Tether 估值為 515B 是一個美麗的數位。

考慮到我們目前(並且不斷增加)比特幣 + 黃金的國庫,可能有點看跌,但我非常謙卑。

也對我們公司的下一階段增長感到非常興奮。

謝謝大家 ❤️

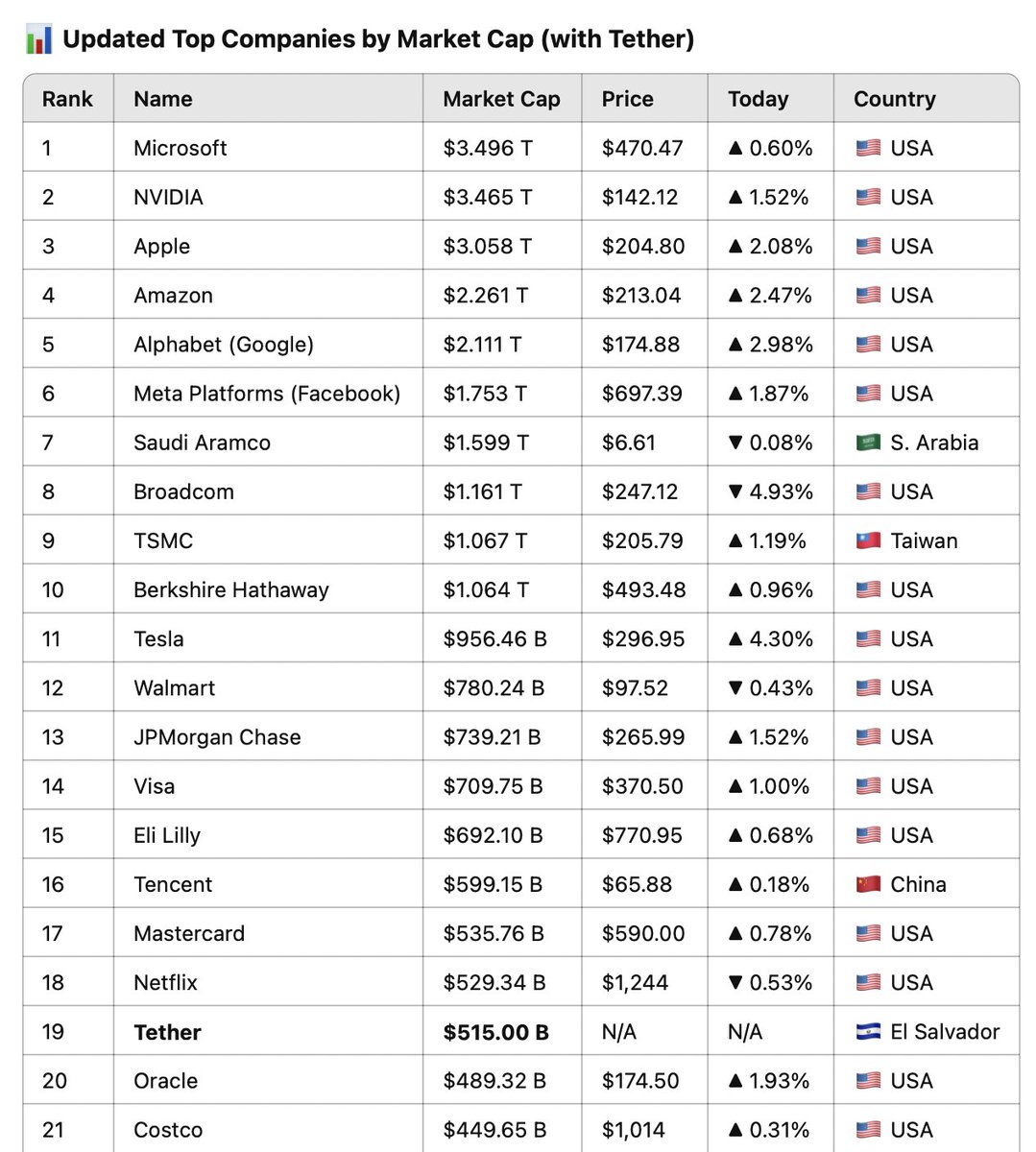

If @Tether_to went public TODAY, Tether would be the 19th largest company in the world at $515B.

That's ahead of Costco and Coca Cola.

Here's why:

- Circle is now public at $30B marketcap

- Our financial model has Circle at $410B EBITDA in 2025 or 69.3x EBITDA

- Tether claims $13B of net profits in 2024. $7B came from Treasuries and Repos -- the other $5B came from unrealized gains from Bitcoin and gold holdings which we don't include in EBITDA.

- We assume Tether grows USDT supply by adding another $50-$60B of USDT and avg USDT supply in 2025 is $170B with avg Fed Funds Rate of 4.2% implies ~$7.4B 2025 EBITDA.

- $7.4B of EBITDA * 69.3x EBITDA = $515B.

Of course our core assumption is using the 69.3x EBITDA $CRCL multiple which is insane and unlikely to hold up.

Sheesh.

25.76萬

1,206

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。