當你退後一步時,速度很重要會感覺很明顯。

費用是在採取行動時產生的。

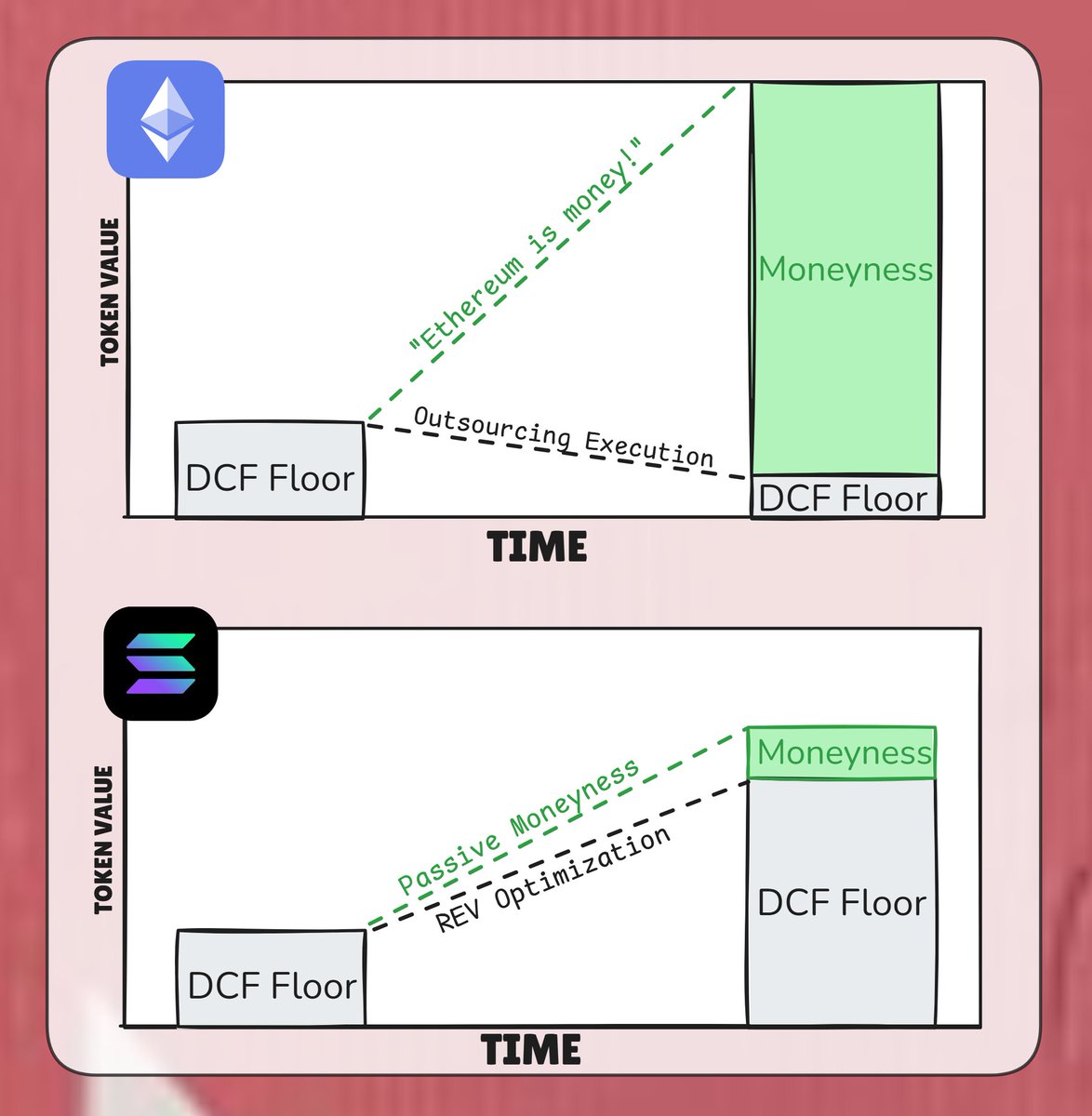

乙太坊社區不想專注於 rev/fees,因為 DCF 看跌 ~3000 億美元,但不管你喜歡與否,投資者都需要它來增強信心。

全押「貨幣」基本上只是擴大了原生資產的結果範圍。

沒有更好的執行力的$ETH要麼價值無限,要麼一文不值。

When compared to Solana, Ethereum has:

