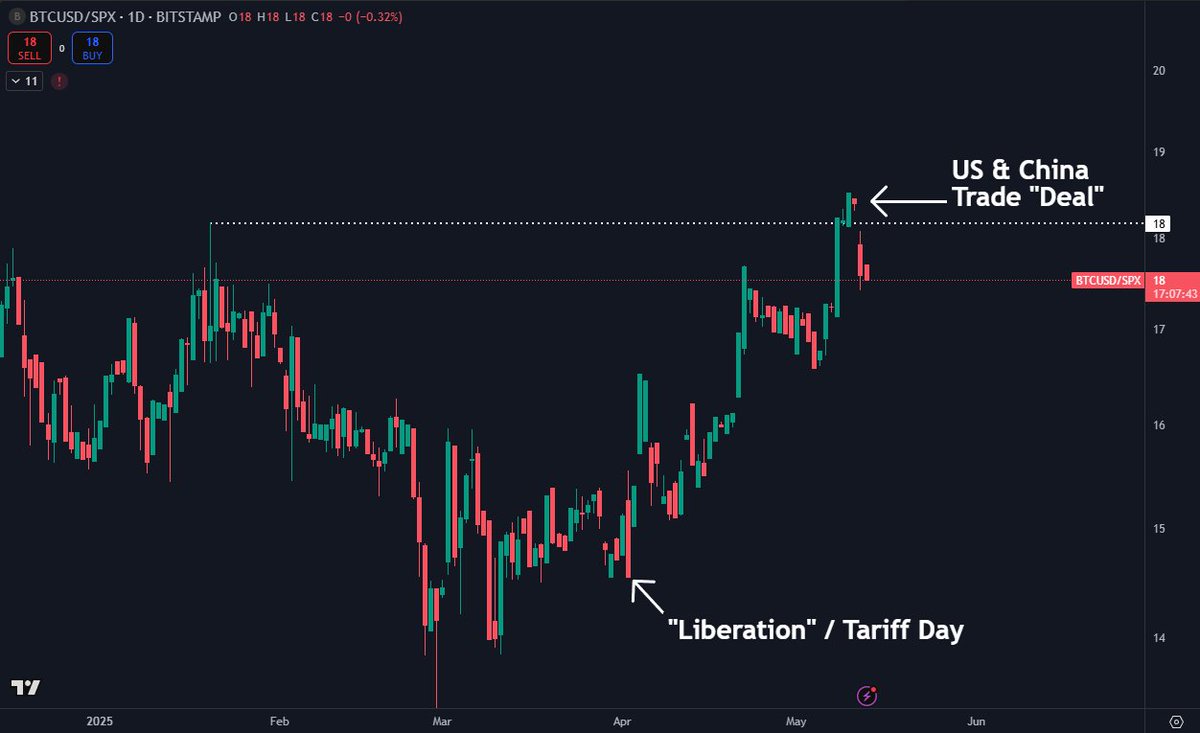

$BTC 到目前為止,BTC/SPX 比率的歷史高位遭到強烈拒絕。這並不完全令人驚訝,因此我本周末重點介紹了這張圖表。

至少在投資者看來,貿易不確定性似乎是驅動因素之一。

隨著美中“協定”的達成和關稅不確定性的消退,股票是受益最大的股票。這導致 $BTC 上有一些拋售,到目前為止,BTC/SPX 比率下降了約 5%。

在這一點上,可以肯定地假設 BTC 確實是一種風險資產,但在圍繞貿易和銀行等問題的不確定情況下(2023 年 3 月),資金也往往是一種資產。

隨著 BTC 的成熟和市場越來越大,我認為它最終會越來越像它的設計目的。

$BTC Has outperformed stocks since "Liberation" / Tariff Day on the 2nd of April.

It held up incredibly strong during a sharp sell off on stocks in April.

It then also proceeded to outperform as the markets bounced and tariffs were implemented.

Back then people were wondering if a reason for the relative strength could have been the narrative that countries could potentially be using $BTC to bypass tariffs.

With a potential US & China Trade "Deal" teased/announced today we could be seeing the answer to this question.

Theoretically speaking, if the trade uncertainty was what was making BTC outperform, it should stop outperforming after we hit the most important deal which includes China.

If BTC keeps doing its thing and just keeps outperforming it's safe to assume that tariffs likely have little direct impact on how BTC is treated/used.

2.57萬

153

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。