pi不需要擔心價格跌不下去,只要有任何上漲的機會,借幣鯨魚就會幫你賣掉你的pi來壓低價格。

You don’t need to worry about Pi’s price not dropping. As long as there’s any chance of a price increase, borrowing whales will sell your Pi to suppress the price.

Everyone is happily providing loans to whales to suppress Pi. Helping whales make money is something most investors are delighted about.

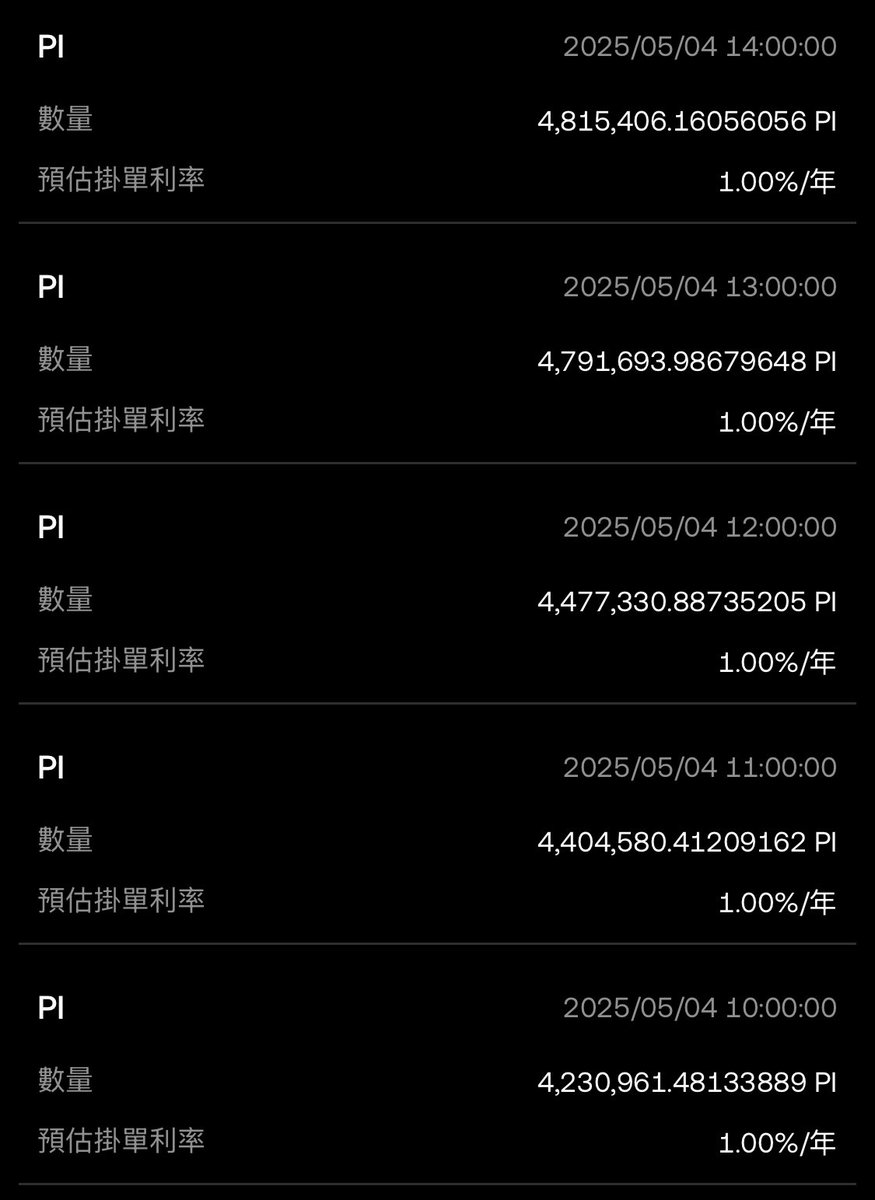

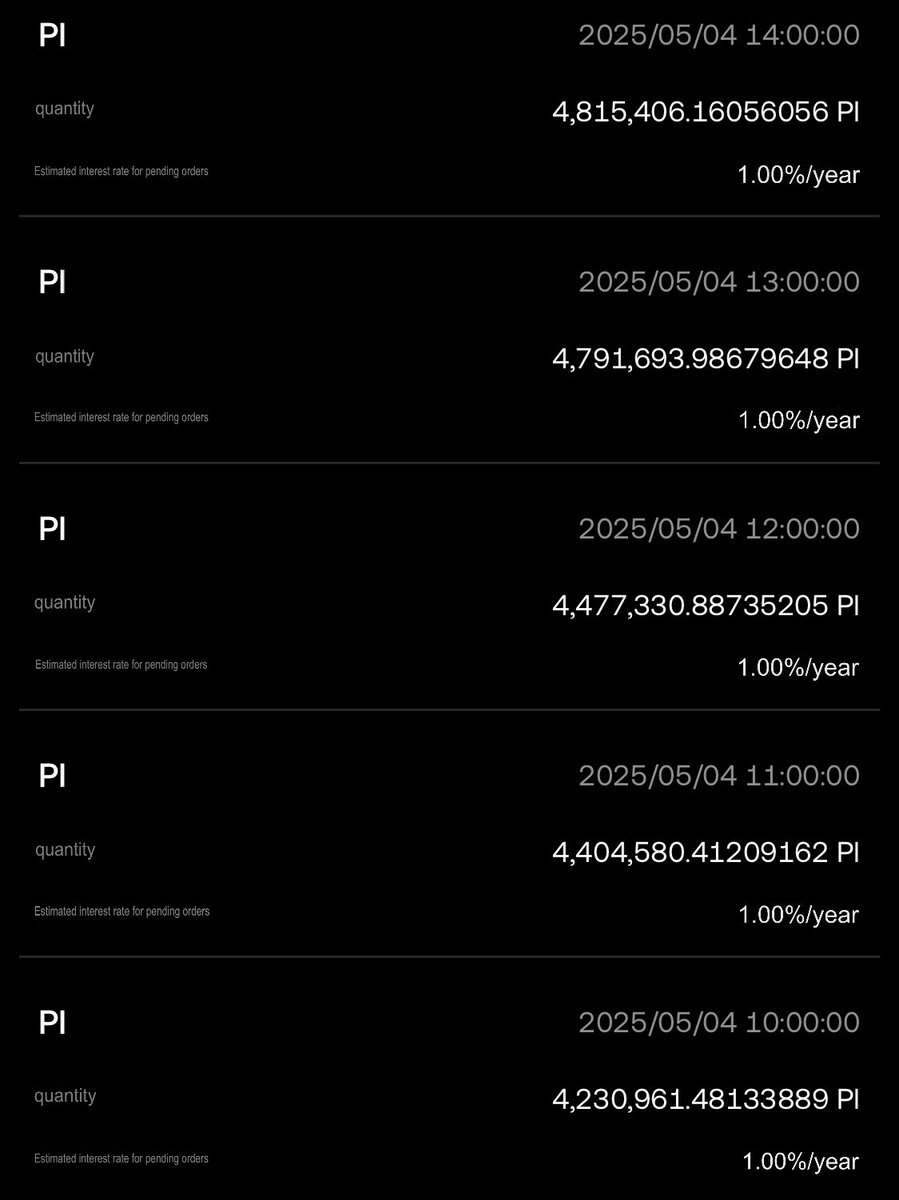

Look at how, when large buy orders appear at 4 a.m., borrowing whales borrow massive amounts of coins to sell on behalf of investors. If borrowing one million isn’t enough to suppress the price, they borrow two million. There’s no need to worry about pumping the price because they can borrow large amounts of spot coins to sell without needing to buy. In the end, the borrowing whales borrowed 3.3 million Pi to suppress the price.

It seems investors’ hearts are bleeding, but they’re bleeding happily, right? Being able to provide for borrowing whales to suppress the price is an honorable thing. You all agree, don’t you? Everyone is willing to help the borrowing whales without any complaints.

