield with ease, leveraging up to 20x on sAUSD and up to 7.5x on earnAUSD.

Supply, borrow, and re-supply to scale your exposure — building a self-reinforcing flywheel of stable yield, rewards, and capital efficiency.

5,250

51

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。