EtherFi 的信用卡業務做得越來越好(真的好用)

推薦連結 :

他正穩步轉型為一家加密原生的新型數位銀行

- TVL 80億美金

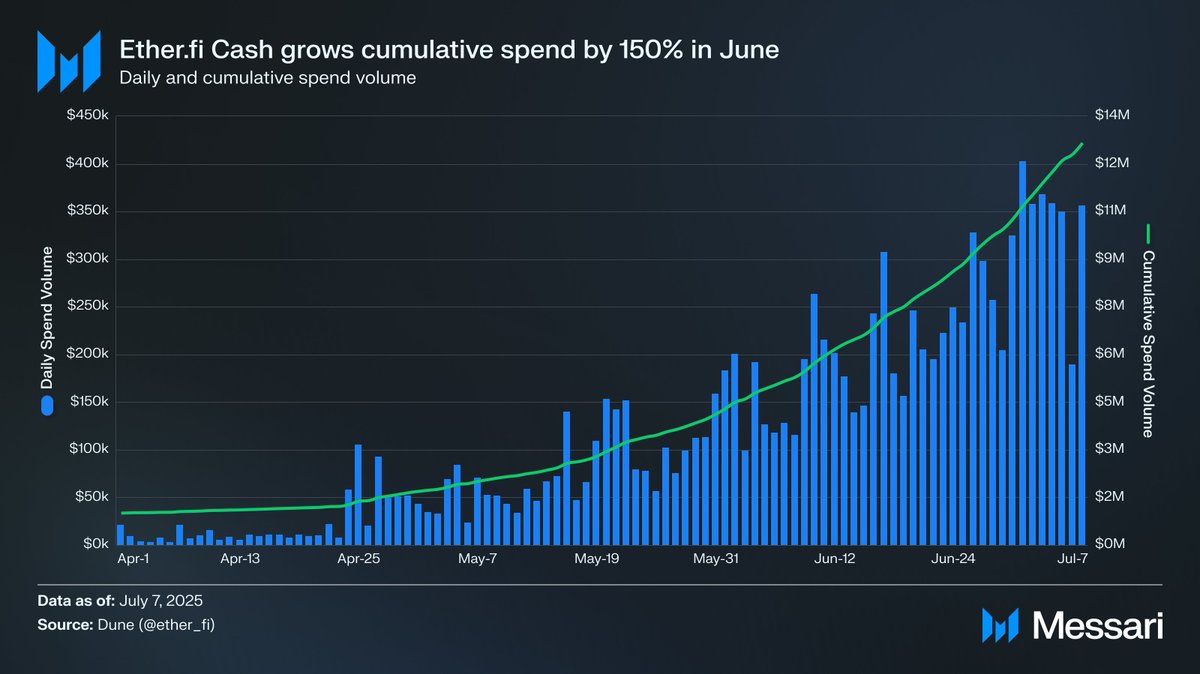

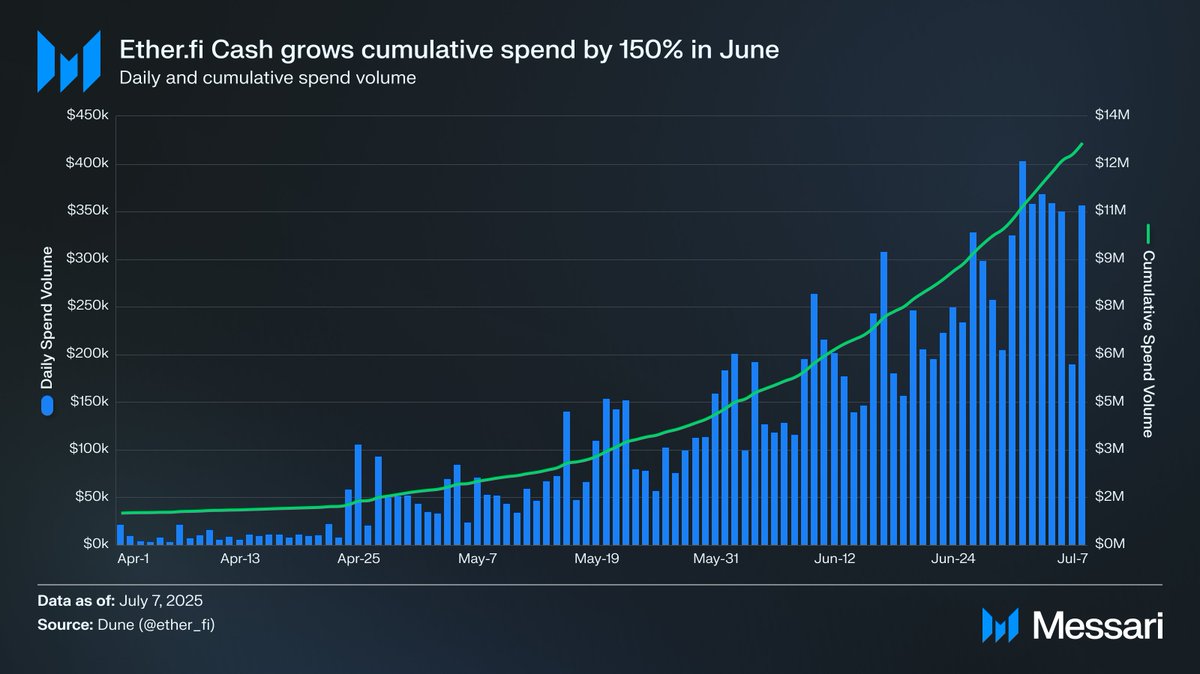

- 信用卡使用者總消費額達到 1500萬美金

- 6月份就佔全部消費額的40%

- 超過 3400位持卡人

🎯持卡人數比我想像中的少, 但可以想見未來會急速成長

@MessariCrypto 最近也寫了一篇關於Etherfi的文章

Etherfi閒置資金 9.2% APY 收益是最大賣點

其來源為固定利率與浮動利率策略的組合

對比其他信用卡對手通常都是 3%~5% APY 收益

整整贏將近一倍 !錢根本就放在裡面生息就好, 不用拿出來

📈 Etherfi協議收入近30天是 $16.5m , 全部協議裡的第16名 , 贏過Phantom和Ethena

如ETH 繼續上漲, 或是web2公司將ETH納入資產負債表, re-staking 的Etherfi 我相信也會表現得很亮眼的

🤷🏻♂️ 不過比較擔心的是 目前3%+1.5%刷卡現金回饋, 其中3%是SCROLL補貼, 不知道還能維持多久 !?

推薦連結 :

To most market participants, @ether_fi is known as the restaking market leader. With over 2.5 million ETH (~$7.7 billion) in deposits, it currently captures roughly 70% of the sector’s market share.

However, is steadily evolving into a crypto native neobank with a multifaceted suite of vertically integrated products and services (potential HL perps integration loading…).

The most recent addition to their product offering is Cash, a non-custodial cashback credit card that allows individuals and businesses to spend and borrow against their assets, including those deposited in vaults earning yield.

In June, Cash product maintained the strong adoption trajectory it has seen since its public launch in late April. Since launching, the product has driven $14.85 million in total spending across more than 3,400 active cardholders, with June alone accounting for approximately 40% of this cumulative spend and the issuance of 1,741 new cards.

While the Cash product is not yet a major revenue driver, the team is laser-focused on scaling this offering. As a base case, the team aims to grow active cardholders to 40,000 in 2025. This would add an estimated $13 million to the $54 million in revenue currently projected from the Liquid and Stake products alone ($90k BTC, 2k ETH assumption).

Achieving their base case target would require sustaining June’s 170% MoM growth rate in card issuance through the rest of the year. However, since their initial article published in April outlining their goals, the team has stated that internal targets have shifted closer to the initial bull case of 100,000 cardholders, which would require an even more aggressive growth rate of roughly 205% MoM.

This is a tall order, but not impossible. To date, retail growth has been fueled primarily by word of mouth and referrals. The team believes that increasing capital investment in growth initiatives could accelerate progress toward this goal. Additionally, over 400 businesses have initiated the onboarding process for Cash, representing a potential 550% increase compared to the current number of onboarded businesses (figure as of July 7).

