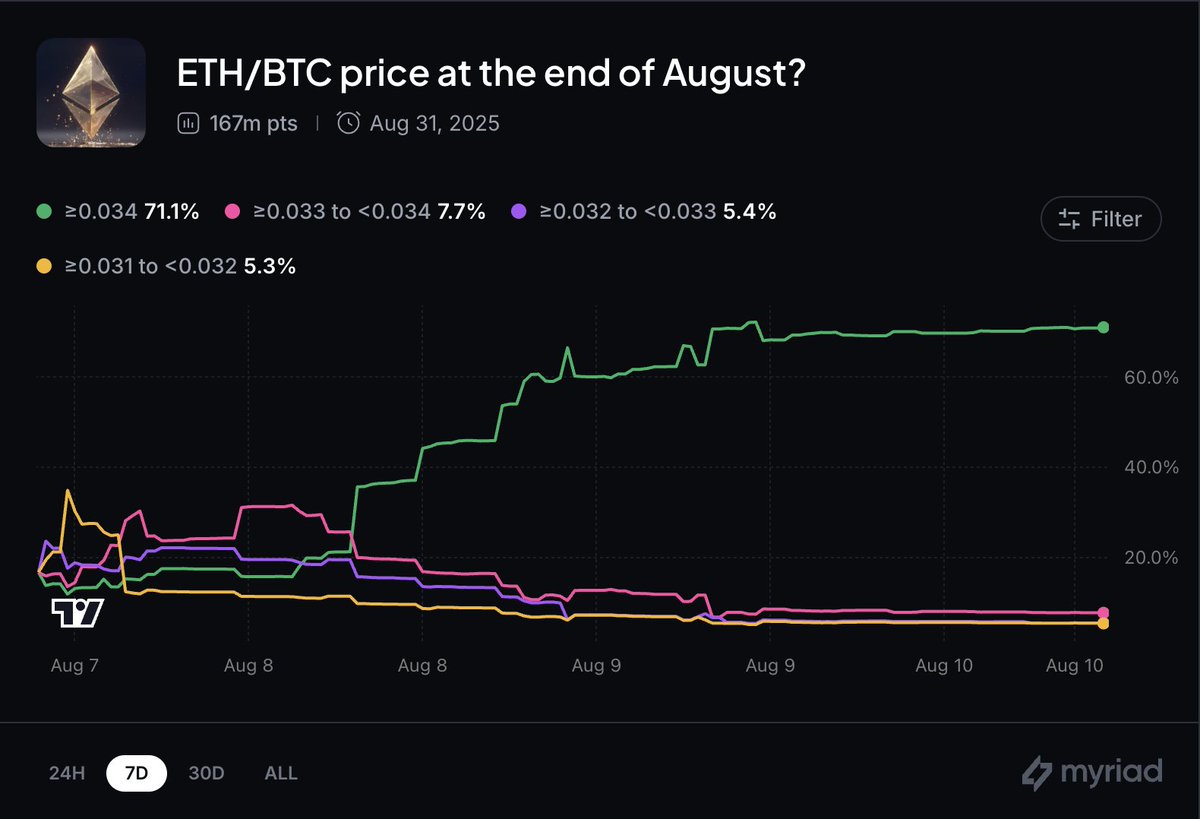

預測市場前景

根據 @MyriadMarkets,到 8 月 31 日,ETH/BTC 價格將> 0.034,71% 的可能性

我喜歡這些賠率;下注

The most hated rally

ETH trades near $4,200, but the more important chart isn’t in USD. It’s ETH/BTC.

Since May lows, the ratio has climbed. Each ETH now buys more BTC. When ETH outperforms, it’s not just a mood swing. It’s a structural shift:

→ Capital rotates from Bitcoin’s store-of-value layer into Ethereum’s execution layer

→ Liquidity starts chasing yield, composability, and settlement demand; not just scarcity

→ Onchain activity compounds as staking rewards, L2 growth, and DeFi usage reinforce the flow

ETH/BTC strength often marks phases where block space becomes the scarce asset, not BTC itself. It’s the market paying for throughput over inertia.

The irony? These rotations start quietly. By the time they’re obvious, the structural repricing is already well underway.

4,259

58

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。