1. Superior decentralization & lindy

2. More developers

3. Greater economic security

4. More assets secured onchain

5. More stablecoin supply

6. More value locked in DeFi

7. More RWAs onchain

8. A more mature DeFi ecosystem

9. A growing network of L2s

10. A larger economy "on top" of the L1

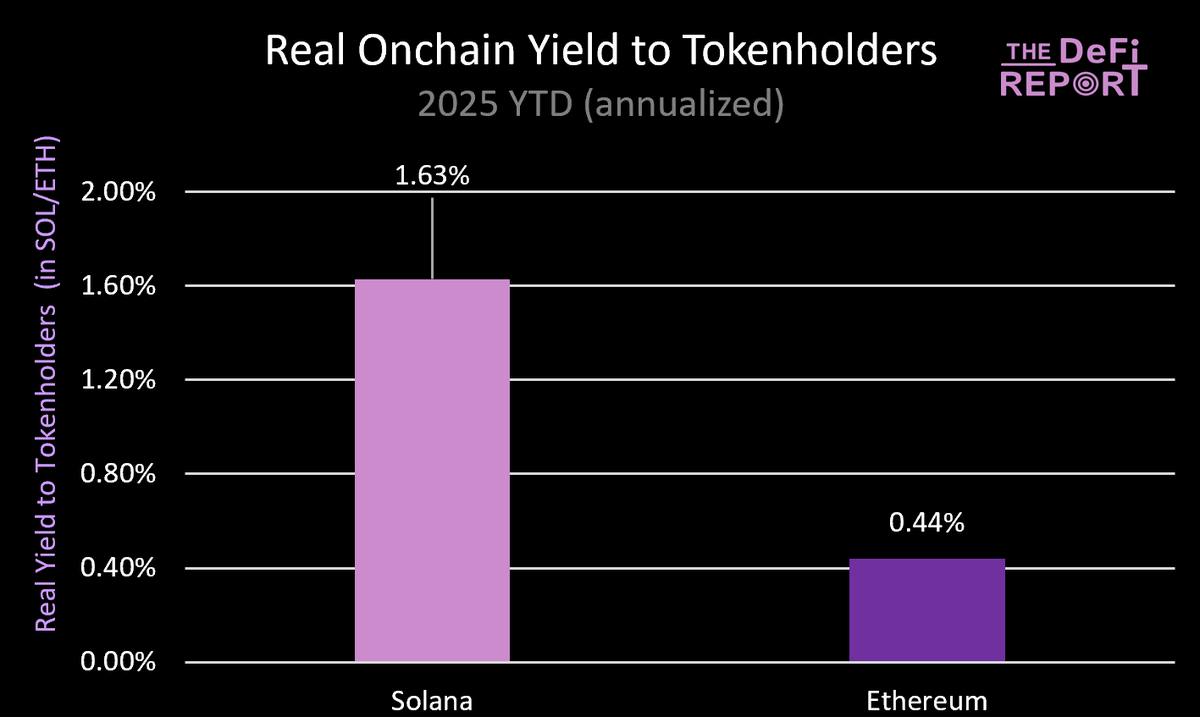

Yet, Solana is paying more *real value* to its tokenholders.

How can that be the case?

