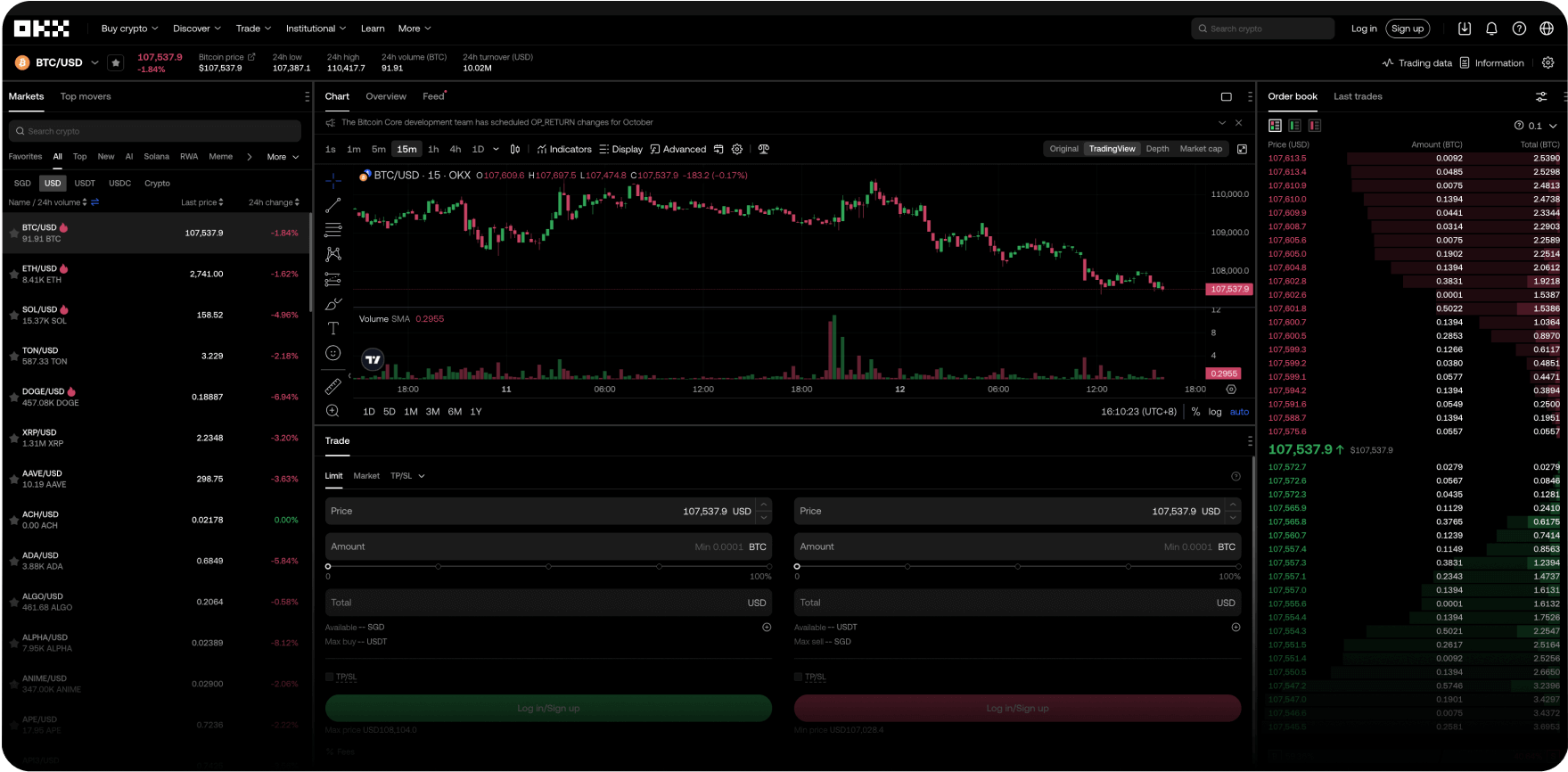

Your global account in digital dollars

Send and receive digital dollars in seconds. Pay worldwide with an international card, with no IOF and no hidden fees. Earn daily yield in digital dollars, directly in the app.Lowest fees, world-class matching engine, powerful APIs and much more

With you every step of the way

From making your first crypto trade to becoming a seasoned trader, you’ll have us to guide you through the process. No question is too small. No sleepless nights. Have confidence in your crypto.

Coach Pep Guardiola

Explains “crazy football formation”

Rewrite the system

Welcome to Web3

Snowboarder Scotty James

Brings in the whole family

Questions? We’ve got answers.

Can I deposit and withdraw my crypto?

How quickly can I deposit and withdraw my funds from my account?

What is crypto?