While initial Cash growth has been impressive, expansion comes with challenges. First is the mounting competition from major industry players such as Coinbase, Revolut, and Robinhood.

GTM for the rest of 2025 focuses primarily on retail and corporate DeFi users before expanding to CeFi users and the broader neobank market in 2026. In these future target markets, incumbents hold a major distribution advantage, with tens of millions of retail users to whom they can cross-sell card products.

However, offering is highly competitive as its Liquid and Stake products strengthen the appeal of Cash. For example, Robinhood Gold’s 4.5% APY on uninvested cash pales in comparison to current 9.6% APY in its market-neutral USD Liquid vault, which generates yield through a mix of fixed and variable rate strategies. Capital in vaults can be borrowed against for credit in Cash, making onboarding attractive and cross-selling significantly easier. While Robinhood and other incumbents are increasingly venturing onchain, ability to offer structured DeFi yields is, at least for now, a distinct advantage.

Another challenge is the sustainability of 3% cashback offer. Currently, this cashback is fully subsidized by Scroll, which funds it using its SCR token. This partnership has been a boon to Scroll’s growth, with Cash funds now accounting for over 50% of Scroll’s TVL. However, as daily transaction volume scales into the millions, relying solely on external subsidies will become untenable. Covering 2-3% cashback directly would erase the 100–200 basis points earns on interchange fees, which make up ~90% of Cash’s revenue. TBD on exactly how the team plans to handle this, but my guess would be lowering cashback and supplementing it with other revenue streams as gross margins expand.

Despite these challenges, product suite is structurally compelling, with each offering designed to drive demand for the others through tight vertical integration. Combined with multiple tailwinds (TradFi firms adding ETH to balance sheets, rising stablecoin adoption, record ETH ETF inflows), the setup looks promising for accelerated growth over the coming months.

For more monthly insights from @0xTulipKing , @AvgJoesCrypto , @SteimetzKinji and @defi_monk check out the report linked below.

1.03萬

19

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。