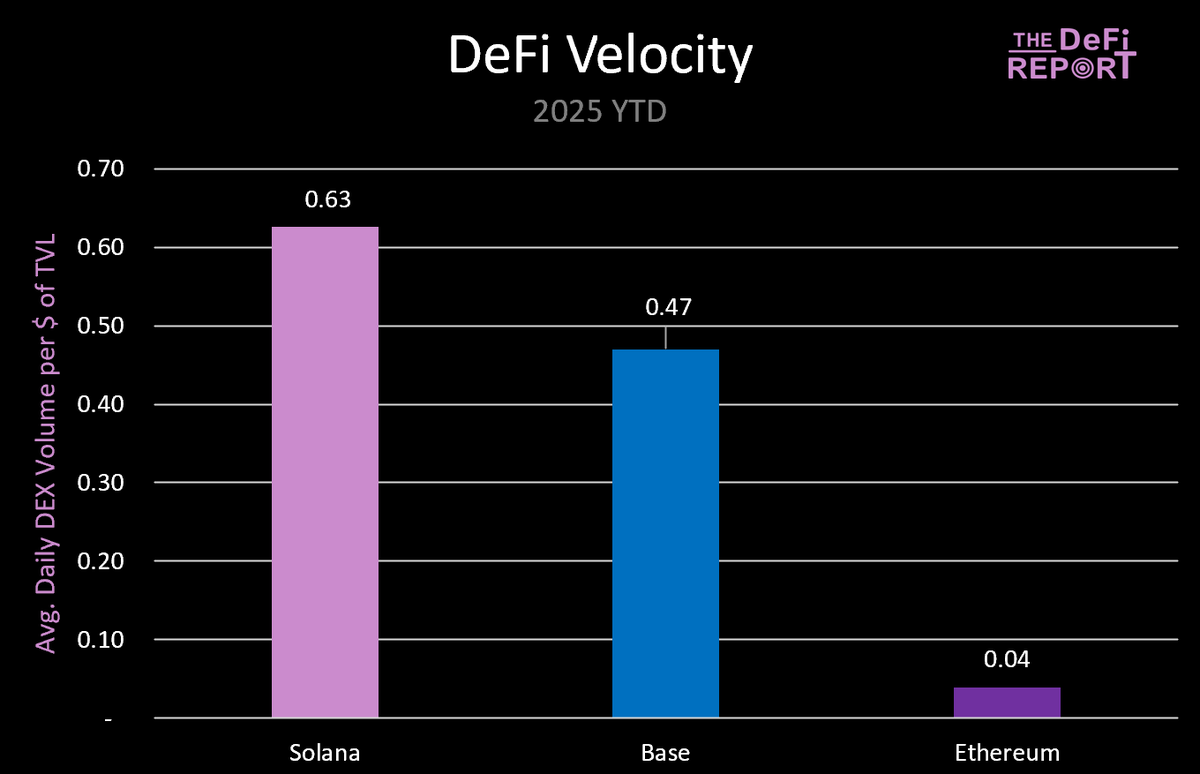

It all comes down to velocity.

Solana is turning over each dollar of TVL in DeFi at a 15.7x greater clip than Ethereum.

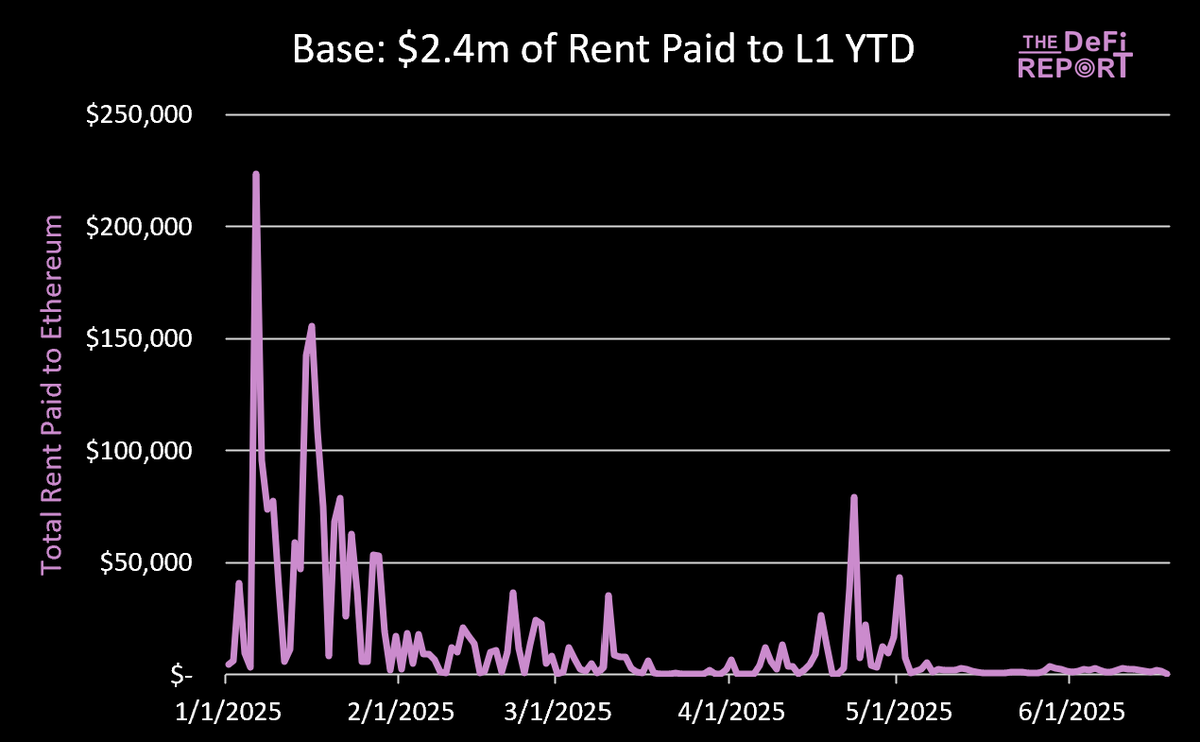

Of course, Ethereum is outsourcing "velocity" to its L2s.

As we can see, Base is filling that gap.

It's just not driving any real value to ETH holders just yet.

----

The key takeaway is that *velocity matters more than just the nominal value of assets secured/TVL.*

This is expressed through the *real onchain yield.*

Moving forward, I expect investors will be paying more attention to velocity as a way to measure how good a chain is at monetizing its assets and returning value to tokenholders.

----

P.S. We're sharing a deep dive on @ethena_labs on Friday with readers of @the_defi_report

If you'd like to have the latest research hit your inbox when it's published, you can sign up below 👇

5.36萬

128

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。