大家都在快樂的提供pi給鯨魚來打壓pi。幫助鯨魚賺錢是一件大多投資人都快樂的事情。

看看凌晨四點出現大量買盤時,借幣鯨魚大量借幣來代替投資人拋售。借一百萬不夠打壓,就借二百萬,完全不用擔心拉價格,因為不需要買幣就能借來大量現貨拋售。最終借幣鯨魚借了330萬顆pi打壓價格。

看起來投資人心在淌血都淌的非常開心呢,自己能夠提供給借幣鯨魚打壓,是一件光榮的事情,你們說對吧?大家都很樂意幫助借幣鯨魚,一點怨言都沒有。

#PI

#pi

借貸pi的鯨魚正在從借貸池一次借百萬顆pi來代替你拋售。

Thank you to GCV for taking this issue seriously and actively promoting it.

Do not stake Pi on exchanges or use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

感謝GCV也重視這個問題來大力宣傳。

不要在交易所質押pi,也不要使用餘幣寶,因為鯨魚正在從借貸池一次借百萬顆pi來代替你拋售。

你看好pi而投資pi是希望價格上漲來獲得收益。然而,你質押的越多,就讓鯨魚幫你把價格壓的越低。

大多人認為的投資長期,是期望生態長期消耗商家成本來替你扛著價格。商家是無法抵抗長期價格虧損,最終會全面退出,生態會崩潰。

如同現在pi價格低於電費,那麼,礦工根本不需要繳費給發電廠1元才獲得0.5元的pi。

聰明人都知道直接購買pi可以獲得1pi,為什麼要自己減半。因此礦工也會崩潰,最終生態會死亡。

對抗鯨魚的方法:

1.不要在交易所質押pi。不要使用餘幣寶質押pi。

2.清空交易所的借幣池。1%apy的低收益轉為選擇34%挖礦增速。

3.每當從數據上看見鯨魚借貸pi並且拋售而產生價格下衝時,這是低價買進的機會。讓我們共識低價購買,拉起價格,讓鯨魚虧錢。

#pi

1.75萬

8

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。